Tax Refund Advance Loans: A Comprehensive Analysis

Tax refund advance loans allow taxpayers to access expected refunds early through tax preparation services like Jackson Hewitt and TurboTax, offering up to $1,500. However, these loans carry significant drawbacks, including high APRs averaging 35.96% and potential financial risks. Financial experts universally advise caution, recommending taxpayers understand all terms and consider alternatives to avoid unnecessary costs. This guide compares providers, details loan structures, and provides strategies for making informed financial decisions.

Tax refund advance loans provide immediate access to anticipated tax refunds, marketed as quick financial solutions during tax season. Offered by major tax preparation services, these loans can deliver funds within hours but come with substantial costs and risks. With annual percentage rates (APRs) reaching 35.96% and maximum amounts capped at $1,500, borrowers face potential debt cycles and reduced refund values. This analysis examines the mechanisms, provider offerings, and expert insights to help taxpayers make educated decisions, emphasizing why financial advisors consistently recommend avoiding these products in favor of safer alternatives.

Jackson Hewitt Refund Advance

Pros

- Immediate access to funds (often same-day)

- No credit check required for eligibility

- Convenient integration with tax filing process

Cons

- High effective APR of 35.96%

- Maximum loan limit of $1,500 may not cover full refund

- Potential for hidden fees and complicated terms

Specifications

TurboTax Refund Advance Options

Pros

- Seamless process for TurboTax users

- Multiple loan tiers available based on refund size

- Direct deposit to bank account for quick access

Cons

- Similarly high APR structure around 35.96%

- Limited to specific TurboTax service packages

- Risk of overlapping with other tax-time financial products

Specifications

Comparison Table

| Provider | Max Loan Amount | APR | Funding Speed | Key Eligibility |

|---|---|---|---|---|

| Jackson Hewitt | $1,500 | 35.96% | Within 24 hours | File with Jackson Hewitt, $1,500+ expected refund |

| TurboTax | $4,000 | 35.96% | Same day (conditions apply) | TurboTax filing, $500+ expected refund |

Verdict

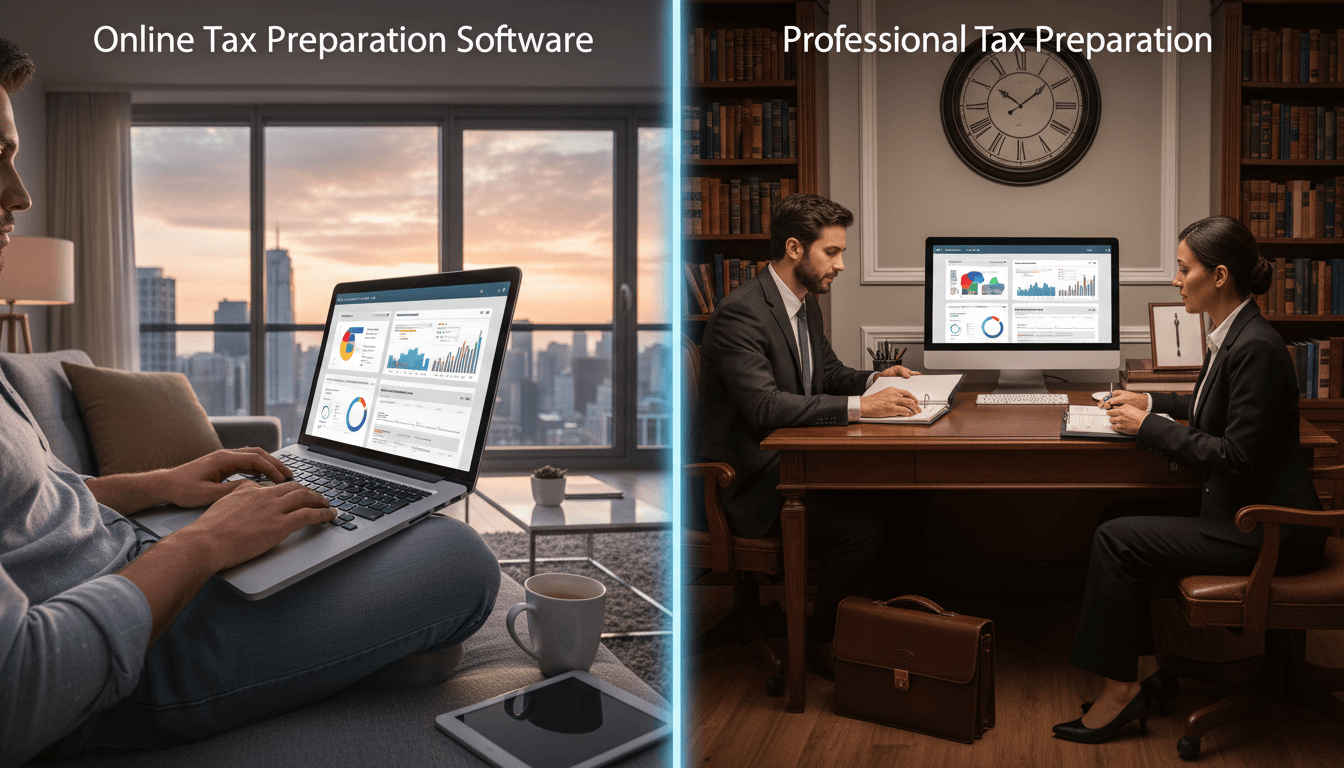

Tax refund advance loans present significant financial disadvantages despite their convenience. With APRs of 35.96%, these products effectively reduce taxpayer refunds through high costs, contradicting the goal of maximizing financial returns. Experts strongly advise against these loans due to the risks of entering debt cycles and the availability of superior alternatives, such as adjusting tax withholdings to increase take-home pay throughout the year or using free filing options to avoid unnecessary fees. Taxpayers should prioritize understanding their full financial picture and consult with accredited financial advisors before considering any refund advance products.