State and Local Tax (SALT) Deduction Optimization

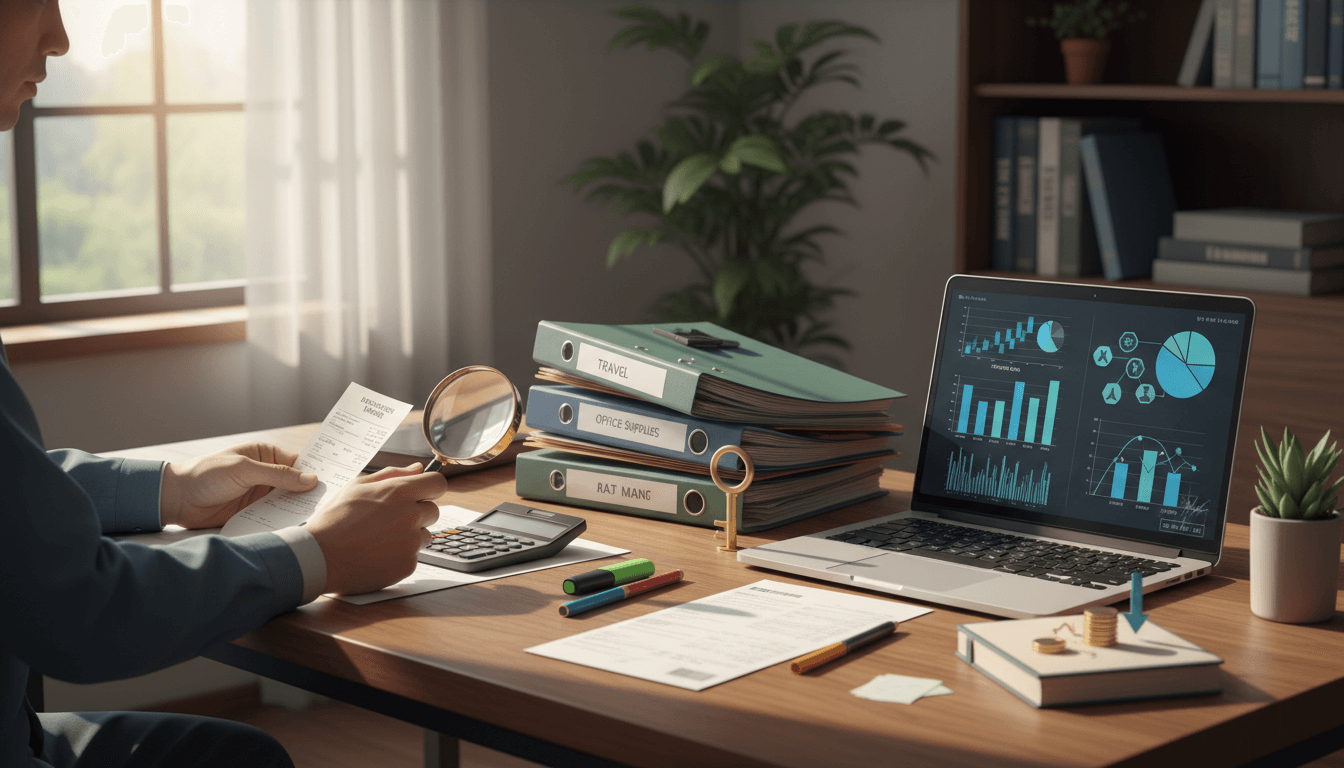

The SALT deduction allows taxpayers to deduct certain state and local taxes on federal returns, but is capped at $10,000 annually under current law. This guide provides expert strategies to maximize this deduction, focusing on prepayment timing, AMT considerations, and state-specific nuances. High-income earners in states like California and New York can significantly benefit from careful planning. We explain IRS rules, real-world scenarios, and compliance requirements to help you reduce federal tax liability while avoiding common pitfalls.

The State and Local Tax (SALT) deduction remains a critical component of tax planning for millions of Americans, particularly those residing in high-tax jurisdictions. Established to prevent double taxation, this deduction enables taxpayers to write off payments for state and local income, sales, and property taxes on their federal returns. However, the Tax Cuts and Jobs Act of 2017 imposed a $10,000 cap ($5,000 for married filing separately) that fundamentally altered planning strategies. This comprehensive guide, drawing from Personal Financial Advisers Research, explores sophisticated optimization techniques to help you navigate this limitation. We'll examine timing strategies, eligibility requirements, and compliance considerations while providing actionable insights tailored to different financial situations.

Understanding the SALT Deduction Framework

The SALT deduction encompasses four primary tax types: state and local income taxes, general sales taxes, and property taxes. Taxpayers must choose between deducting income taxes or sales taxes—they cannot deduct both. The $10,000 cap applies to the combined total of these deductible taxes. For example, if you pay $8,000 in state income tax and $5,000 in property taxes, only $10,000 is deductible despite $13,000 in total payments. This limitation particularly impacts residents of high-tax states like California (13.3% top income tax rate), New York (10.9%), and New Jersey (10.75%). According to IRS data, approximately 11% of taxpayers claimed SALT deductions exceeding $10,000 prior to the cap implementation, with average deductions above $25,000 in some jurisdictions. Understanding this framework is essential for effective planning.

Strategic Prepayment of State Tax Liabilities

Prepaying state tax liabilities before year-end represents one of the most effective SALT optimization strategies. By accelerating estimated tax payments or fourth-quarter state income tax payments from January to December, taxpayers can bunch deductions into a single tax year to maximize the $10,000 cap. For instance, if your 2025 state tax liability is projected at $15,000, prepaying $5,000 in December 2024 (for Q1 2025) could help fully utilize your 2024 SALT deduction if you hadn't reached the cap. However, this strategy requires careful calculation to avoid underpayment penalties and consider Alternative Minimum Tax (AMT) implications. The IRS specifically allows prepayment of state estimated taxes, but not prepayment of state income taxes that haven't been assessed. Documentation must clearly indicate the tax year for which payments are made.

High-Income Optimization in High-Tax States

Taxpayers with incomes exceeding $200,000 in states with top marginal rates above 8% typically benefit most from SALT optimization. In California, where the top rate reaches 13.3%, a taxpayer earning $500,000 could face state income taxes approaching $50,000—far exceeding the SALT cap. For these individuals, strategic timing becomes crucial. Consider a hypothetical scenario: A New York resident with $750,000 income pays approximately $65,000 in state income taxes and $18,000 in property taxes annually. Without optimization, they lose $73,000 in potential deductions above the cap. By prepaying $8,000 of next year's state taxes in December and timing property tax payments to alternate between standard and itemized deduction years, they could save approximately $2,800 in federal taxes annually (assuming a 24% marginal rate).

Compliance Considerations and Limitations

Several critical limitations govern SALT deduction strategies. The $10,000 cap applies to all filing statuses except married filing separately, which has a $5,000 limit. Prepaid state taxes are deductible only in the year paid, regardless of the tax year they apply to. The IRS imposes strict substantiation requirements: taxpayers must maintain records showing payment dates, amounts, and the specific tax period covered. Additionally, the Pease limitation may reduce itemized deductions for high-income taxpayers, though this provision was suspended through 2025. Taxpayers subject to AMT should calculate both regular tax and AMT liabilities, as SALT deductions are not allowed for AMT purposes. State-specific rules also vary; some states like Illinois have rejected workarounds such as entity-level tax elections for pass-through businesses.

Key Takeaways

The SALT deduction is permanently capped at $10,000 ($5,000 if married filing separately) under current law

Prepaying state estimated taxes before year-end can help maximize the deduction through bunching strategies

High-income earners in states with income tax rates above 8% benefit most from optimization

Document prepayments clearly with payment dates and applicable tax years for IRS compliance

Consider AMT implications and state-specific rules before implementing SALT strategies

Frequently Asked Questions

Can I prepay next year's state income taxes to claim a deduction this year?

You can only prepay state estimated taxes, not final state income tax liabilities. The IRS allows deduction of prepaid state estimated taxes in the year paid, but you cannot prepay taxes that haven't been assessed or calculated.

Does the SALT cap apply to business taxes?

No, the $10,000 cap applies only to individual taxes. Business taxes paid at the entity level (such as state corporate income taxes) remain fully deductible for businesses, though pass-through entity taxes may have different treatment depending on state election rules.

How does the SALT deduction interact with the standard deduction?

The SALT deduction is only available to taxpayers who itemize deductions. With the standard deduction at $14,600 for singles and $29,200 for married couples (2024), you should calculate whether your total itemized deductions (including SALT) exceed these thresholds before pursuing optimization strategies.

Are there any proposed changes to the SALT deduction cap?

The $10,000 cap is scheduled to expire after 2025, but legislative proposals to modify it earlier have faced political challenges. Taxpayers should monitor congressional developments but plan based on current law for the foreseeable future.

Conclusion

Optimizing the SALT deduction requires sophisticated understanding of both federal tax law and state-specific regulations. While the $10,000 cap presents challenges, strategic timing of tax payments and careful planning can still yield significant savings, particularly for high-income taxpayers in states with substantial tax burdens. The prepayment strategy outlined in this guide, when implemented with proper documentation and consideration of AMT implications, represents a legitimate approach to maximizing this valuable deduction. As tax laws evolve, staying informed about legislative changes remains crucial. Consult with a qualified tax professional to tailor these strategies to your specific financial situation and ensure compliance with all applicable regulations.