Expert Tax Advice &Financial Guidance

Personal-Financial-Advisers.com provides expert tax advice and easy-to-follow guides on income tax, deductions, credits, and filing. Learn how to reduce your tax burden, maximize refunds, and stay compliant while managing your personal finances wisely.

Browse by Category

Quick access to all our tax resources

Tax Guides

Income Deferral Tax Planning: Strategies to Manage Tax Liability

Income deferral tax planning is a strategic method to shift taxable income to future years, potentially reducing overall tax liability by leveraging anticipated lower tax brackets. This approach is particularly beneficial for individuals expecting changes in income levels, such as those deferring year-end bonuses or delaying invoicing. By understanding key timing considerations and IRS regulations, taxpayers can optimize their financial outcomes while maintaining compliance. This guide provides actionable insights and professional advice to implement income deferral effectively.

Electric Vehicle Tax Credit Strategy for High-Income Earners

High-income individuals can strategically leverage electric vehicle (EV) tax credits by documenting business use, even if they exceed standard income thresholds. This guide details how prorated credits, calculated based on business mileage percentage, can offset tax liabilities up to $7,500. Learn IRS-compliant methods for tracking use, maximizing deductions, and integrating EV credits into broader tax planning to reduce overall tax burdens effectively.

Capital Gains Tax Harvesting: A Strategic Guide to Minimizing Tax Liability

Capital gains tax harvesting is a sophisticated tax strategy that enables investors to strategically manage capital gains and losses to reduce overall tax liability. By offsetting realized gains with capital losses, investors can lower their taxable income and potentially benefit from preferential tax rates on long-term investments. Key techniques include selling underperforming assets to generate losses, deducting up to $3,000 of excess losses against ordinary income annually, and navigating IRS wash sale rules to avoid disallowances. This guide provides comprehensive insights into implementing these strategies effectively while adhering to tax regulations.

Asset Location Tax Efficiency Strategy: Maximizing After-Tax Returns

Asset location is a critical tax planning strategy that involves placing investments in specific account types to minimize tax liabilities. By holding tax-efficient assets like stocks and index funds in taxable accounts and tax-inefficient ones such as bonds and REITs in tax-deferred accounts, investors can enhance after-tax returns. This guide details how to implement this approach effectively, considering factors like dividend yields, capital gains, and tax brackets, supported by research from Personal Financial Advisers.

Required Minimum Distribution (RMD) Updates: Key Changes and Strategic Implications

Recent legislative updates have significantly altered Required Minimum Distribution rules, increasing the starting age to 73 in 2023 with a planned increase to 75 by 2033. These changes provide enhanced flexibility for retirement account holders, allowing extended tax-deferred growth opportunities. This comprehensive guide examines the new RMD thresholds, Traditional IRA contribution rules, and strategic approaches for optimizing retirement income while minimizing tax liabilities. Understanding these updates is crucial for effective retirement planning and tax management.

Charitable Contribution Tax Strategies: Maximizing Benefits for Individuals 70+

Charitable contributions offer substantial tax advantages, particularly for individuals aged 70 and older. Qualified Charitable Distributions (QCDs) enable direct donations from IRAs up to $100,000 annually, avoiding increases in taxable income. This guide explores QCD mechanics, benefits of donating appreciated assets, and strategic planning to optimize tax efficiency while supporting charitable causes. Learn how to align philanthropy with financial goals and comply with IRS regulations.

State and Local Tax (SALT) Deduction Optimization

The SALT deduction allows taxpayers to deduct certain state and local taxes on federal returns, but is capped at $10,000 annually under current law. This guide provides expert strategies to maximize this deduction, focusing on prepayment timing, AMT considerations, and state-specific nuances. High-income earners in states like California and New York can significantly benefit from careful planning. We explain IRS rules, real-world scenarios, and compliance requirements to help you reduce federal tax liability while avoiding common pitfalls.

Gifting and Estate Tax Planning: Maximizing Lifetime Exemptions Before 2026

This comprehensive guide explores strategic gifting and estate tax planning to leverage current high lifetime gift tax exemptions. In 2024, individuals can shield up to $13.61 million ($27.22 million for married couples) from taxes, increasing in 2025 before a projected drop to approximately $5 million in 2026. Learn proactive techniques like direct gifts, trusts, and valuation discounts to transfer wealth tax-efficiently, minimize estate taxes, and preserve family assets amid changing tax landscapes.

Electric Vehicle and Green Energy Tax Incentives: Maximize Your Savings

Discover how to leverage electric vehicle and green energy tax incentives to reduce your tax liability and support sustainability. This guide details the Electric Vehicle Tax Credit, offering up to $7,500 for qualifying purchases, with eligibility requirements including personal use primarily in the U.S., income thresholds, and vehicle specifications. Learn about additional green energy credits, strategic planning tips, and common pitfalls to avoid, empowering you to make informed financial decisions while contributing to environmental conservation.

Income Tax Basics and Deduction Strategies: A Comprehensive Guide

This detailed guide covers the fundamental principles of income tax, explaining the critical differences between tax deductions and credits. Deductions reduce your taxable income, such as the standard deduction of $14,600 for single filers in 2024, while credits directly lower your tax liability. Learn strategies to maximize contributions like IRAs up to $7,000 for those under 50 and $8,000 for those 50 and older, ensuring you understand income thresholds and eligibility to optimize your tax outcomes and comply with IRS regulations.

Mastering Business Expense Deduction Strategies for Tax Optimization

This comprehensive guide explores essential business expense deduction strategies to reduce your tax liability effectively. Learn how cash basis businesses can deduct credit card purchases made before year-end and maximize the Qualified Business Income (QBI) deduction, which allows eligible business owners to deduct up to 20% of qualified income through 2025. Understand eligibility criteria, limitations, and strategic planning tips to optimize your tax outcomes while maintaining compliance with IRS regulations.

Navigating Alternative Minimum Tax (AMT) in Modern Tax Planning

The Alternative Minimum Tax (AMT) is a parallel tax system designed to ensure high-income taxpayers pay a minimum tax, even with substantial deductions. Since the Tax Cuts and Jobs Act of 2017, AMT impact has significantly reduced, but vigilance remains crucial. This guide explores AMT mechanics, post-TCJA changes, and strategic use of tax planning software to assess liability. Learn which deductions are disallowed and how to optimize your tax position to avoid unexpected liabilities while maximizing compliance and savings.

Student Loan and Education Tax Benefits: A Comprehensive Guide

This guide explores key tax benefits for education expenses, including the American Opportunity Credit offering up to $2,500 per eligible student and the student loan interest deduction, which phases out for single filers with modified adjusted gross income over $80,000 and joint filers over $165,000. It also covers the tax-free status of student loan debt forgiveness through 2025. Learn how to leverage these provisions to reduce your tax liability and maximize financial planning for education costs.

Adoption and Family-Related Tax Credits: Maximizing Financial Support for Families

The Federal Adoption Tax Credit provides substantial financial relief for families adopting children, with a maximum credit of $17,280 per child in 2025. This non-refundable credit phases out for taxpayers with Modified Adjusted Gross Income (MAGI) starting at $259,190 and is fully phased out at $299,190. It covers qualified adoption expenses, helping to alleviate costs such as adoption fees, court costs, attorney fees, and travel. Understanding eligibility, documentation requirements, and income thresholds is essential to maximize benefits and reduce tax liabilities effectively.

Maximizing Retirement Account Contributions: Tax-Smart Strategies for 2025

Explore effective strategies to leverage tax-advantaged retirement accounts like 401(k), 403(b), and IRAs to reduce current taxable income and secure long-term financial stability. This guide details 2025 contribution limits, including $23,500 for 401(k) and $7,000 for IRAs, plus catch-up provisions for those 50 and older. Learn how pre-tax contributions lower your tax burden, optimize retirement planning, and align with IRS regulations to maximize savings while staying compliant.

Retirement Savings and Tax Strategies: Maximizing Benefits Through Savers Credit and IRA Contributions

This comprehensive guide explores strategic retirement savings to optimize tax advantages. Learn how the Retirement Savings Contributions Credit (Saver's Credit) can reduce your tax bill by 10% to 50% of contributions to qualified accounts like 401(k)s and IRAs. Understand the 2024 IRA contribution limits of $7,000 for most individuals, with an additional $1,000 catch-up for those aged 50 and older. Implement these proven methods to enhance your financial security while minimizing tax liabilities.

Top Tax Credits to Maximize Your Refund in 2025

This comprehensive guide explores key tax credits that can significantly reduce your tax liability and increase your refund. Learn about the Earned Income Tax Credit offering $600 to $7,430, the American Opportunity Credit providing up to $2,500 for education, and the Electric Vehicle Tax Credit worth up to $7,500. Discover eligibility requirements, income thresholds, and strategic approaches to maximize these valuable tax benefits while staying compliant with IRS regulations.

Energy Efficiency and Home Improvement Tax Credits: Maximize Savings Through Strategic Upgrades

This comprehensive guide explores federal tax credits and rebates available for residential energy efficiency improvements from 2023 to 2031. Learn how to claim the Residential Energy Tax Credit covering 30% of solar panel installation costs, the HOMES Rebate offering up to $8,000, and the High-Efficient Electric Home Rebate Act providing up to $14,000 for qualified upgrades. These incentives reduce upfront costs, lower utility bills, and decrease your tax liability while supporting environmental sustainability through clean energy adoption.

Tax Deduction and Credit Fundamentals: Maximizing Your Tax Savings

Understanding the critical distinctions between tax deductions and credits is essential for effective tax planning. Deductions reduce your taxable income based on your marginal tax rate, while credits directly lower your tax liability dollar-for-dollar. This comprehensive guide explains how deductions like the standard deduction and itemized deductions work alongside refundable and non-refundable credits, using real-world examples to illustrate potential savings. Learn strategies to identify eligible tax benefits, optimize your filing, and minimize your overall tax burden with insights from financial experts.

Child and Dependent Care Tax Credits: A Complete Guide for Working Parents and Caregivers

The Child and Dependent Care Tax Credit provides substantial financial relief for eligible taxpayers covering care expenses for children under 13 or dependents unable to self-care. This credit can reach up to $3,000 for individual filers and $6,000 for married couples filing jointly, directly reducing tax liability dollar-for-dollar. To qualify, care must be necessary for employment or job-seeking activities. Our guide details eligibility criteria, calculation methods, documentation requirements, and strategic tips to maximize your tax benefits while ensuring IRS compliance.

Income Shifting and Tax Bracket Management

Income shifting is a strategic tax planning approach that involves transferring income to family members in lower tax brackets or deferring it to years with potentially reduced rates. By utilizing trusts and other legal structures, taxpayers can significantly lower their overall tax liability. This guide explores proven techniques, including income transfers to children or spouses, trust-based strategies, and timing income deferrals, to help you optimize your tax situation while remaining compliant with IRS regulations.

State and Local Tax (SALT) Deduction Strategies: Maximizing Your $10,000 Cap

The State and Local Tax (SALT) deduction allows taxpayers to deduct up to $10,000 in state and local taxes from federal taxable income. This guide explores comprehensive strategies for navigating the cap, including timing of payments, evaluating state tax credits, and considering entity structuring for business owners. With detailed examples and actionable steps, you'll learn to optimize deductions while maintaining compliance with IRS regulations, particularly beneficial for residents in high-tax states.

Expiring Tax Provisions and Extensions: A Comprehensive Guide Through 2025

This guide explores key federal tax provisions extended through December 31, 2025, including the employer credit for paid family and medical leave, the Work Opportunity Tax Credit (WOTC), and special expensing rules for film, television, and live theatrical productions. Learn how these extensions impact employers and individuals, eligibility requirements, and strategies to maximize benefits. Stay compliant and reduce tax burdens with expert insights on navigating these provisions effectively.

Healthcare and Medical Expense Tax Considerations: Strategies for Maximizing Deductions and HSA Benefits

This comprehensive guide explores the tax implications of healthcare expenses, focusing on medical expense deductions and Health Savings Account (HSA) strategies. Learn how to navigate IRS thresholds, optimize HSA contributions, and implement tax-efficient healthcare planning to reduce your tax burden. With detailed insights on documentation requirements, contribution limits, and eligibility criteria, this article provides actionable advice for individuals and families managing healthcare costs while maximizing tax benefits.

Real Estate and Property Tax Strategies: Maximizing Deductions, Credits, and Savings

This comprehensive guide explores essential tax strategies for real estate owners and investors. Learn how to leverage mortgage interest deductions, navigate property tax limitations including the SALT deduction cap of $10,000, and capitalize on energy-efficient home improvement credits like the 30% solar panel installation credit and rebates up to $14,000. Understand how these elements impact your overall tax liability, reduce your tax burden, and enhance financial returns while ensuring compliance with IRS regulations.

Retirement Account Contribution and Withdrawal Strategies

This comprehensive guide details strategies for optimizing retirement savings through tax-deferred contributions and withdrawals. Learn how to maximize contributions to Traditional IRAs, navigate Required Minimum Distributions (RMDs), and implement tax-efficient withdrawal methods to reduce liabilities. Includes current contribution limits, RMD calculations, and actionable steps for all age groups to enhance retirement readiness while complying with IRS regulations.

Cryptocurrency and Digital Asset Tax Reporting: A Comprehensive Guide to Compliance and Strategy

Navigating cryptocurrency tax reporting is essential for financial compliance and optimization. This guide details IRS requirements for capital gains, losses, and transaction tracking across various digital assets. Learn how to maintain precise records, apply tax-efficient strategies, and avoid penalties. With evolving regulations, staying informed ensures you accurately report crypto activities, from mining to trading, while maximizing deductions and minimizing liabilities through structured approaches.

Tax Filing and Preparation Strategies for Maximum Savings

This comprehensive guide outlines essential tax filing strategies to optimize your financial outcomes. Learn to compare standard versus itemized deductions effectively, leverage tax preparation software to identify credits and deductions, and determine when to seek professional tax advice for complex situations. With data-driven insights and expert recommendations, you'll minimize liabilities, enhance refunds, and ensure IRS compliance while managing personal finances wisely.

Foreign Income and International Tax Considerations: A Comprehensive Guide

This guide provides a detailed overview of managing foreign income and international tax obligations. It covers essential topics such as foreign income reporting requirements, leveraging tax treaties to avoid double taxation, and strategic planning to minimize tax liabilities. With insights into IRS forms like Form 2555 and Form 1116, plus analysis of key tax treaties, readers will learn to navigate global income scenarios confidently while ensuring compliance and optimizing their financial outcomes.

Tax Deductions vs. Tax Credits: Understanding the Fundamentals of Tax Reduction

This comprehensive guide explains the critical differences between tax deductions and tax credits, two key mechanisms for reducing tax liability. Deductions lower your taxable income, potentially placing you in a lower tax bracket, whereas credits offer a direct dollar-for-dollar reduction in taxes owed. Understanding these tools—including specific examples like the $3000 deduction for capital losses and the $2000 Child Tax Credit—empowers taxpayers to maximize refunds and minimize liabilities. Based on IRS guidelines and financial advisory insights, this article provides actionable strategies for effective tax planning.

Deduction Database

Small Business Health Care Premium Credit: Maximizing Tax Benefits for Employers

The Small Business Health Care Premium Credit offers eligible employers a substantial tax incentive, providing up to 50% of healthcare premium costs. To qualify, businesses must enroll through the SHOP Marketplace, maintain fewer than 25 full-time equivalent employees, and ensure average annual wages remain below $56,000. This credit helps reduce operational expenses while promoting employee wellness, making it a vital consideration for small business tax strategy. Understanding eligibility criteria, calculation methods, and compliance requirements ensures optimal financial benefits and sustained organizational health.

Emergency Personal Expenses Distribution: Expanded IRS Penalty Exceptions

Effective January 1, 2024, the IRS has expanded exceptions to the 10% early withdrawal penalty for qualified retirement account distributions used for emergency personal expenses. This change, detailed in IRS Publication, allows individuals facing unforeseen financial hardships—such as medical emergencies, essential home repairs, or sudden unemployment—to access funds without incurring additional taxes. Key provisions include applicability to distributions after December 31, 2023, and specific eligibility criteria for emergency expenses. This update provides critical financial flexibility, helping taxpayers manage unexpected costs while remaining compliant with tax regulations. Always consult a financial advisor to assess individual circumstances.

Qualified Transportation Fringe Benefit: Maximizing Tax-Free Commuter Benefits

The Qualified Transportation Fringe Benefit allows employees to receive up to $300 per month in tax-free compensation for qualified commuting expenses, including transit passes, vanpooling, and parking. This employer-provided program reduces taxable income while promoting sustainable commuting. The IRS sets annual adjustments to these limits, with current provisions detailed in Publication 15-B. Employers must comply with substantiation requirements and non-discrimination rules, while employees benefit from reduced out-of-pocket costs and simplified expense tracking through payroll deductions.

Mortgage Interest Deduction: A Comprehensive Guide to Tax Benefits for Homeowners

The mortgage interest deduction enables homeowners to reduce their taxable income by deducting interest paid on mortgages for primary and second residences. Eligibility and limits depend on the home purchase date: properties acquired before December 15, 2017, qualify for deductions on up to $1,000,000 in acquisition debt, while those purchased after are limited to $750,000. To claim this deduction, taxpayers must be legally obligated on the loan and provide lender-reported payment documentation. Understanding these rules helps maximize tax savings and ensure IRS compliance.

Premium Tax Credit: Reducing Health Insurance Premium Costs

The Premium Tax Credit (PTC) is a refundable tax credit designed to assist eligible individuals and families in affording health insurance premiums purchased through the Health Insurance Marketplace. It targets those with household incomes between 100% and 400% of the federal poverty level, allowing advance payments to insurers or claims on tax returns. Even non-filers can benefit, provided they meet IRS criteria. This credit helps reduce out-of-pocket premium expenses, promoting accessible healthcare coverage under the Affordable Care Act.

Charitable Contribution Deduction: A Comprehensive Guide to Itemized Tax Benefits

The charitable contribution deduction enables taxpayers who itemize to reduce their taxable income by donating cash or property to IRS-qualified nonprofit organizations. This incentive supports philanthropy while offering financial relief, requiring proper documentation like receipts and adherence to annual deduction limits. Eligible contributions range from monetary gifts to appreciated assets, with specific rules for non-cash items such as stocks or vehicles. Understanding eligibility criteria, record-keeping standards, and filing procedures ensures compliance and maximizes tax savings, making it essential for strategic financial planning.

Student Loan Interest Deduction: Maximize Your Tax Benefits

The Student Loan Interest Deduction is an above-the-line tax deduction allowing eligible taxpayers to deduct up to $2,500 annually in qualified student loan interest payments. This deduction does not require itemization, making it accessible to all qualifying filers. Eligibility phases out for single filers with modified adjusted gross incomes exceeding $80,000 and joint filers over $165,000. This guide details qualification criteria, calculation methods, and strategic approaches to optimize this valuable tax benefit while ensuring compliance with IRS regulations.

Work Opportunity Tax Credit

The Work Opportunity Tax Credit (WOTC) is a federal tax incentive designed to encourage employers to hire individuals from specific target groups who face significant barriers to employment. Administered by the IRS, this credit provides financial benefits to businesses that hire veterans, ex-felons, long-term unemployed individuals, and other eligible groups. By reducing tax liability, the WOTC supports workforce diversity and economic inclusion while helping employers lower their overall employment costs. Proper documentation through Form 3800 is essential for claiming this credit, which can significantly impact a company's bottom line and community engagement efforts.

Self-Employed Health Insurance Deduction: Maximize Tax Savings with Form 7206

Self-employed individuals can deduct health insurance premiums for themselves, spouses, and dependents through Form 7206, reported on Schedule 1 (Form 1040), line 17. Eligible premiums include medical, dental, and long-term care insurance, offering substantial tax relief by reducing adjusted gross income. Key requirements include having net earnings from self-employment and not being eligible for employer-sponsored health plans. This deduction can lower tax liability by up to 37% of premium costs, depending on the taxpayer's bracket, and applies to various self-employment structures like sole proprietorships and partnerships. Proper documentation and adherence to IRS guidelines ensure compliance and maximize benefits.

Family and Medical Leave (FMLA) Tax Credit: Eligibility, Calculations, and Strategic Benefits for Employers

The Family and Medical Leave Act (FMLA) Tax Credit offers eligible employers a significant financial incentive, providing a tax credit ranging from 12.5% to 25% of wages paid to employees on FMLA leave. To qualify, employers must meet specific criteria outlined by the IRS, including maintaining compliant leave policies and ensuring wage replacement rates are at least 50%. This credit, claimed via Form 8994, helps offset the costs of providing paid family and medical leave, supporting workforce stability and compliance with federal regulations. Proper documentation and adherence to eligibility requirements are essential for maximizing this benefit.

Qualified Charitable Distribution: Maximizing Tax Benefits Through IRA Giving

A Qualified Charitable Distribution (QCD) allows individuals aged 70½ or older to transfer up to $100,000 annually directly from an IRA to qualified charities, counting toward Required Minimum Distributions (RMDs) without being included in taxable income. Starting in 2023, a one-time election permits up to $50,000 to be distributed to charitable remainder unitrusts or charitable gift annuities, offering lifetime income streams while supporting charitable causes. This strategy reduces adjusted gross income, potentially lowering taxes on Social Security benefits and Medicare premiums. Proper documentation and adherence to IRS guidelines are essential for compliance.

Earned Income Tax Credit (EITC): Maximizing Your Refund

The Earned Income Tax Credit (EITC) is a significant refundable tax credit designed to assist low- to moderate-income workers and families. By reducing tax liability and potentially providing refunds exceeding taxes paid, it supports financial stability. Eligibility hinges on earned income, filing status, and the number of qualifying children, with credit amounts scaling based on these factors. Administered by the IRS, the EITC can deliver substantial financial benefits, making it essential for eligible taxpayers to understand and claim it accurately to enhance their tax outcomes.

Employee Retention Credit: A Comprehensive Guide for COVID-19 Impacted Businesses

The Employee Retention Credit (ERC) is a refundable tax credit designed for employers who continued to pay employees during the COVID-19 pandemic. Eligible businesses and tax-exempt organizations can claim up to $26,000 per employee through 2024 using Form 941. Qualification criteria include full or partial suspension of operations or significant declines in gross receipts. This guide covers eligibility requirements, calculation methods, application procedures, and strategic considerations for maximizing this financial relief opportunity while maintaining compliance with IRS regulations.

Coverdell Education Savings Account

Coverdell ESAs are tax-advantaged savings accounts designed to help families fund K-12 and higher education expenses. With an annual contribution limit of $2,000 per beneficiary, these accounts allow tax-free growth and withdrawals for qualified educational costs, including tuition, books, and supplies. While contributions are not tax-deductible, the accounts offer significant long-term savings benefits, particularly for elementary and secondary education expenses not covered by 529 plans. Income phase-outs apply, making them most beneficial for moderate-income households seeking flexible education funding solutions.

Research and Development (R&D) Tax Credit: Maximizing Innovation Incentives

The Research and Development (R&D) Tax Credit offers businesses a substantial incentive to invest in innovation, covering up to 20% of qualifying R&D expenses. This credit targets activities that advance technology, improve products, or enhance processes, directly reducing tax liability and encouraging sustained investment in research. Eligible expenses include wages, supplies, and contracted research costs. Proper documentation and adherence to IRS guidelines are essential to claim this credit, which can significantly lower a company's tax burden while fostering long-term growth and competitiveness in the market.

2024 Retirement Plan Contribution Limits: Maximizing Your Tax-Advantaged Savings

The IRS has announced significant updates to retirement plan contribution limits for 2024, allowing individuals to contribute up to $23,000 to 401(k), 403(b), and Thrift Savings Plans. Those aged 50 and older can make additional catch-up contributions of $7,500, bringing their total potential contribution to $30,500. These increased limits provide substantial opportunities for tax-deferred growth and immediate tax savings. Understanding these limits is crucial for effective retirement planning and tax strategy optimization, particularly for high-income earners seeking to maximize their retirement savings while reducing current tax liabilities.

Health Savings Account (HSA) Contribution Deduction: Maximizing Tax Benefits in 2024

The Health Savings Account (HSA) contribution deduction enables eligible individuals to reduce their taxable income through pre-tax or tax-deductible contributions to an HSA, provided they are enrolled in a qualifying high-deductible health plan (HDHP). For the 2024 tax year, the IRS has increased contribution limits, allowing single coverage holders to contribute up to $4,150 and family coverage holders up to $8,300, with an additional $1,000 catch-up contribution for those aged 55 and older. This above-the-line deduction not only lowers your adjusted gross income but also supports long-term healthcare savings with tax-free growth and withdrawals for qualified medical expenses.

2024 Standard Deduction: Complete Guide to Tax Savings

The Standard Deduction for 2024 is a fundamental tax provision allowing single filers to deduct $14,600 and married couples filing jointly to deduct $29,200 from their adjusted gross income, reducing taxable income without itemizing expenses. Annually adjusted for inflation, this deduction simplifies tax filing and lowers tax liability for millions. Key aspects include automatic application, filing status variations, and specific rules for dependents, making it essential for efficient tax planning and compliance with IRS guidelines.

Traditional IRA Contribution Deduction: Maximizing Your 2024 Tax Benefits

The traditional IRA contribution deduction allows eligible taxpayers to reduce their taxable income by contributing to a traditional IRA. For the 2024 tax year, individuals can deduct up to $7,000 ($8,000 if age 50 or older). Deduction eligibility is subject to phase-out rules based on modified adjusted gross income (MAGI) and whether you or your spouse are covered by a workplace retirement plan. Understanding these rules is crucial for optimizing tax savings and retirement planning strategies.

Domestic Abuse Distribution Exception: Waiving the 10% Early Withdrawal Penalty

The Domestic Abuse Distribution Exception, effective for distributions made after December 31, 2023, exempts eligible domestic abuse victims from the 10% additional tax on early withdrawals from qualified retirement plans. This provision, detailed in IRS guidelines, offers crucial financial relief by allowing penalty-free access to funds during times of crisis. To qualify, distributions must meet specific requirements, including verification of abuse and adherence to annual limits. This exception supports victims in achieving financial independence without the burden of early withdrawal penalties, aligning with broader efforts to provide compassionate tax solutions.

2024 Standard Deduction: Complete Guide to Increased Amounts and Tax Savings

The Internal Revenue Service has announced significant increases to the standard deduction for the 2024 tax year, providing taxpayers with enhanced tax-saving opportunities. Single filers and married individuals filing separately will benefit from a $14,600 deduction, while married couples filing jointly can claim $29,200. Heads of household receive a substantial $22,500 standard deduction. These adjustments represent approximately 5% increases from 2023 levels, reflecting ongoing inflation adjustments. Understanding these changes is crucial for optimizing tax strategies and maximizing potential refunds while maintaining compliance with current tax regulations.

Medical Expense Deduction: Maximizing Tax Savings on Healthcare Costs

The medical expense deduction allows taxpayers to reduce taxable income by deducting qualified medical and dental expenses exceeding 7.5% of their adjusted gross income (AGI). Eligible expenses include health insurance premiums, out-of-pocket costs for treatments, prescriptions, and preventive care. This guide details calculation methods, documentation requirements, and strategic planning to optimize deductions while ensuring IRS compliance, helping individuals manage healthcare expenses effectively and lower their overall tax liability.

Qualified Vehicle Interest Deduction: Maximize Tax Benefits for Personal Auto Loans (2025-2028)

The Qualified Vehicle Interest Deduction, effective from 2025 through 2028 under the IRS One Big Beautiful Bill Act, allows eligible taxpayers to deduct interest paid on loans for qualifying personal vehicles. With a maximum annual deduction of $10,000, this benefit phases out for single filers with modified adjusted gross income (MAGI) over $100,000 and joint filers exceeding $200,000. To qualify, vehicles must be new with original use commencing with the taxpayer and cannot include business or commercial vehicles. This guide details eligibility criteria, calculation methods, phase-out mechanics, and strategic tips to optimize your tax savings while remaining compliant with IRS regulations.

IRA Contribution Limits for 2024: Complete Guide with Deduction Rules

For 2024, the standard IRA contribution limit is $7,000, with an additional $1,000 catch-up contribution available for individuals aged 50 and older, making the total limit $8,000 for eligible savers. However, tax deductions for these contributions may be phased out based on modified adjusted gross income (MAGI) and participation in employer-sponsored retirement plans. This guide covers detailed eligibility criteria, income phase-out ranges, contribution deadlines, and strategies to maximize tax advantages while staying compliant with IRS regulations outlined in Publication 505.

Adoption Credit

The adoption credit for 2025 provides a maximum benefit of $17,280 for qualified adoption expenses, offering significant tax relief to eligible taxpayers. To qualify, your modified adjusted gross income must be below $299,190, and the credit can be claimed for both domestic and international adoptions. This comprehensive guide covers eligibility criteria, calculation methods, documentation requirements, and strategic planning tips to maximize your tax savings while ensuring compliance with IRS regulations outlined in Publication 505.

Senior Additional Deduction: Maximizing Tax Benefits for Individuals 65 and Older

The Senior Additional Deduction, effective from tax years 2025 through 2028, provides eligible individuals aged 65 and older with an extra $6,000 deduction to reduce taxable income. Married couples filing jointly may claim up to $12,000 if both spouses qualify. This deduction supplements existing senior tax benefits, offering substantial savings and strategic financial planning opportunities. Understanding eligibility criteria, claiming procedures, and integration with other deductions is essential for optimizing tax outcomes during these years.

Clean Vehicle Tax Credit: Maximize Your 2023 Tax Savings

The Clean Vehicle Tax Credit offers up to $7,500 for qualifying new plug-in electric or fuel cell vehicles purchased in 2023. This comprehensive guide details eligibility requirements, including North American manufacturing, income limits (up to $300,000 for joint filers), and vehicle-specific criteria. Learn how to claim this credit, understand phase-out thresholds, and integrate it with other tax strategies to optimize your financial benefits while supporting sustainable transportation.

Health Savings Account (HSA) Deduction: Maximizing Tax Benefits with Qualified Contributions

The Health Savings Account (HSA) deduction allows eligible taxpayers to deduct contributions made to their HSA, directly reducing taxable income. To qualify, individuals must be covered by a high-deductible health plan (HDHP), with 2024 limits set at $4,150 for self-only and $8,300 for family coverage. Contributions grow tax-free, and withdrawals for qualified medical expenses are not taxed. This guide details eligibility requirements, contribution strategies, IRS guidelines, and how HSAs compare to other tax-advantaged accounts, helping you optimize savings while complying with tax laws.

Fringe Benefits Tax Limit: Understanding the $300 Monthly Cap on Qualified Transportation and Parking Benefits

The IRS has increased the monthly limit for tax-free qualified transportation and parking fringe benefits to $300 in 2023, up from $280 in 2022. Employers can provide these benefits—covering transit passes, vanpooling, and parking—without incurring additional tax liabilities for employees. This adjustment reflects inflation and aims to support commuting expenses. Understanding these limits helps both employers structure compliant benefit programs and employees maximize tax-free compensation. Proper documentation and adherence to IRS guidelines are essential to avoid penalties.

Home Office Deduction: A Complete Guide for Self-Employed and Remote Workers

The home office deduction allows self-employed individuals and remote workers to deduct expenses for a workspace used regularly and exclusively for business. Eligible costs include portions of rent, utilities, real estate taxes, repairs, and maintenance, calculated based on the business-use area of the home. Proper documentation and adherence to IRS guidelines are essential to claim this deduction accurately and avoid audits. This guide covers eligibility, calculation methods, and common pitfalls to help you maximize tax savings.

Tax Software Comparisons

FreeTaxUSA: Comprehensive Review of Budget-Friendly Tax Preparation Software

FreeTaxUSA offers cost-effective tax filing with free federal returns and economical state filings at $14.99. It supports over 350 deductions and credits, catering to various tax situations including self-employment and investments. The platform features a user-friendly interface, audit assistance, and priority support via its Deluxe plan. Ideal for individuals seeking affordable, reliable tax software without sacrificing functionality.

TurboTax: Comprehensive Review of Tax Preparation Software Features and Plans

TurboTax stands as a premier tax preparation software, acclaimed for its user-friendly interface and extensive feature set. It accommodates diverse tax situations through multiple pricing tiers, from Free for simple Form 1040 returns to specialized plans for self-employed individuals and investors. With direct integrations like Coinbase for cryptocurrency reporting and support for 37% of taxpayers eligible for free filing, TurboTax simplifies tax compliance while maximizing deductions and refunds. Expert support is available with paid upgrades, ensuring accuracy and confidence in filing.

Comprehensive Guide to Tax Software Audit and Error Support Services

This detailed comparison examines audit and error support offerings from leading tax software providers. TurboTax provides a comprehensive accuracy guarantee with full audit support, TaxAct offers a robust $100,000 accuracy guarantee covering penalties and legal fees, while H&R Block delivers Worry-Free Audit Support across paid tiers. Understanding these protection levels helps taxpayers choose software that matches their risk tolerance and filing complexity needs while ensuring compliance confidence.

Cash App Taxes: Comprehensive Review of the 100% Free Tax Filing Solution

Cash App Taxes offers a completely free tax filing service designed for individuals with simple tax returns and single-state filers. This platform eliminates hidden fees while providing essential features for basic tax preparation, making it an ideal choice for straightforward financial situations. It supports W-2 income, standard deductions, and common credits without complex investment or business income handling. Users benefit from an intuitive interface and secure filing, backed by robust data encryption. However, those with multi-state filings, itemized deductions, or self-employment income may need to explore alternative solutions due to its limitations in handling advanced tax scenarios.

TaxAct: Comprehensive Review of Affordable Tax Preparation Software

TaxAct stands out as a leading tax software solution for its exceptional cost-effectiveness and robust feature set. It offers comprehensive support for various tax situations, from simple returns to complex self-employment scenarios, with a $100,000 accuracy guarantee for peace of mind. Key tools like the Deduction Maximizer help identify potential tax savings, while pricing tiers include Free, Deluxe, Premier, and Self-Employed options. State returns cost $39.99 each, and 44% of users qualify for the free version. Additional features like Xpert Assist and Identity Recovery enhance its value, making it a top choice for budget-conscious filers seeking reliable tax preparation.

Tax Software Pricing and Cost Comparison: TurboTax, H&R Block, and TaxAct

This comprehensive analysis compares tax software pricing for TurboTax, H&R Block, and TaxAct, detailing costs from free options up to $89 for complex returns. TurboTax leads in premium pricing with robust features, H&R Block balances cost and value with a strong free tier, and TaxAct offers the most budget-friendly packages. We evaluate each platform's pricing tiers, state return costs, and suitability for different tax situations to help filers maximize value while ensuring accurate, compliant tax preparation.

Expert Tax Assistance Comparison: TurboTax vs H&R Block vs TaxAct

This detailed comparison analyzes expert support features across leading tax software: TurboTax offers Live Assisted and Full Service with unlimited help from dedicated experts, H&R Block combines AI Tax Assist with live chat and in-person support at nationwide offices, and TaxAct provides Xpert Assist for a flat $60 fee across all plans. Availability varies by pricing tier, impacting access to professional guidance. Understanding these options helps taxpayers choose appropriate assistance levels for complex returns, maximizing deductions while ensuring compliance.

Tax Software User Experience and Interface Comparison

This comprehensive analysis evaluates the user experience and interface design of leading tax software providers, including TurboTax, H&R Block, and TaxAct. TurboTax leads with its intuitive, question-based navigation and extensive explanatory resources, while H&R Block simplifies tax filing by avoiding complex financial language. TaxAct offers a straightforward design ideal for experienced users who prefer fewer advanced features. Each platform's step-by-step guidance ensures users can file taxes accurately, with tools tailored to minimize confusion and maximize efficiency. Data from NerdWallet and CNBC Select supports these insights, helping filers choose the best option for their needs.

Mobile App and Accessibility in Tax Software: TurboTax, H&R Block, and TaxAct

This analysis examines mobile app accessibility in leading tax software, focusing on TurboTax, H&R Block, and TaxAct. TurboTax and H&R Block offer full-featured mobile applications with e-filing capabilities, while TaxAct discontinued its mobile app for the 2023 tax year, requiring users to file via their website. Mobile apps provide convenient access to tax preparation tools, early refund options, and user-friendly interfaces, enhancing the overall filing experience. This guide compares features, pros, and cons to help users make informed decisions based on their mobile needs.

Free Tax Filing Comparison: H&R Block vs. TurboTax vs. TaxAct

This comprehensive analysis compares the top free tax filing software options from H&R Block, TurboTax, and TaxAct. H&R Block offers the most robust free tier with no income restrictions, while TurboTax's free version is accessible to approximately 37% of taxpayers with simple returns. TaxAct provides a competitive free option but charges $39.99 per state return. Understanding eligibility criteria, such as Form 1040 limitations and credit restrictions, is crucial for selecting the optimal solution to minimize costs and maximize refunds while ensuring IRS compliance.

Additional Features Comparison: TurboTax, H&R Block, and TaxAct

This comprehensive analysis evaluates the unique additional features of leading tax software solutions. TurboTax excels with advanced reporting capabilities and third-party integrations, H&R Block offers in-person professional support and six-year tax return storage, while TaxAct emphasizes cost-efficiency with year-round planning resources and deduction maximization tools. Each platform caters to distinct user preferences, from DIY filers to those requiring expert assistance, ensuring tailored solutions for diverse financial situations and compliance needs.

Ramsey SmartTax: Dave Ramsey’s Debt-Free Tax Solution Powered by TaxSlayer

Ramsey SmartTax is a tax preparation service endorsed by financial expert Dave Ramsey and built on TaxSlayer’s robust platform. It emphasizes a debt-free philosophy by excluding refund advance loans and offers three distinct versions: Federal Classic, Federal Premium, and a unique bundle with EveryDollar financial planning. Key features include comprehensive federal form support, no hidden fees for deductions, and integration with Ramsey’s financial principles. This review explores its versions, pros, cons, and suitability for taxpayers seeking alignment with Ramsey’s proven money management strategies.

Choosing Tax Preparation Software: A Comprehensive Guide for 2024

Selecting the optimal tax preparation software requires evaluating your tax situation's complexity, budget, and support needs. This guide covers key criteria like free tier eligibility, pricing structures, audit protection features, and expert assistance options. We provide detailed comparisons of leading platforms, practical recommendations for different taxpayer profiles, and strategies to maximize refunds while ensuring IRS compliance.

Investment and Self-Employed Tax Support: A Comprehensive Analysis of TurboTax, H&R Block, and TaxAct

This detailed comparison explores how TurboTax, H&R Block, and TaxAct cater to investors and self-employed individuals. TurboTax leads with extensive third-party integrations, including direct Coinbase support for cryptocurrency traders. H&R Block excels in asset depreciation tools for business assets, while TaxAct provides personalized business deduction calculations and year-round tax planning resources. This guide helps you choose the right software to optimize deductions, manage investments, and ensure tax compliance effectively.

H&R Block: Comprehensive Tax Preparation Solutions with AI Assistance and In-Person Support

H&R Block delivers an all-encompassing tax preparation experience, combining powerful digital tools with professional human assistance. Its robust free tier allows for federal and state returns at no cost, while paid versions like Deluxe and Premium cater to homeowners, investors, and those with complex income sources. Key features include AI Tax Assist for instant guidance, unlimited live chat support, and seamless online or in-person filing options. Ideal for taxpayers seeking accuracy, convenience, and expert advice, H&R Block ensures optimal refunds and compliance through intuitive software and extensive support services.

Accuracy and Support Guarantees: TurboTax vs. TaxAct vs. H&R Block

This comprehensive analysis compares the accuracy and support guarantees offered by leading tax software providers TurboTax, TaxAct, and H&R Block. TurboTax promises 100% accuracy and maximum refunds, TaxAct provides $100,000 in coverage for penalties, interest, and audit fees, while H&R Block delivers Worry-Free Audit Support across paid tiers. Understanding these guarantees helps taxpayers choose software that minimizes financial risks and ensures compliance during tax filing.

Tax Software Market Overview 2025: A Comprehensive Analysis of Leading Platforms and Emerging Trends

The tax software market is experiencing rapid expansion, driven by digital transformation and evolving taxpayer needs. Leading providers like TurboTax, H&R Block, and TaxAct dominate with user-friendly interfaces, free filing tiers, and AI-powered features. This analysis covers market dynamics, key trends including third-party integrations and audit protection services, and detailed comparisons to help users select optimal solutions for simple to complex tax situations while maximizing refunds and compliance.

State Return and Filing Options: A Comprehensive Tax Software Comparison

This detailed guide explores state tax return filing options across major tax software providers. H&R Block and TurboTax offer free state returns with federal filing, while TaxAct charges $39.99 per state return—significantly impacting overall costs. All platforms support e-filing and provide multiple plan tiers to accommodate various tax complexities. Understanding these differences helps filers minimize expenses while ensuring accurate, compliant state tax submissions. Professional analysis covers cost structures, features, and strategic recommendations for optimal filing decisions.

Self-Employed and Freelance Tax Support: Comprehensive Software Comparison

This comprehensive analysis examines specialized tax software features for self-employed professionals and freelancers. We evaluate TurboTax's 1099-MISC photo import and tax estimation capabilities, H&R Block's industry-specific expense guidance through interview-style processes, and TaxAct's personalized business deduction calculations. Each platform offers year-round tax planning tools designed specifically for independent contractors, gig workers, and small business owners. Our detailed comparison covers feature specifications, user experience, cost-effectiveness, and specialized support for maximizing deductions while maintaining IRS compliance.

Free Tax Filing Options: A Comprehensive Guide to Eligibility and Software Comparisons

Explore free tax filing services ideal for taxpayers with straightforward financial situations, including W-2 income, standard deductions, and common credits like Earned Income Tax Credit and child tax credits. This guide details eligibility criteria, provider variations, and coverage limitations, helping approximately 37% of taxpayers identify suitable options. Learn how to navigate free tiers effectively while ensuring accuracy and maximizing refunds without incurring preparation fees.

Tax Refund Advance Loans: A Comprehensive Analysis

Tax refund advance loans allow taxpayers to access expected refunds early through tax preparation services like Jackson Hewitt and TurboTax, offering up to $1,500. However, these loans carry significant drawbacks, including high APRs averaging 35.96% and potential financial risks. Financial experts universally advise caution, recommending taxpayers understand all terms and consider alternatives to avoid unnecessary costs. This guide compares providers, details loan structures, and provides strategies for making informed financial decisions.

Advanced Tax Preparation Features: Maximizing Refunds with Modern Software

Modern tax software offers sophisticated tools like third-party integrations, cryptocurrency transaction support, investment income reporting, and deduction optimization to help taxpayers ensure accuracy and maximize refunds. This guide explores advanced features in leading platforms such as TurboTax, H&R Block Premium, and TaxAct Premier, detailing their pros, cons, and specifications for complex financial scenarios including rental properties and foreign accounts.

Mobile and Digital Experience in Tax Software: A Comprehensive Comparison

This analysis explores the mobile and digital capabilities of leading tax software platforms, including TurboTax, H&R Block, and TaxAct. We evaluate features such as automatic document importing, real-time guidance, and cross-device functionality, providing insights into how these tools enhance efficiency, accuracy, and user convenience during tax preparation. Based on current trends, this guide helps filers choose the best platform for their digital needs, whether through mobile apps or web interfaces.

H&R Block 2025 Tax Software: In-Person Support Meets Digital Excellence

H&R Block 2025 stands out with its comprehensive free filing tier and nationwide physical office support, offering a unique hybrid approach to tax preparation. The software includes AI Tax Assist, live chat, and robust support for simple to complex returns, including small business scenarios. With features like up to six years of tax return storage and user-friendly interfaces avoiding complex jargon, it's ideal for taxpayers seeking reliability and accessibility. This review covers its tiers, advantages, and performance metrics for 2025.

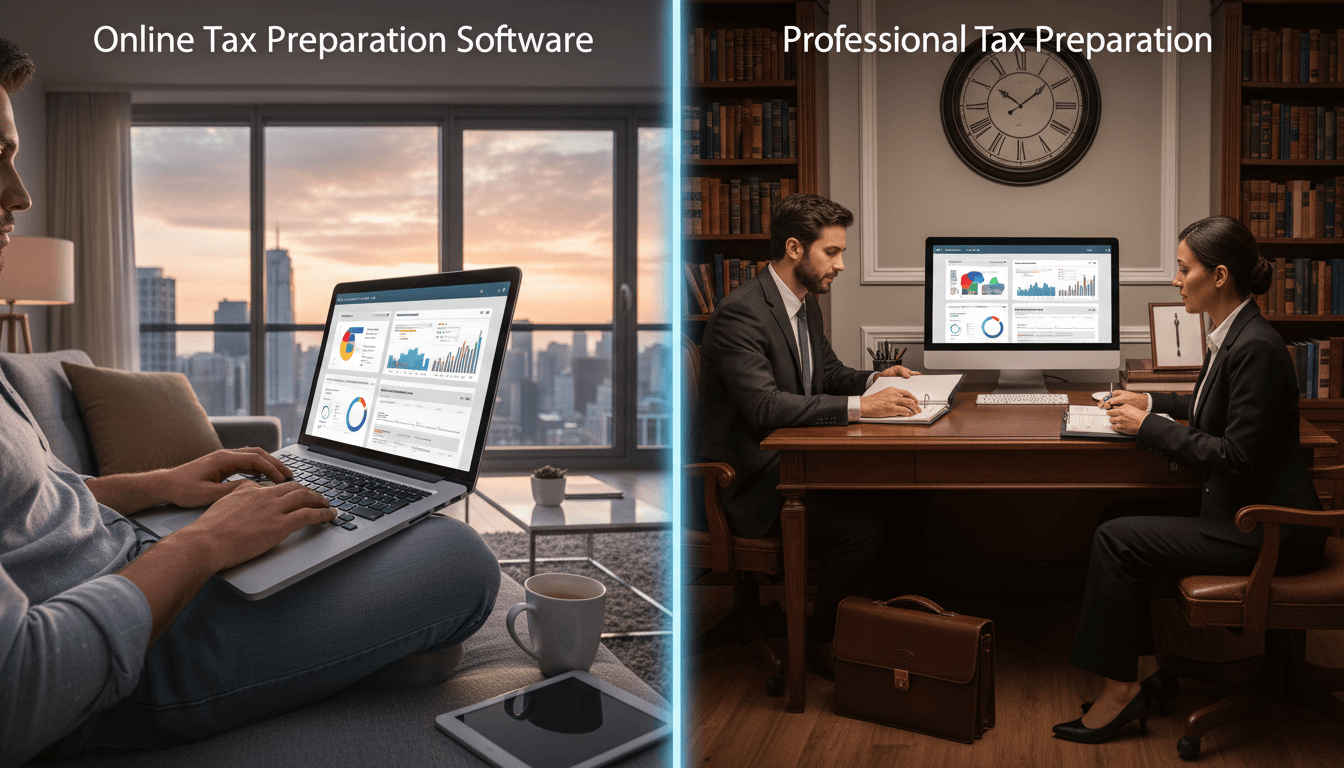

Tax Filing Process Comparison: Online Software vs. Professional Tax Preparers

This guide compares online tax preparation software with professional tax preparers, highlighting key differences in cost, efficiency, and features. Online platforms automate form filling, tax bracket calculations, and deduction optimization, offering a cost-effective alternative to professionals who charge around $1,000 on average. Considerations include tax complexity, expert support needs, and budget constraints, empowering users to make informed decisions for streamlined tax filing and financial compliance.

Tax Software Pricing and Value Analysis: Maximizing Savings and Features

Tax preparation software offers tiered pricing models that vary from free to premium levels, influenced by tax return complexity, support access, and additional features. Leading providers like TurboTax, H&R Block, and TaxAct present distinct cost structures, with average savings of up to 80% compared to professional tax preparers. Early filers can secure discounts, while state returns and expert support often incur extra fees. This guide examines pricing transparency, cost-effectiveness, and strategies to optimize value while ensuring accurate tax filing.

State Tax Return Considerations: Navigating Costs, Providers, and Filing Strategies

State tax return filing costs and support vary significantly among tax preparation services. While some providers like H&R Block and Cash App Taxes offer free state filing with federal returns, others charge fees ranging from $0 to $59. This comprehensive guide examines pricing structures, provider-specific features, and key considerations to help taxpayers optimize their filing approach, minimize expenses, and ensure compliance with state tax regulations.

Small Business and Self-Employed Tax Filing: A Comprehensive Software Comparison

This guide explores specialized tax software solutions for self-employed individuals and small business owners, focusing on features like quarterly tax payment reminders, expense tracking, and deduction maximization tools. We analyze top platforms including TaxSlayer, TurboTax Self-Employed, and TaxAct Self-Employed, providing detailed comparisons of their capabilities for handling multiple income types and business structures. Learn how to streamline tax compliance, reduce your tax burden, and maximize refunds with professional-grade software tailored to entrepreneurial needs.

Mobile and Cloud Tax Filing: A Comprehensive Comparison of Modern Tax Software Features

This detailed analysis explores how leading tax preparation services leverage mobile apps and cloud-based solutions to enhance user experience. We examine key providers like TurboTax, H&R Block, and TaxSlayer, highlighting their mobile support, secure cloud storage capabilities, and multi-device accessibility. Learn about critical features including previous year data import, encrypted return storage, and seamless data transfer. The article provides professional insights into how these technologies offer flexibility, security, and convenience for modern taxpayers while identifying gaps in competitor offerings.

Expert Support and Audit Protection: A Comprehensive Comparison of Tax Software Services

This detailed comparison examines how leading tax software platforms provide expert support and audit protection to safeguard filers. We analyze TurboTax Live, H&R Block Online Assist, and TaxAct Xpert Assist, evaluating their offerings like live expert assistance, professional return reviews, and audit defense services. Learn which service best matches your needs for accuracy, compliance, and peace of mind during tax season.

User Tax Stories

Maximize Your Tax Refund Strategy: Expert Techniques for 2025

Explore comprehensive strategies to enhance your tax refund potential, leveraging expert insights from the Finance Monthly Tax Guide 2025. This guide details optimal filing status selection, key tax credits, and deduction itemization to reduce liabilities. With the average refund at $2,850 and a deadline of April 15, 2025, learn actionable steps for financial planning that align with IRS regulations, ensuring maximum returns and compliance.

Dependent Care and Tax Credits: A Comprehensive Guide to Maximizing Family Financial Benefits

This detailed guide explores essential tax credits and strategies for parents and caregivers, focusing on the $2,000 Child Tax Credit per dependent under 17, income thresholds of $200,000 for single filers and $400,000 for married couples, and benefits of filing as Head of Household. Learn how to leverage dependent care expense deductions, understand phase-out ranges, and implement strategic tax planning to optimize your financial outcomes while ensuring compliance with IRS regulations. Practical examples and actionable steps are included to help families reduce tax liability and increase refunds effectively.

Retirement Account Tax Planning: Strategies to Optimize Your Financial Future

Master retirement account tax planning with this comprehensive guide. Learn how 401(k) contributions directly reduce taxable income, explore IRA conversion strategies to manage future tax liabilities, and understand the tax implications of retirement distributions. Discover actionable steps to minimize taxes while maximizing savings across Traditional IRAs, Roth IRAs, and employer-sponsored plans. Implement proven techniques to align retirement planning with overall financial goals and IRS compliance.

Emerging Technologies in Tax Preparation: AI, Automation, and the Future of Filing

Tax preparation is undergoing a profound transformation driven by emerging technologies like artificial intelligence and digital tools. The IRS is pioneering innovations such as the Inform Me mobile app prototype, capable of scanning and interpreting tax documents, while modern software automates calculations, ensures compliance, and identifies deductions. These advancements significantly reduce manual errors, save time, and enhance the user experience with features like 256-bit encryption and multi-factor authentication. This article explores how these technologies are reshaping tax filing, providing expert insights into maximizing refunds and maintaining compliance.

Maximizing Health Savings Account (HSA) Benefits: Triple Tax Advantages and Strategic Planning

Health Savings Accounts (HSAs) offer unparalleled triple tax benefits—deductible contributions, tax-free growth, and tax-exempt withdrawals for qualifying medical expenses—making them a powerful tool for managing healthcare costs and optimizing tax liabilities. Eligibility requires a high-deductible health insurance plan, and strategic contributions can enhance long-term financial security. This guide explores how to leverage HSAs effectively, including contribution limits, investment opportunities, and compliance with IRS regulations, providing actionable insights for individuals and families to reduce tax burdens while preparing for future medical needs.

Investment and Capital Gains Tax Insights: Navigating Tax Liabilities on Financial Instruments

Gain expert insights into the tax implications of investments such as cryptocurrency, stocks, and other financial instruments. This guide covers essential reporting requirements for capital gains, interest, and dividends, alongside the impact of retirement account changes on your tax liability. Learn actionable strategies to minimize taxes while maximizing compliance, backed by data from the Investment Tax Reporting Guide.

Understanding Tax Credits for Education: A Guide to the American Opportunity Tax Credit

This comprehensive guide explores the American Opportunity Tax Credit (AOC), a valuable tax incentive for students and parents covering up to $2,500 per student annually during the first four years of college. Learn about eligibility criteria, including income thresholds of $80,000 for single filers and $160,000 for married couples filing jointly, how to claim the credit, and strategies to maximize educational tax benefits. Essential for reducing tax burdens and funding higher education expenses effectively.

Advanced Business Owner Tax Strategies: Maximize Deductions and Optimize Income

This comprehensive guide explores essential tax strategies for small business owners and self-employed individuals, focusing on the 20% automatic deduction on qualified business income, equipment and utility deductions, and income limitations. Learn how to navigate complex tax regulations, reduce your taxable income, and leverage deductions for significant savings. With income thresholds of $164,900 for individuals and $329,800 for married couples, understanding these rules is critical for tax optimization and compliance in entrepreneurship.

Maximizing Home Mortgage Interest Deductions: A Comprehensive Tax Strategy Guide

Understanding home mortgage interest deductions is essential for homeowners aiming to optimize tax savings. This guide explores how you can deduct interest on the first $750,000 of mortgage debt ($1 million for pre-December 16, 2017 purchases), the tax-deductibility of mortgage points, and strategic financial planning tips. Learn about IRS requirements, qualifying periods, and how to accurately claim these deductions to reduce your taxable income while maintaining compliance with current tax laws.

Emergency Fund Building with Tax Refund: A Strategic Financial Safety Net

Maximize your tax refund by building a robust emergency fund, a cornerstone of financial stability. Financial advisors universally recommend saving 3-6 months of essential living expenses in a high-yield savings or money market account. This strategic allocation protects against unforeseen events like medical emergencies, job loss, or urgent home repairs. By leveraging your tax refund, you create a liquid, low-risk financial buffer that prevents debt accumulation and reduces stress. This guide details actionable steps to calculate your target savings, select the right account, and integrate this practice into your long-term financial planning for lasting security.

Tax Compliance and Legal Considerations: A Comprehensive Guide for Taxpayers

Maintaining tax compliance is essential to avoid legal repercussions and penalties, as demonstrated by historical cases like Al Capone's conviction for tax evasion. This guide emphasizes the critical importance of accurate and complete reporting of all income sources, including digital assets, online earnings, and investments. By leveraging professional resources and staying informed about evolving tax regulations, individuals and businesses can effectively manage their tax obligations, minimize risks, and ensure adherence to IRS standards for timely filing and full disclosure.

Tax Filing Essentials: Maximizing Your Refund and Compliance with IRS Guidelines

Navigating tax filing requires meticulous preparation and strategic planning to optimize refunds while maintaining full IRS compliance. This comprehensive guide details essential steps from gathering W-2s, 1099s, and income statements to leveraging electronic filing with direct deposit for 21-day refund processing. Learn critical updates on reduced Child Tax Credit and Earned Income Tax Credit amounts, plus strategies for accurately reporting all income sources including online platform earnings and investment income. With 168 million individual returns expected by the April 18 deadline, these professional insights help minimize errors and maximize financial outcomes.

IRS Modernization and Taxpayer Services: A Comprehensive Guide to Enhanced Tax Support

The Internal Revenue Service is undergoing a significant transformation to improve taxpayer experiences through technological upgrades and expanded support services. Recent achievements include hiring 5,000 new customer service representatives, dramatically reducing phone wait times from 28 to 3 minutes, and enhancing digital capabilities. The IRS is developing advanced Individual Online Accounts featuring secure messaging, live chat support, and virtual assistant technology. Future innovations will enable taxpayers to securely file documents, access complete account history, and validate bank accounts online, representing a major leap forward in tax administration efficiency and user convenience.

Common Tax Filing Mistakes to Avoid: A Comprehensive Guide for Taxpayers

Navigating tax filing can be complex, with common errors like incorrect personal details, unreported income, and filing status missteps leading to IRS delays or audits. This guide details critical mistakes to avoid, emphasizing accurate reporting of all income sources—including online earnings, investments, and freelance work—and proper documentation. Learn how to verify Social Security numbers, claim deductions correctly, and maintain records to ensure compliance and optimize your tax outcomes, based on IRS guidelines.

Strategic Charitable Giving: Maximizing Tax Benefits While Supporting Your Community

Discover how strategic charitable contributions can align with your financial goals while making a meaningful community impact. This guide explains how donations to qualified organizations may offer tax deductions, with limits up to 50% of your adjusted gross income. Learn key strategies for documentation, timing donations, and understanding IRS requirements to optimize both your philanthropic efforts and potential tax savings. Implement these professional approaches to enhance your financial planning and create lasting positive change.

Navigating Tax Refunds and Payments: A Professional Guide to Timely Processing and Strategic Financial Management

This comprehensive guide explains the tax refund process, emphasizing electronic filing with direct deposit as the fastest method, typically yielding refunds within 21 days. Special credits like the Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC) may delay refunds until mid-February. Taxpayers can track their status using the IRS 'Where's My Refund?' tool, updated every 24 hours after e-file acceptance. Learn to optimize your tax strategy, avoid common pitfalls, and manage finances effectively with expert insights.

Tax Filing for Special Situations: Divorce, Self-Employment, and Free Assistance Programs

Navigating tax obligations during life changes like divorce requires understanding filing status adjustments, dependent claims, and eligibility for credits such as the Child Tax Credit. Self-employed individuals must utilize the IRS Tax Withholding Estimator to prevent underpayment penalties and manage quarterly estimated taxes. Free tax preparation services, including Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE), offer expert guidance. This guide details strategies to optimize your tax position, ensure compliance, and leverage available resources effectively.

Premium Tax Credit and Health Insurance Considerations for Tax Year 2022

The Premium Tax Credit (PTC) offers crucial financial assistance for taxpayers who purchase health insurance through the Health Insurance Marketplace. With temporarily expanded eligibility in tax year 2022, this credit helps reduce insurance premium costs for individuals and families enrolled in qualified health plans. To claim the PTC, taxpayers must accurately file Form 8962, ensuring all documentation—such as Form 1095-A—is reviewed thoroughly. This article provides a detailed guide on eligibility, filing requirements, and strategies to maximize benefits while staying compliant with IRS regulations, making it essential for anyone navigating marketplace health insurance and tax credits.

Choosing the Right Tax Preparation Software: A Comprehensive Guide to TurboTax, H&R Block, and TaxAct

Selecting the ideal tax preparation software is crucial for accurate, efficient filing. This guide compares TurboTax, H&R Block, and TaxAct, highlighting TurboTax's AI-powered deduction discovery and live expert support, H&R Block's hybrid online and in-person assistance with complimentary audit defense, and TaxAct's cost-effective, education-focused platform. All options utilize 256-bit encryption and multi-factor authentication for security, offering automated calculations, compliance verification, and deduction optimization to minimize errors and maximize refunds while saving time.

Tax Deduction and Credit Landscape for 2023: Key Changes and Strategic Insights

The 2023 tax year introduces pivotal adjustments to credits and deductions, significantly impacting taxpayers. The Child Tax Credit has reverted to $2,000 per dependent, down from $3,600 in 2021, while the Earned Income Tax Credit for individuals without children has decreased sharply from approximately $1,500 to $500. Additionally, the Child and Dependent Care Credit is now capped at $2,100, a substantial reduction from the previous $8,000. Above-the-line charitable deductions are no longer accessible for those opting for the standard deduction. This article provides a thorough analysis of these changes, offering actionable strategies to navigate the evolving tax environment, maximize eligibility for remaining benefits, and ensure compliance with IRS guidelines.

Navigating Tax Filing Deadlines: Essential IRS Deadlines, Extension Strategies, and Best Practices for 2025

Understanding tax filing deadlines is crucial for compliance and financial health. This guide covers the primary IRS deadline of April 15, 2025, extension options until October 15, 2025, and the benefits of direct deposit for faster refunds. Learn how to avoid penalties, manage extensions, and utilize IRS resources effectively. Based on IRS Filing Guidelines 2025, this article provides actionable strategies for timely and accurate tax submission, helping you minimize stress and maximize financial outcomes.

Tax Audit Prevention Strategies: Proactive Steps to Minimize IRS Scrutiny

This guide provides actionable strategies to reduce the likelihood of IRS audits by focusing on accurate tax reporting and compliant record-keeping. Learn to identify common audit triggers like incorrect data entry and unsubstantiated deductions, implement best practices for maintaining financial documentation, and leverage professional insights to safeguard your filings. By adopting these measures, taxpayers can enhance compliance, avoid penalties, and achieve peace of mind.

IRA and Retirement Contribution Strategies: Maximizing Tax Efficiency

This guide explores IRA and retirement contribution strategies to optimize tax savings. Learn about Traditional IRA deduction phase-outs, income limits for full deductions, and how workplace plans like 401(k)s interact with IRAs. For single filers, deductions phase out starting at $73,000, while married couples filing jointly face a $116,000 limit. Discover actionable steps to enhance retirement readiness while minimizing tax liabilities through informed contribution planning and compliance with IRS guidelines.

Clean Vehicle Tax Credit Strategy: Maximize Savings Before the Deadline

Discover how to leverage the Clean Vehicle Tax Credit before it expires on September 30, 2025. This guide covers eligibility requirements for electric and eco-friendly vehicles, potential savings up to $7,500, and strategic purchasing considerations. Learn about income limitations, vehicle specifications, and how to integrate this credit into your broader tax planning. With time running out, this is a crucial opportunity to reduce your tax liability while supporting sustainable transportation.

Dependent Care Financial Planning: Strategies for Maximizing Tax Benefits

This comprehensive guide explores effective financial strategies for managing dependent care expenses, focusing on tax-advantaged solutions. Learn how to utilize pre-tax dollars through Dependent Care Flexible Spending Accounts (FSAs) to cover childcare and elder care costs, reducing your taxable income. Understand eligibility requirements, contribution limits, and how FSAs compare to tax credits. Discover practical steps to optimize your financial planning, avoid common pitfalls, and leverage expert insights to maximize savings while ensuring compliance with IRS regulations. Ideal for families and caregivers seeking to lower their tax burden and manage care expenses efficiently.

Tax Filing Status Optimization: A Strategic Guide to Maximizing Refunds and Minimizing Liabilities

Choosing the right tax filing status is a critical decision that can significantly impact your financial outcomes. This comprehensive guide explores key statuses—Single, Married Filing Jointly, Married Filing Separately, and Head of Household—detailing their eligibility requirements, standard deductions, and strategic advantages. With real data showing deductions like $25,100 for married joint filers and $18,800 for head of household, learn how to align your status with life events such as marriage, divorce, or dependents to optimize tax savings, avoid common pitfalls, and ensure compliance with IRS regulations.

Cryptocurrency and Investment Reporting: A Comprehensive Tax Guide

This detailed guide explores the essential aspects of cryptocurrency and investment tax reporting, emphasizing the tax implications of digital assets like Bitcoin and Ethereum, stocks, and other financial instruments. It covers how capital gains from crypto are taxable, the necessity of reporting all investment income, and the critical importance of maintaining accurate, detailed records for compliance. Readers will learn about IRS requirements, strategies for minimizing tax liabilities, and tools for effective financial documentation, helping investors navigate complex regulations while optimizing their financial outcomes.

Strategic Charitable Donation Tax Planning: Maximizing Impact and Benefits

This guide explores a strategic approach to charitable giving, emphasizing tax-efficient methods to support meaningful causes while optimizing financial outcomes. Learn how to leverage the IRS allowance of donating up to 50% of your adjusted gross income, understand the nuances of itemized deductions, and implement best practices for documentation and timing. With insights into qualified organizations, valuation rules, and long-term planning, this resource helps donors align philanthropic goals with potential tax savings, ensuring compliance and maximizing both social and financial returns.

Home Energy Efficiency Tax Credits: Maximize Savings Under the Inflation Reduction Act

Learn how to leverage the Inflation Reduction Act's energy-efficient home improvement tax credits to reduce your tax burden. Eligible homeowners can claim up to 30% of qualified expenses, with a maximum annual credit of $1,200 for projects completed between 2022 and 2032. This guide covers qualifying upgrades, documentation requirements, and step-by-step instructions to seamlessly integrate these savings into your tax strategy, helping you enhance home performance while cutting costs.

State and Local Tax (SALT) Deduction Limits: Strategies and Compliance Guide

The State and Local Tax (SALT) deduction allows taxpayers to deduct specified state and local taxes from federal taxable income, subject to a $10,000 annual cap ($5,000 if married filing separately). This comprehensive guide explores the complexities of SALT deductions, covering deductible taxes like state income, local, and property taxes. Learn strategic approaches to navigate these limitations, optimize tax benefits, and ensure compliance with current IRS regulations. Essential for taxpayers in high-tax states seeking to maximize deductions while adhering to federal tax laws.