Tax Filing Status Optimization: A Strategic Guide to Maximizing Refunds and Minimizing Liabilities

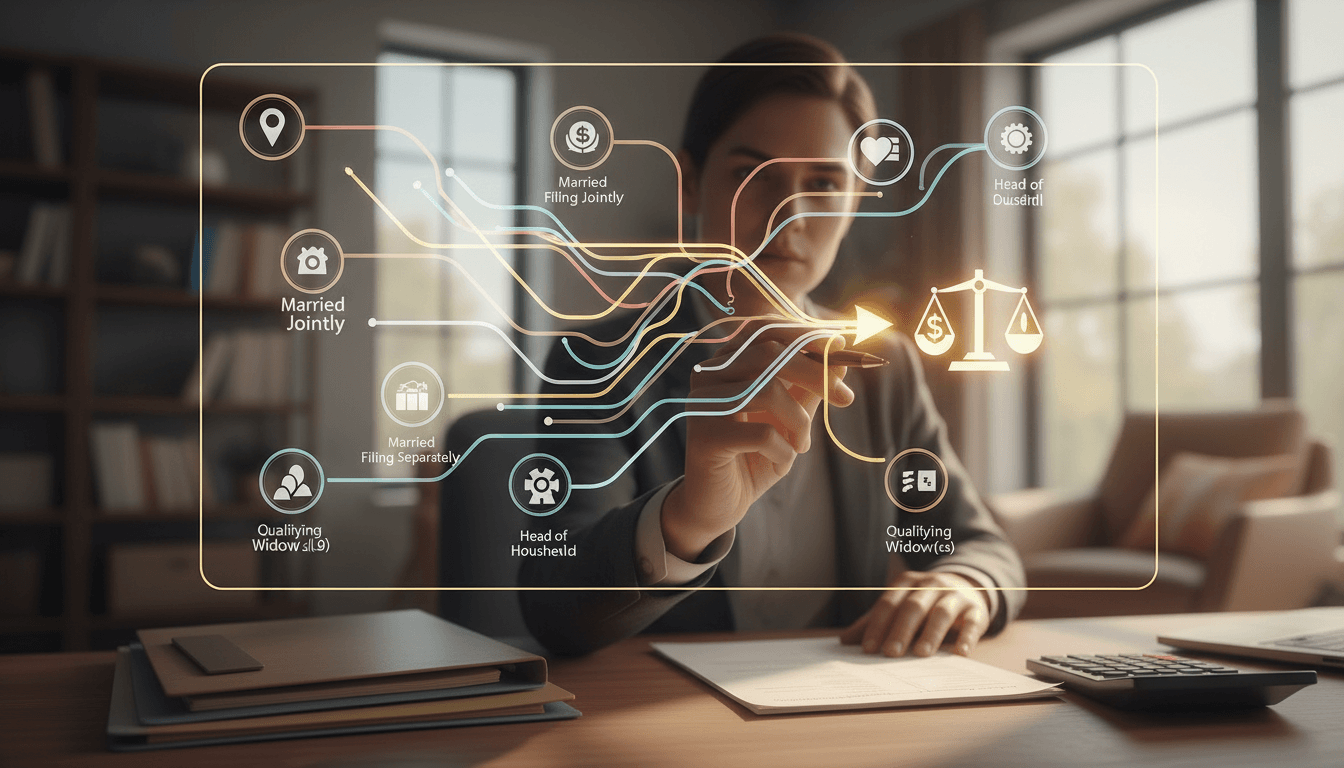

Choosing the right tax filing status is a critical decision that can significantly impact your financial outcomes. This comprehensive guide explores key statuses—Single, Married Filing Jointly, Married Filing Separately, and Head of Household—detailing their eligibility requirements, standard deductions, and strategic advantages. With real data showing deductions like $25,100 for married joint filers and $18,800 for head of household, learn how to align your status with life events such as marriage, divorce, or dependents to optimize tax savings, avoid common pitfalls, and ensure compliance with IRS regulations.

Article Information

Author | Financial Advisor Team |

Date | August 20, 2025 |

Rating | 4.8 / 5.0 |

Would Recommend | Yes |

Helpful Count | 1106 |

Helpful Votes | 1106 |

Not Helpful Votes | 200 |