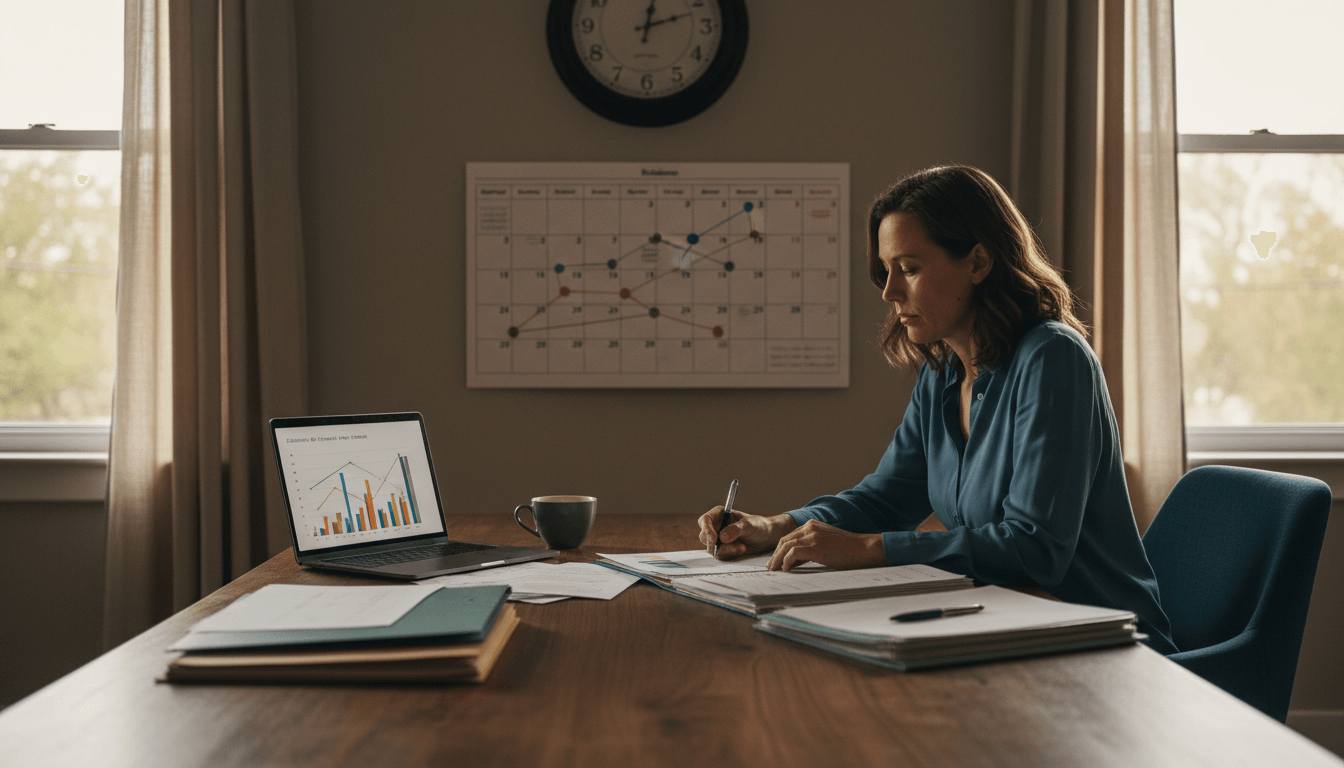

Tax filing is a critical annual responsibility, yet many taxpayers inadvertently make errors that can result in processing delays, penalties, or IRS inquiries. Based on data from the Internal Revenue Service (IRS), this article expands on common pitfalls and offers professional strategies to mitigate them. Incorrect personal information, such as mismatched Social Security numbers or misspelled names, is a frequent issue; even minor discrepancies can trigger manual reviews, delaying refunds by weeks. Always cross-reference official documents like Social Security cards and W-2 forms to ensure accuracy. Misreporting income is another major concern. Taxpayers must declare all earnings, including those from online platforms (e.g., gig economy apps), investment income (like dividends and capital gains), freelance work, and digital asset transactions (such as cryptocurrency sales). The IRS receives copies of income statements (e.g., Forms 1099), so omissions can lead to automated notices and potential audits. In 2023, the IRS flagged over 2 million returns for unreported income, emphasizing the need for thoroughness. Choosing the wrong filing status—such as single versus head of household—can drastically alter tax liability and credit eligibility. For instance, head of household status offers lower tax rates and higher standard deductions, but it requires meeting specific criteria like providing over half the household support. Mathematical errors, though reduced with e-filing software, still occur in manually prepared returns; double-check calculations for deductions, credits, and tax owed. To avoid these mistakes, develop a comprehensive recordkeeping system. Maintain digital or physical records of all financial documents, including receipts, invoices, and bank statements, for at least three years. This practice not only supports accurate filing but also simplifies responses to IRS inquiries. By adhering to these guidelines, taxpayers can enhance compliance, minimize stress, and potentially maximize refunds.