Gifting and Estate Tax Planning: Maximizing Lifetime Exemptions Before 2026

This comprehensive guide explores strategic gifting and estate tax planning to leverage current high lifetime gift tax exemptions. In 2024, individuals can shield up to $13.61 million ($27.22 million for married couples) from taxes, increasing in 2025 before a projected drop to approximately $5 million in 2026. Learn proactive techniques like direct gifts, trusts, and valuation discounts to transfer wealth tax-efficiently, minimize estate taxes, and preserve family assets amid changing tax landscapes.

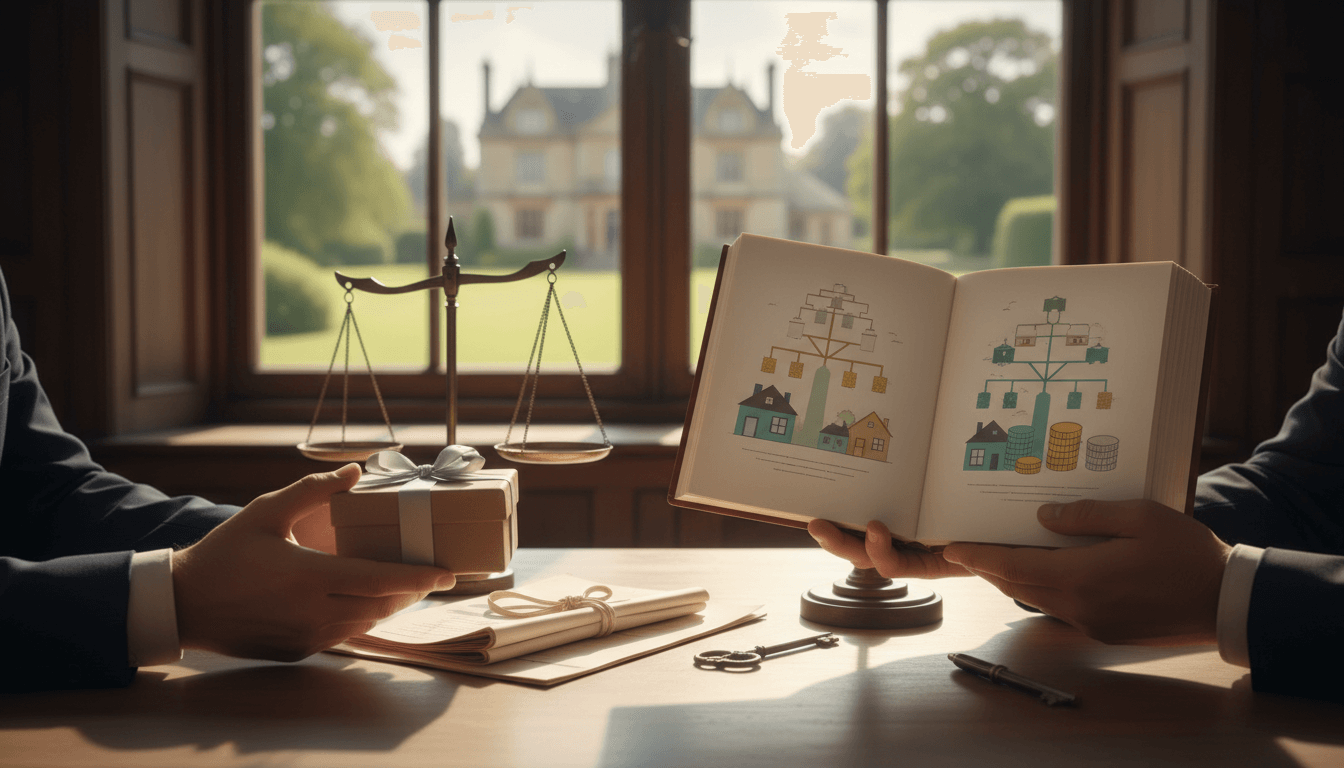

Estate and gift tax planning is a critical component of wealth preservation, allowing individuals to transfer assets to heirs while minimizing tax liabilities. The current lifetime gift tax exemption presents a historic opportunity, with 2024 limits at $13.61 million for individuals and $27.22 million for married couples, set to rise in 2025 before a significant expected reduction in 2026. This guide delves into the mechanics of these exemptions, strategic gifting methods, and proactive steps to optimize your financial legacy in alignment with IRS regulations and forthcoming legislative changes.

Understanding Lifetime Gift Tax Exemptions and Current Limits

The lifetime gift tax exemption is a cornerstone of estate planning, permitting taxpayers to gift substantial assets without incurring federal gift tax. For 2024, the exemption stands at $13.61 million per individual, or $27.22 million for married couples electing portability. In 2025, adjustments for inflation will increase these amounts to $13.99 million (single) and $27.98 million (married). However, without Congressional action, the Tax Cuts and Jobs Act provisions sunset after 2025, reverting the exemption to an inflation-adjusted base of approximately $5 million per person in 2026. This potential decrease of over 60% underscores the urgency for high-net-worth individuals to utilize exemptions now. Gifts exceeding the annual exclusion ($18,000 per recipient in 2024) count against this lifetime limit, and unused portions can be carried forward, though strategic use before 2026 is advisable to lock in higher thresholds.

Strategic Gifting Techniques to Maximize Tax Efficiency

Proactive gifting strategies can significantly reduce taxable estates. Direct cash or asset gifts to heirs up to the lifetime exemption avoid immediate taxation, while annual exclusion gifts ($18,000 per donee in 2024) require no filing and preserve the lifetime limit. For larger transfers, consider leveraging irrevocable trusts, such as Grantor Retained Annuity Trusts (GRATs) or Spousal Lifetime Access Trusts (SLATs), which remove assets from your estate while providing income streams or spousal benefits. Valuation discounts for family-limited partnerships or non-publicly traded assets can further enhance gifting efficiency by reducing the taxable value of transferred interests. Additionally, paying medical or educational expenses directly for beneficiaries (e.g., tuition to institutions) does not count against exemptions, offering tax-free support. Document all transactions meticulously with appraisals and Form 709 filings to ensure compliance and audit readiness.

Estate Tax Integration and Long-Term Planning Considerations

Gifting and estate tax planning are inherently linked, as lifetime gifts reduce the gross estate subject to estate tax at death. The unified tax system means exemptions apply cumulatively to both gifts and estates, with top rates of 40% for excess transfers. To mitigate risks, employ portability elections for married couples to transfer unused exemptions between spouses, and consider state-level estate taxes, which may have lower thresholds than federal rules. Charitable giving through donor-advised funds or charitable remainder trusts can also reduce taxable estates while supporting causes. With the projected 2026 exemption drop, individuals with estates near or above $5 million should prioritize gifting appreciating assets (e.g., stocks, real estate) to remove future growth from their estates. Regular reviews with financial advisors are essential to adapt to legislative changes and family circumstances.

Common Pitfalls and Compliance Requirements

Navigating gift and estate taxes requires vigilance to avoid costly errors. Failure to file Form 709 for taxable gifts can result in penalties and interest, while inadequate documentation may lead to IRS challenges on valuations. Clawback risks—where pre-2026 gifts could be reevaluated if exemptions decrease—are mitigated by current IRS guidance, but legislative uncertainty remains. Avoid gifts with retained control (e.g., keeping usufruct over property), which may invalidate estate exclusion. Also, be mindful of generation-skipping transfer taxes for gifts to grandchildren, which have separate exemptions. Work with certified professionals to ensure strategies align with overall financial plans, and maintain records for at least seven years post-filing to support audits or disputes.

Key Takeaways

2024 gift tax exemptions are $13.61M (single) and $27.22M (married), rising in 2025 before a projected drop to ~$5M in 2026.

Use trusts, annual exclusions, and direct payments for education/medical expenses to transfer wealth tax-efficiently.

Portability and valuation discounts can maximize exemptions and reduce taxable estate values.

File Form 709 for taxable gifts and document all transactions to ensure IRS compliance.

Plan proactively before 2026 to lock in higher exemptions and protect family wealth from future tax increases.

Frequently Asked Questions

What happens if I don't use my full lifetime gift tax exemption before 2026?

Unused portions may be lost if exemptions decrease, as the higher pre-2026 amounts are not grandfathered for future gifts. The IRS provides anti-clawback rules to protect gifts made before the reduction, but leveraging exemptions now ensures maximum benefit.

Can I gift more than the annual exclusion without filing a tax return?

No, gifts exceeding the annual exclusion ($18,000 per recipient in 2024) require filing IRS Form 709 and will count against your lifetime exemption. Failure to file may result in penalties and interest on unpaid taxes.

How does portability work for married couples in estate planning?

Portability allows a surviving spouse to use any unused lifetime gift and estate tax exemption from the deceased spouse, effectively doubling protections. An election must be made on Form 706 filed within nine months of death, extending the combined exemption for future gifts or estates.

Are there strategies to gift assets while retaining some income or control?

Yes, instruments like GRATs or Qualified Personal Residence Trusts (QPRTs) enable gifting with retained income or use rights for a term, removing assets from your estate after the term ends. However, overly controlling gifts may risk IRS reclassification, so consult an advisor.

Conclusion

Gifting and estate tax planning offer powerful tools to preserve wealth across generations, but the window for leveraging current high exemptions is narrowing. By acting before 2026, individuals can utilize strategies like direct gifting, trusts, and valuation discounts to transfer assets tax-efficiently and reduce future estate liabilities. Stay informed on legislative updates, maintain meticulous records, and collaborate with financial professionals to tailor approaches to your unique circumstances. Proactive planning today can secure a lasting legacy and minimize tax burdens for your heirs.