Tax Filing Process Comparison: Online Software vs. Professional Tax Preparers

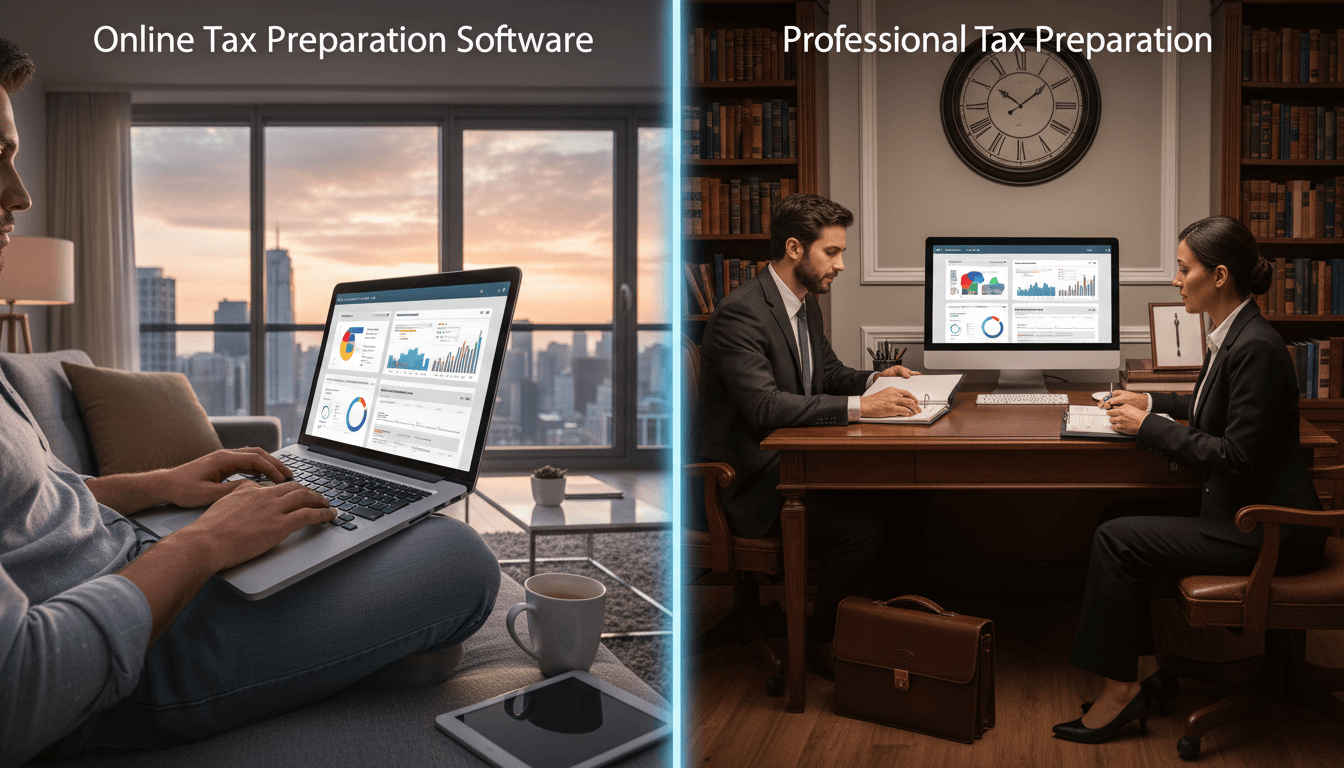

This guide compares online tax preparation software with professional tax preparers, highlighting key differences in cost, efficiency, and features. Online platforms automate form filling, tax bracket calculations, and deduction optimization, offering a cost-effective alternative to professionals who charge around $1,000 on average. Considerations include tax complexity, expert support needs, and budget constraints, empowering users to make informed decisions for streamlined tax filing and financial compliance.

Navigating the tax filing process requires careful consideration of available options to maximize efficiency and minimize liabilities. This comparison examines online tax preparation software and professional tax preparers, leveraging data from Tax Software Comparative Analysis. Online solutions simplify tax filing through automated processes, while professionals offer personalized expertise. Key factors such as automated form filling, tax bracket determination, deduction optimization, and cost-effectiveness—with professional services averaging $1,000—are analyzed to help individuals choose the best approach based on their financial situation, complexity, and budget.

Online Tax Preparation Software

Pros

- Automated form filling reduces manual errors and saves time

- Real-time tax bracket determination ensures accurate calculations

- Deduction optimization identifies eligible credits and deductions for maximum savings

- Cost-effective, often free or low-cost compared to professional services

- User-friendly interfaces with step-by-step guidance for easy navigation

- Accessible from any device with internet connectivity for convenience

Cons

- Limited expert support for complex tax scenarios

- May not cover highly specialized deductions or international tax issues

- Potential security risks if using unverified platforms

- Updates required for annual tax law changes, which can delay filing

Specifications

Professional Tax Preparers

Pros

- Expert support for complex tax situations, including audits and investments

- Personalized deduction and credit strategies tailored to individual finances

- Handles intricate scenarios like business taxes, estates, and multi-state filings

- Reduces liability through professional accuracy and compliance checks

- Ongoing advisory services for year-round tax planning and financial management

Cons

- Higher cost, averaging $1,000 per return, which may not fit all budgets

- Longer processing times due to manual review and appointment scheduling

- Less accessibility for last-minute filings or urgent updates

- Potential for variability in quality depending on the preparer's expertise

Specifications

Comparison Table

| Feature | Online Tax Software | Professional Tax Preparers |

|---|---|---|

| Cost | $0 - $150 | $1,000 average |

| Automation Level | High - automated form filling and calculations | Low - manual review with expert input |

| Deduction Optimization | Automated algorithms identify standard and itemized deductions | Custom strategies based on in-depth financial analysis |

| Tax Bracket Handling | Real-time software updates for accurate bracket application | Expert interpretation for complex bracket scenarios |

| Support Availability | Limited to online help centers and chatbots | Direct access to certified professionals for consultations |

| Ideal Tax Complexity | Simple to moderate (e.g., single income, basic deductions) | Complex (e.g., multiple incomes, investments, businesses) |

| Filing Speed | Immediate to a few days with e-filing | Weeks due to appointments and manual processes |

| Security | Varies by platform; reputable services use encryption | High, with confidentiality agreements and secure data handling |

Verdict

Choosing between online tax software and professional preparers depends on individual circumstances. Online software excels in cost-effectiveness, automation, and accessibility for straightforward tax situations, with features like automated form filling and deduction optimization reducing errors and saving time. However, for complex finances requiring expert support—such as business ownership or audit risks—professional preparers justify the $1,000 average cost through personalized strategies and compliance assurance. Evaluate factors like tax complexity, budget constraints, and the need for ongoing advice to select the optimal filing method, ensuring maximum refunds and regulatory adherence.