Advanced Tax Preparation Features: Maximizing Refunds with Modern Software

Modern tax software offers sophisticated tools like third-party integrations, cryptocurrency transaction support, investment income reporting, and deduction optimization to help taxpayers ensure accuracy and maximize refunds. This guide explores advanced features in leading platforms such as TurboTax, H&R Block Premium, and TaxAct Premier, detailing their pros, cons, and specifications for complex financial scenarios including rental properties and foreign accounts.

Advanced tax preparation software has evolved significantly, offering features that go beyond basic filing to handle complex financial situations. With over 60% of taxpayers now reporting investment income and the rise of digital assets, tools like third-party integrations, cryptocurrency support, and detailed deduction optimizers are essential. This analysis delves into the capabilities of top-tier software, helping users navigate intricate tax laws, maximize refunds through accurate reporting, and avoid penalties. Based on data from 'Tax Software Advanced Features Analysis,' we evaluate how platforms like TurboTax, H&R Block Premium, and TaxAct Premier cater to advanced needs, including rental property management and foreign account disclosures.

Third-Party Integrations

Pros

- Seamlessly import data from financial institutions, reducing manual entry errors by up to 90%

- Supports integrations with platforms like Coinbase for automatic cryptocurrency transaction tracking

- Enhances efficiency with real-time updates from investment and banking apps

Cons

- May require additional fees for premium integrations

- Compatibility issues with lesser-known financial software can occur

- Data security concerns when sharing sensitive information across platforms

Specifications

Cryptocurrency Transaction Support

Pros

- Automatically calculates gains and losses for crypto trades, complying with IRS guidelines

- Integrates with exchanges like Coinbase to fetch transaction histories accurately

- Provides detailed reports for Form 8949, reducing audit risks

Cons

- Limited support for decentralized or lesser-known cryptocurrencies

- Can be complex for high-volume traders with thousands of transactions

- May incur extra costs for advanced crypto reporting features

Specifications

Investment Income Reporting

Pros

- Accurately reports dividends, interest, and capital gains from stocks, bonds, and mutual funds

- Includes tools like investment income calculators to optimize tax liabilities

- Supports rental property income and expenses with depreciation schedules

Cons

- May not cover exotic investments without manual adjustments

- Advanced features often locked behind higher-priced tiers

- Learning curve for first-time users handling complex portfolios

Specifications

Comparison Table

| Feature | TurboTax | H&R Block Premium | TaxAct Premier |

|---|---|---|---|

| Third-Party Integrations | Yes (Coinbase, banks) | Yes (limited crypto support) | Yes (basic integrations) |

| Cryptocurrency Support | Full with auto-import | Partial with manual entry | Basic with upload options |

| Investment Reporting | Comprehensive with calculators | Detailed for standard investments | Moderate with rental support |

| Rental Property Tools | Included in premium tiers | Available with add-ons | Basic features included |

| Foreign Account Reporting | Yes (FBAR assistance) | Yes (with guidance) | Limited to form generation |

Verdict

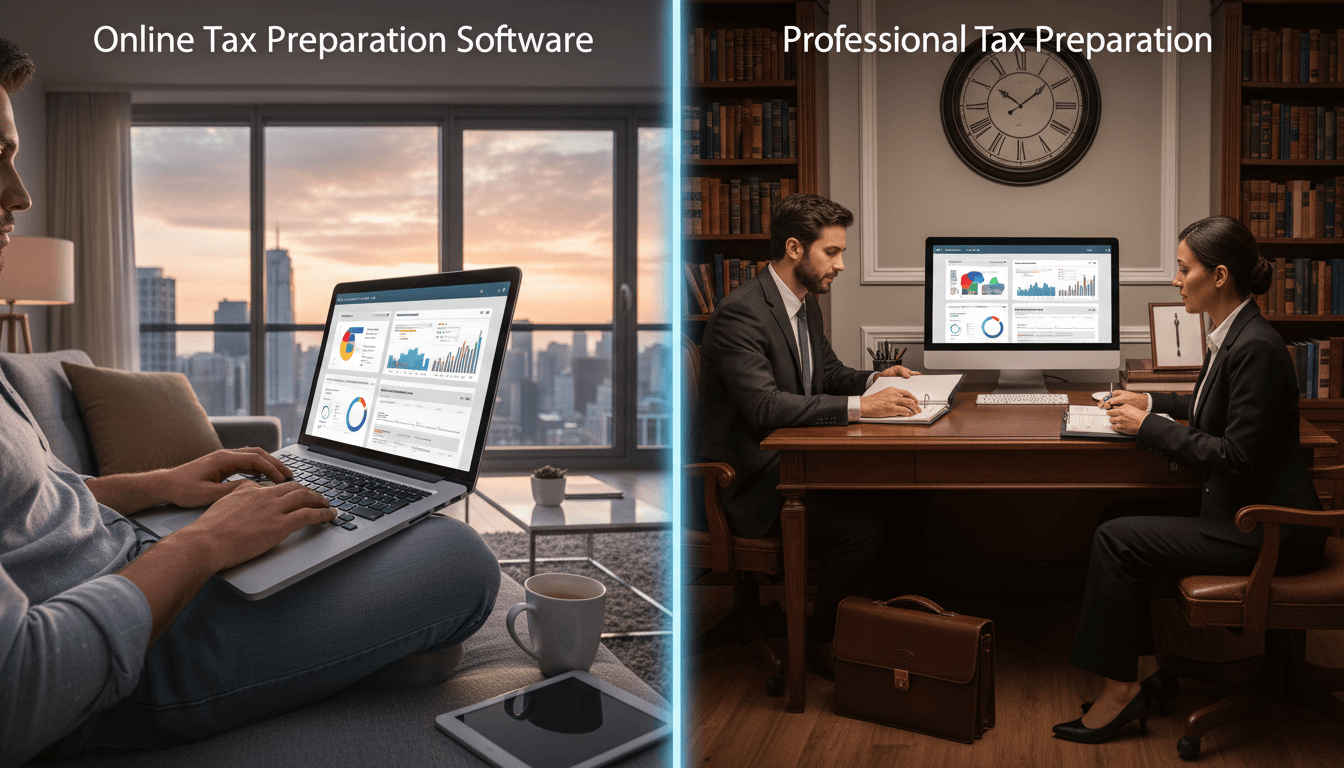

Advanced tax preparation features are critical for taxpayers with complex finances, and TurboTax leads with robust third-party integrations, full cryptocurrency support, and comprehensive investment reporting. H&R Block Premium offers strong alternatives but may require manual inputs for some crypto transactions, while TaxAct Premier provides a cost-effective option with essential tools. To maximize refunds and ensure compliance, choose software that aligns with your specific needs, such as rental properties or foreign accounts, and always verify integration capabilities before filing.