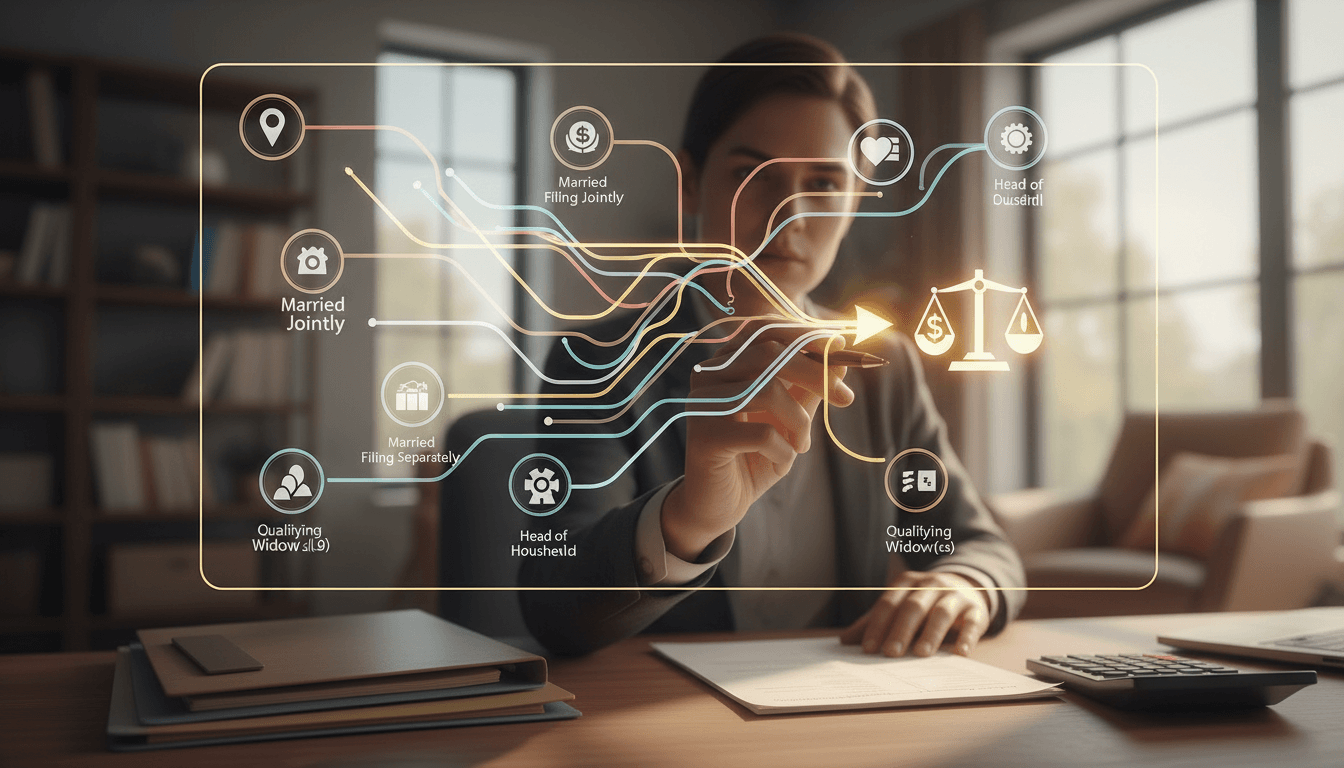

The 2023 tax year marks a significant shift in the availability and value of key tax credits and deductions, necessitating careful planning and informed decision-making. Central to these changes is the reduction of the Child Tax Credit from $3,600 per dependent in 2021 to $2,000 for the 2023 tax year. This adjustment reverts to pre-pandemic levels and may affect middle-income families relying on this credit to offset child-rearing expenses. Similarly, the Earned Income Tax Credit (EITC) for taxpayers with no qualifying children has seen a drastic decrease, falling from approximately $1,500 in 2021 to $500 in 2023. This reduction impacts low-to-moderate-income workers, potentially diminishing refunds and increasing tax liabilities. The Child and Dependent Care Credit, which provided up to $8,000 for eligible expenses in previous years, is now limited to a maximum of $2,100. This cap applies to expenses incurred for the care of a child under age 13 or a disabled dependent, affecting families' ability to claim substantial reimbursements for childcare costs. Furthermore, the elimination of above-the-line charitable deductions for those taking the standard deduction means taxpayers can no longer deduct up to $300 ($600 for married filing jointly) in cash contributions without itemizing. This change may reduce incentives for charitable giving among non-itemizers. To adapt, taxpayers should consider itemizing deductions if their total itemizable expenses (such as mortgage interest, state and local taxes, and medical expenses exceeding 7.5% of adjusted gross income) exceed the standard deduction. Additionally, exploring other credits like the Lifetime Learning Credit or the Saver's Credit, and maintaining meticulous records of eligible expenses, can help mitigate the impact of these reductions. Consulting with a tax professional is advisable to assess eligibility, optimize tax positions, and ensure compliance with evolving IRS regulations. Proactive planning, including adjusting withholdings and leveraging retirement contributions, remains crucial for managing tax burdens effectively in 2023.