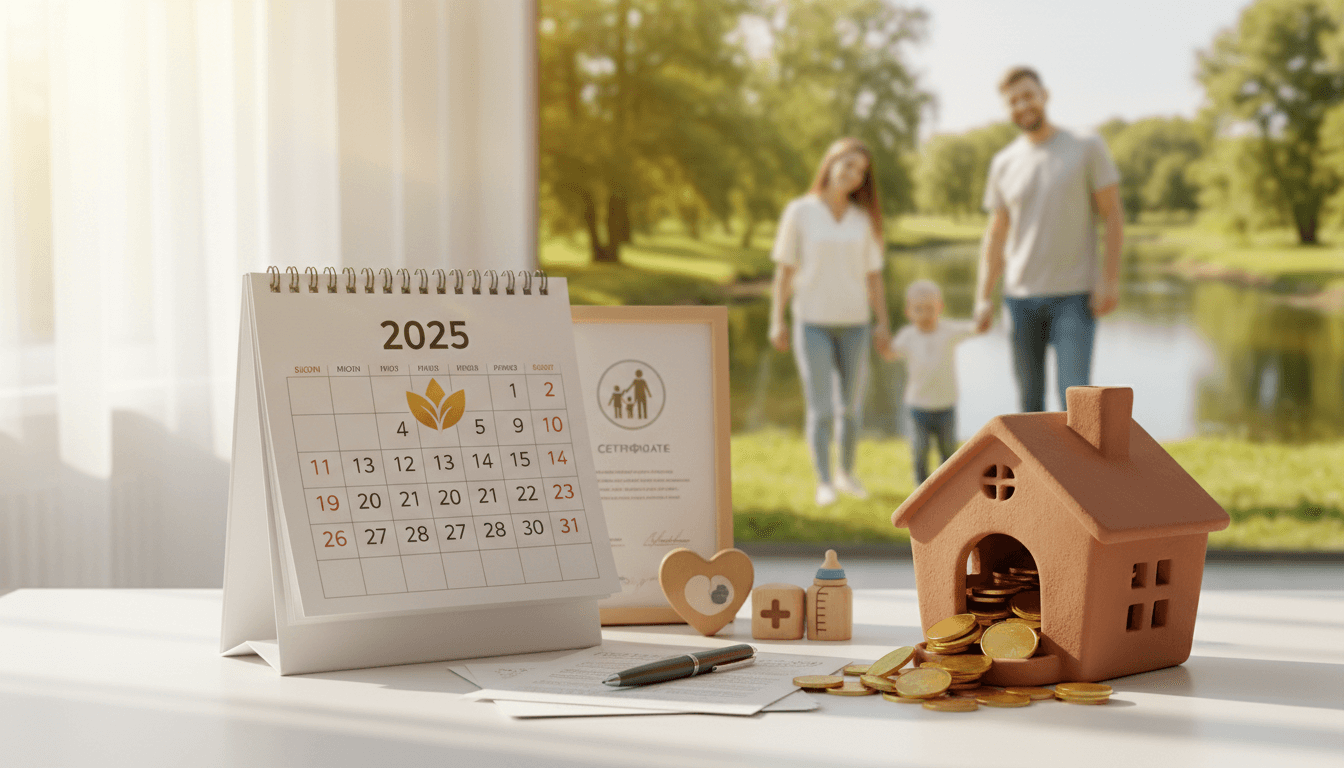

Adoption Credit

The adoption credit for 2025 provides a maximum benefit of $17,280 for qualified adoption expenses, offering significant tax relief to eligible taxpayers. To qualify, your modified adjusted gross income must be below $299,190, and the credit can be claimed for both domestic and international adoptions. This comprehensive guide covers eligibility criteria, calculation methods, documentation requirements, and strategic planning tips to maximize your tax savings while ensuring compliance with IRS regulations outlined in Publication 505.

Overview

The adoption credit is a non-refundable tax credit designed to alleviate the financial burden of adoption by allowing taxpayers to offset qualified expenses against their tax liability. For the 2025 tax year, the maximum credit amount is $17,280, applicable to both domestic and international adoptions. Eligibility is contingent upon the taxpayer's modified adjusted gross income (MAGI) being less than $299,190. This credit is part of the IRS's efforts to support families in expanding through adoption, covering expenses such as adoption fees, court costs, attorney fees, travel, and other necessary expenditures. Proper documentation and adherence to IRS guidelines are crucial for successful claims.

Specifications

- Form 8839

- Schedule 3

- Domestic

- International

- Special Needs

- Adoption fees

- Court costs

- Attorney fees

- Travel expenses

- Home study costs

- Other directly related expenses

Details

The adoption credit calculation begins with aggregating all qualified adoption expenses, which are necessary costs directly related to the legal adoption of an eligible child. These expenses must not be reimbursed by any employer or other source. The credit is claimed in the tax year following the year the expenses were paid or the year the adoption becomes final, whichever is later. For special needs adoptions, taxpayers may claim the full $17,280 credit regardless of actual expenses, provided the child is a U.S. citizen or resident and the state has determined the child has special needs. Income phase-outs apply progressively between MAGI of $239,190 and $279,190, reducing the credit amount linearly until it phases out completely at $299,190. Taxpayers must complete Form 8839, Qualified Adoption Expenses, and attach it to their federal tax return, ensuring all documentation such as adoption decrees, receipts, and court orders is retained for at least three years post-filing. Strategic considerations include timing expenses to optimize credit utilization, coordinating with employer-provided adoption benefits, and planning for multi-year carryforwards if the credit exceeds tax liability.

Comparison Points

The adoption credit is non-refundable, unlike the Child Tax Credit which may be partially refundable

Income limits for the adoption credit are higher than those for the Earned Income Tax Credit

Unlike adoption exclusions for employer benefits, the credit directly reduces tax liability dollar-for-dollar

The credit amount is adjusted annually for inflation, similar to other tax provisions like the standard deduction

Important Notes

Taxpayers adopting a spouse's child are generally ineligible for the credit. Expenses paid using funds from a 529 plan or other tax-advantaged accounts may not qualify. International adoptions must be finalized to claim the credit for non-special needs children. Consult a tax professional for complex situations involving multiple adoptions or changes in marital status.