IRA and Retirement Contribution Strategies: Maximizing Tax Efficiency

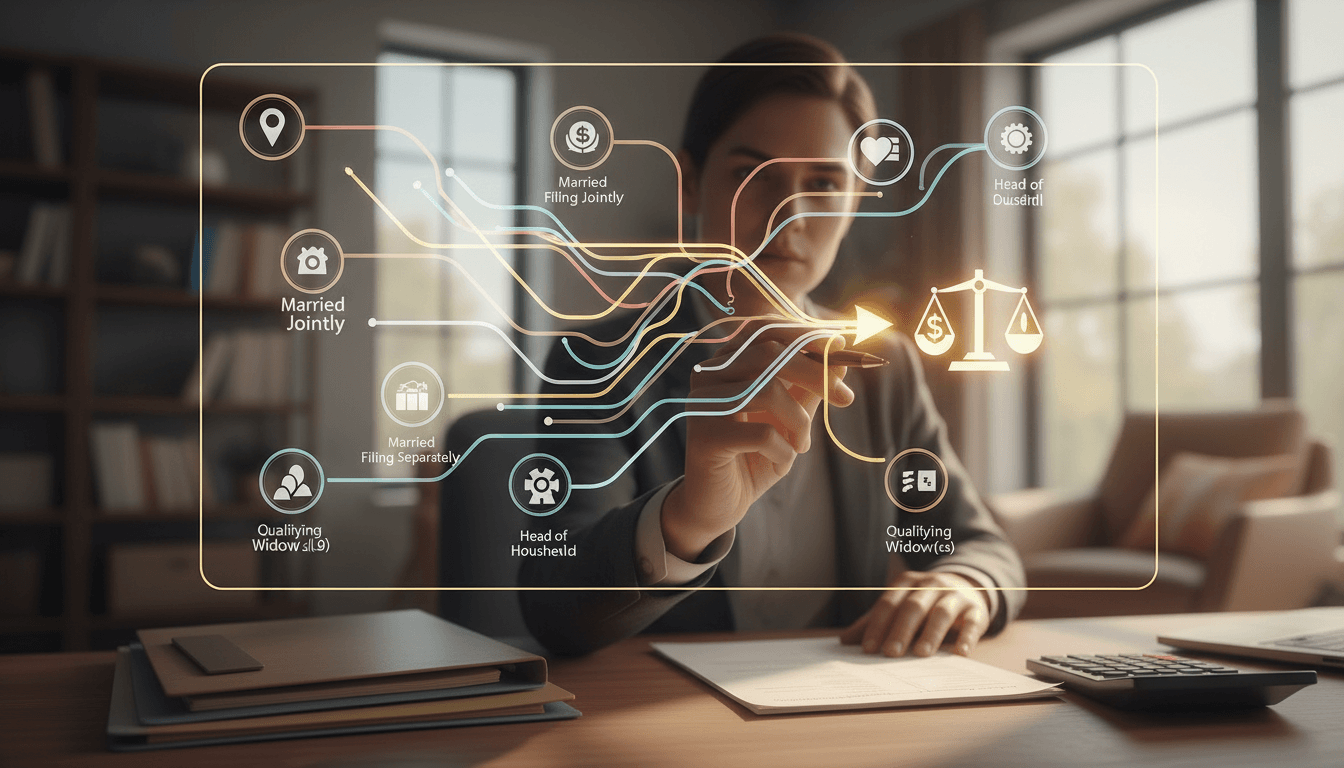

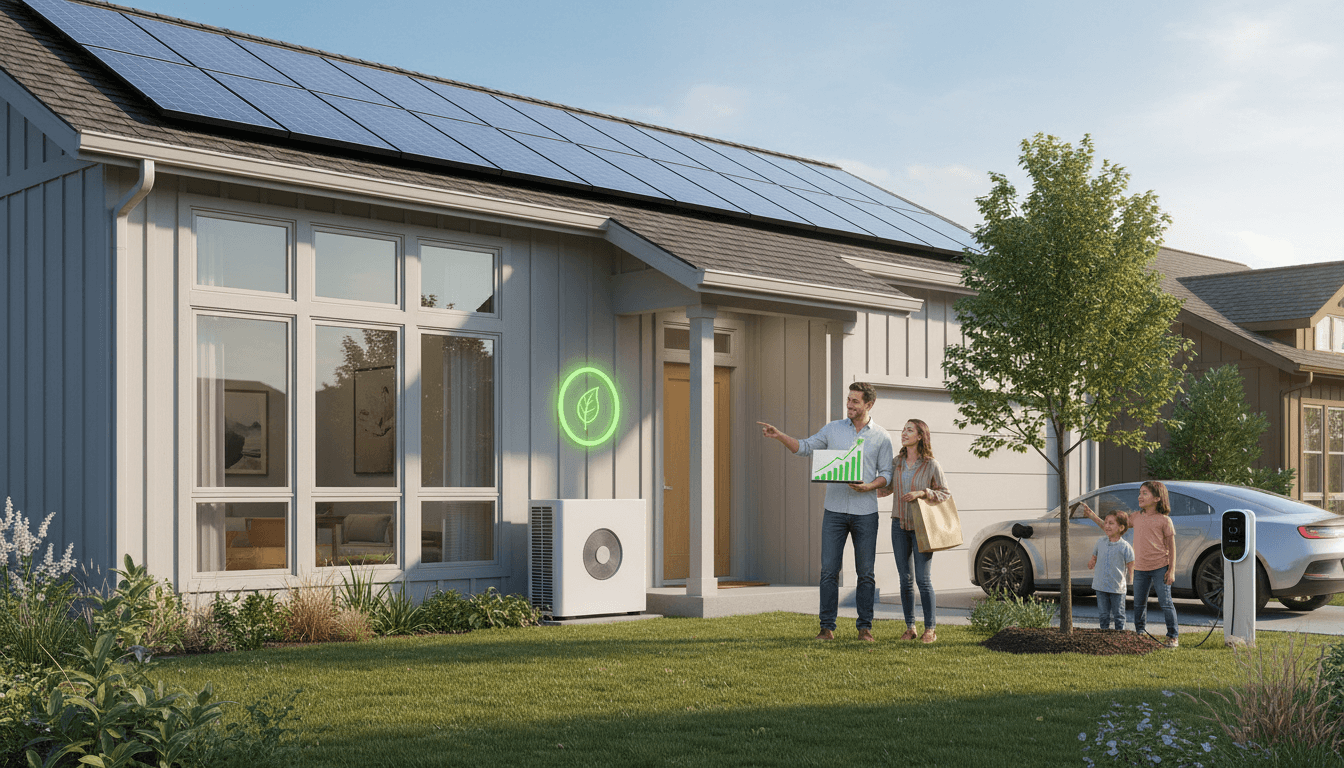

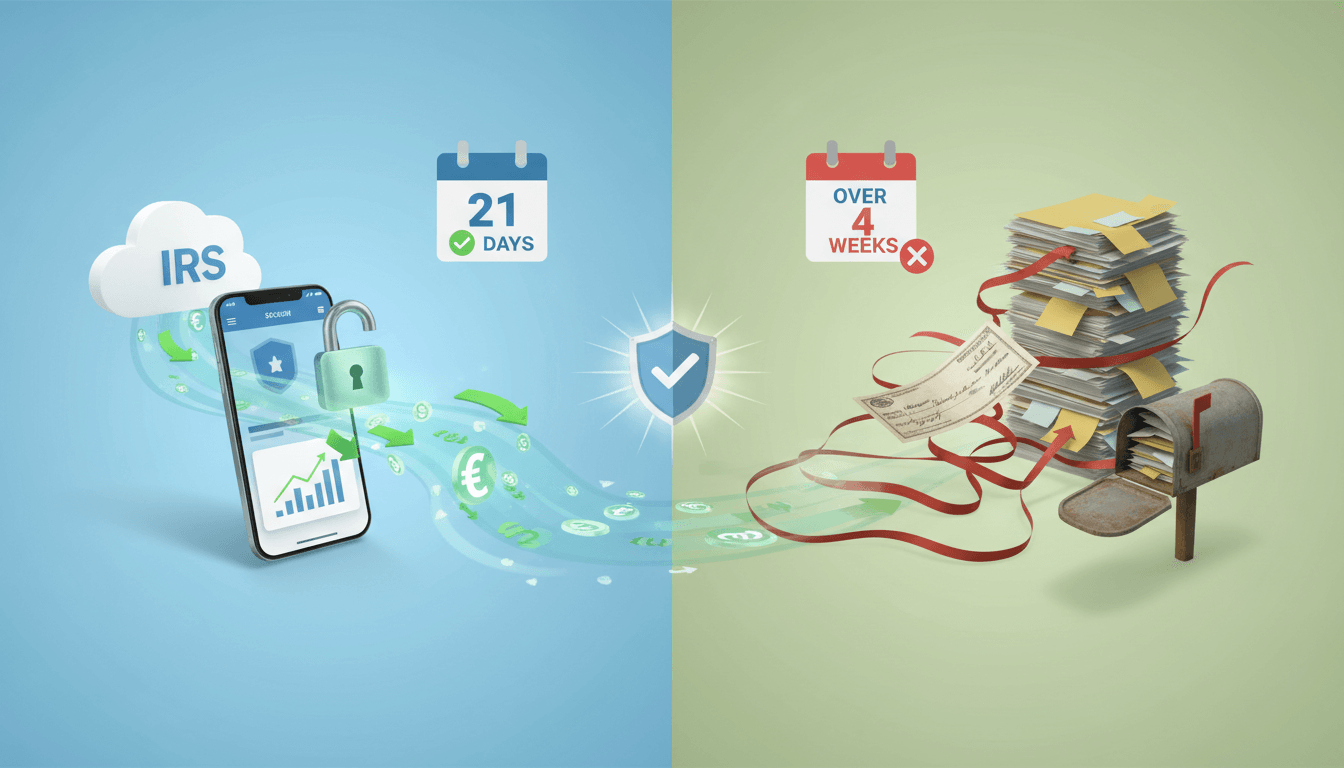

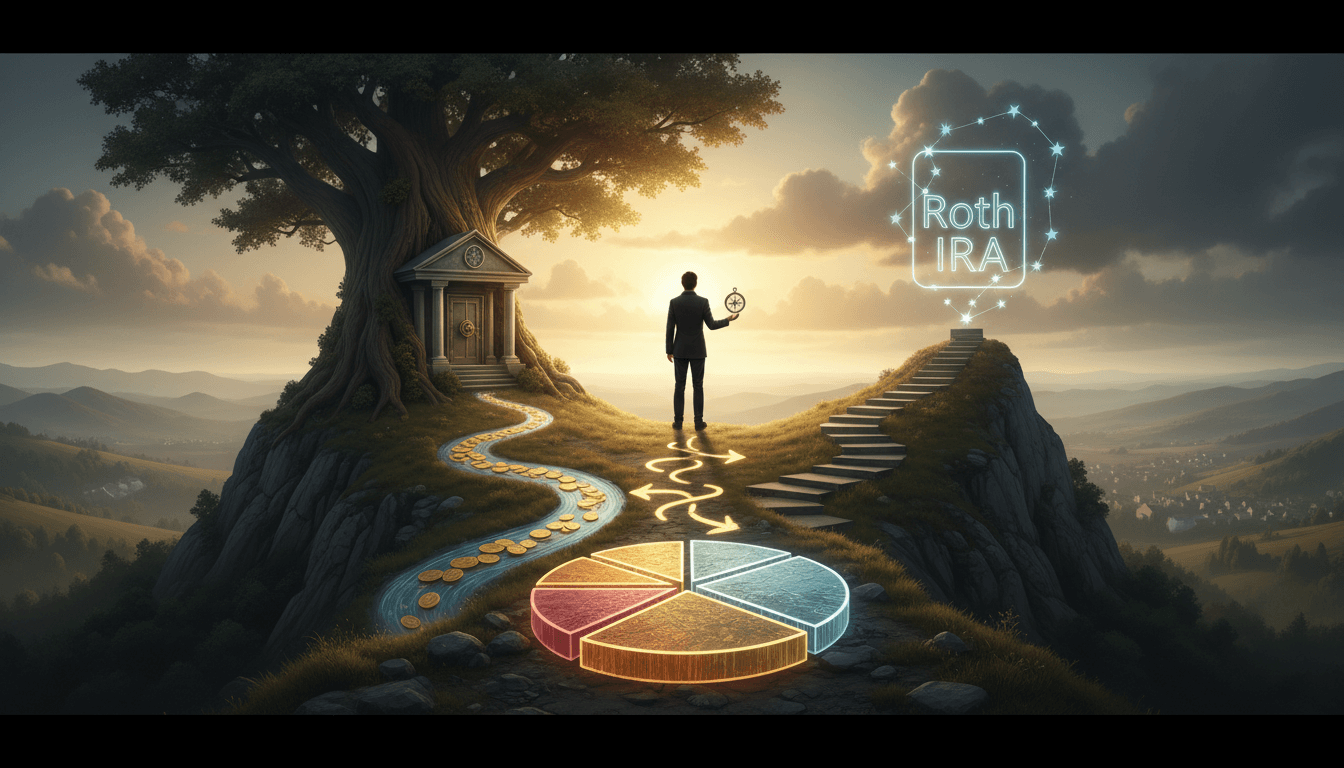

This guide explores IRA and retirement contribution strategies to optimize tax savings. Learn about Traditional IRA deduction phase-outs, income limits for full deductions, and how workplace plans like 401(k)s interact with IRAs. For single filers, deductions phase out starting at $73,000, while married couples filing jointly face a $116,000 limit. Discover actionable steps to enhance retirement readiness while minimizing tax liabilities through informed contribution planning and compliance with IRS guidelines.

Article Information

Author | Financial Advisor Team |

Date | September 29, 2025 |

Rating | 5 / 5.0 |

Would Recommend | Yes |

Helpful Count | 4317 |

Helpful Votes | 4317 |

Not Helpful Votes | 347 |