Tax Deductions vs. Tax Credits: Understanding the Fundamentals of Tax Reduction

This comprehensive guide explains the critical differences between tax deductions and tax credits, two key mechanisms for reducing tax liability. Deductions lower your taxable income, potentially placing you in a lower tax bracket, whereas credits offer a direct dollar-for-dollar reduction in taxes owed. Understanding these tools—including specific examples like the $3000 deduction for capital losses and the $2000 Child Tax Credit—empowers taxpayers to maximize refunds and minimize liabilities. Based on IRS guidelines and financial advisory insights, this article provides actionable strategies for effective tax planning.

Navigating the complexities of the U.S. tax system can be daunting, but mastering the distinction between tax deductions and tax credits is essential for optimizing your financial health. According to the IRS and financial advisors, deductions work by reducing your taxable income, which indirectly lowers your tax bill, while credits provide a direct reduction in the amount of tax you owe. For instance, a $1000 tax credit saves you exactly $1000, whereas a $1000 deduction's value depends on your marginal tax rate—saving $220 if you're in the 22% bracket. This article delves into the mechanisms, types, and strategic applications of both, empowering you to make informed decisions that align with your financial goals.

How Tax Deductions Work: Lowering Your Taxable Income

Tax deductions operate by reducing your adjusted gross income (AGI), which is the foundation for calculating your tax liability. The IRS allows taxpayers to claim deductions through either the standard deduction or itemized deductions. For the 2023 tax year, the standard deduction is $13,850 for singles and $27,700 for married couples filing jointly. Itemized deductions, on the other hand, include expenses such as mortgage interest (up to $750,000 of acquisition debt), state and local taxes (capped at $10,000), and charitable contributions (generally limited to 60% of AGI). For example, if your AGI is $60,000 and you claim $15,000 in itemized deductions, your taxable income drops to $45,000. This reduction can also shift you into a lower tax bracket, amplifying savings. It's crucial to evaluate which method—standard or itemized—yields the greater benefit, as you cannot claim both.

The Power of Tax Credits: Direct Reductions in Tax Owed

Tax credits are universally regarded as more advantageous than deductions because they subtract directly from your tax liability. The IRS categorizes credits into two types: refundable and non-refundable. Refundable credits, like the Earned Income Tax Credit (EITC), can result in a refund even if they reduce your tax below zero. For the 2023 tax year, the EITC offers up to $7,430 for families with three or more children. Non-refundable credits, such as the Lifetime Learning Credit (up to $2,000 per tax return), can reduce your tax to zero but not beyond. For instance, if you owe $3,000 in taxes and qualify for a $2,500 credit, your remaining liability is $500. Credits often target specific behaviors, such as education (American Opportunity Credit), energy efficiency (Residential Energy Efficient Property Credit), or child care (Child and Dependent Care Credit), making them powerful tools for targeted financial planning.

Comparing Deductions and Credits: Real-World Scenarios

To illustrate the difference, consider a taxpayer with a $50,000 AGI in the 22% tax bracket. A $5,000 deduction reduces taxable income to $45,000, saving $1,100 in taxes ($5,000 × 0.22). In contrast, a $5,000 credit directly cuts the tax bill by $5,000—over 4.5 times more valuable. Common deductions include student loan interest (up to $2,500) and self-employment expenses, while credits might include the Savers Credit (up to $1,000 for retirement contributions) or the Child Tax Credit (up to $2,000 per child under 17). It's important to note that some deductions and credits phase out at higher income levels; for example, the Child Tax Credit begins to phase out at $200,000 AGI for singles and $400,000 for joint filers. Strategic combination of both can yield maximum savings, but eligibility often depends on meticulous record-keeping and adherence to IRS guidelines.

Strategic Tax Planning: Maximizing Deductions and Credits

Effective tax planning involves proactively identifying and claiming all eligible deductions and credits. Start by maintaining detailed records of expenses such as medical costs (deductible if exceeding 7.5% of AGI), business-related travel, and educational fees. Utilize tax-advantaged accounts like Health Savings Accounts (HSAs) or 401(k)s, which offer pre-tax contributions that reduce AGI. For credits, ensure you meet specific criteria; the Premium Tax Credit, for example, requires enrollment in a Marketplace health plan. According to IRS data, over 25 million taxpayers claim the EITC annually, underscoring its impact. Consulting a financial advisor can help navigate complex situations, such as the Alternative Minimum Tax (AMT), which limits certain deductions. By planning year-round and staying informed about tax law changes—like those in the Inflation Reduction Act extending energy credits—you can optimize your financial outcomes and avoid common pitfalls.

Key Takeaways

Tax deductions reduce taxable income, with savings based on your marginal tax rate.

Tax credits provide a dollar-for-dollar reduction in taxes owed, making them more valuable per dollar than deductions.

Common deductions include mortgage interest and charitable contributions, while credits cover areas like education and child care.

Strategic planning, including itemizing deductions and claiming refundable credits, can significantly lower your tax burden.

Always refer to IRS publications or a financial advisor to ensure compliance and maximize eligible benefits.

Frequently Asked Questions

Can I claim both the standard deduction and itemized deductions?

No, the IRS requires you to choose either the standard deduction or itemized deductions, whichever provides the greater tax benefit. For 2023, the standard deduction is $13,850 for singles and $27,700 for married couples filing jointly.

What is the difference between refundable and non-refundable tax credits?

Refundable credits, like the Earned Income Tax Credit, can reduce your tax liability below zero and result in a refund. Non-refundable credits, such as the Child Tax Credit, can only reduce your tax to zero but not beyond, meaning any excess credit is forfeited.

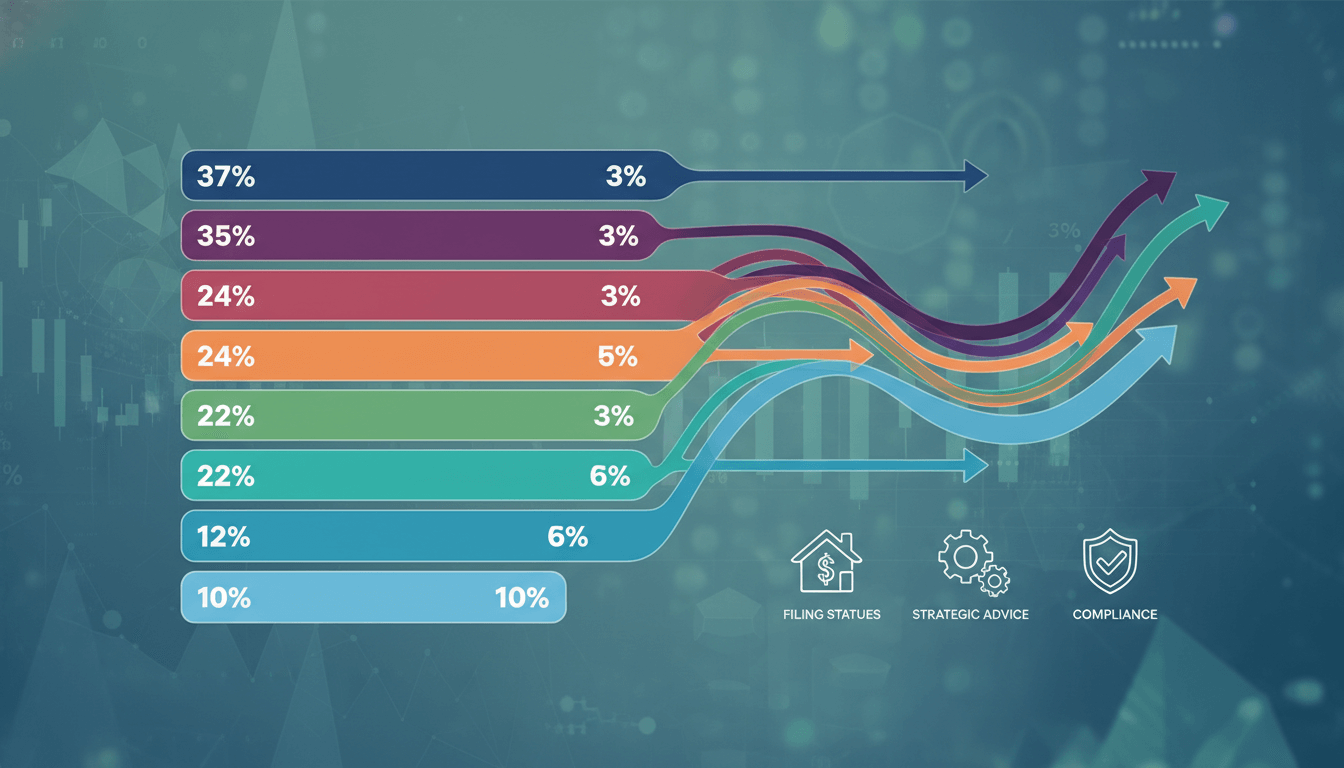

How do tax brackets affect the value of a deduction?

The value of a deduction depends on your marginal tax bracket. For example, a $1,000 deduction saves $100 if you're in the 10% bracket but $370 if in the 37% bracket. In contrast, credits offer fixed savings regardless of your bracket.

Are there income limits for claiming tax credits?

Yes, many credits phase out at higher income levels. The Child Tax Credit, for instance, begins to phase out at $200,000 AGI for single filers and $400,000 for joint filers. Always check IRS guidelines for specific thresholds.

Conclusion

Understanding the distinction between tax deductions and credits is fundamental to effective tax management. While deductions lower your taxable income and indirectly reduce taxes, credits offer direct, dollar-for-dollar savings that can substantially decrease your liability or even increase your refund. By leveraging both tools—through careful documentation, strategic planning, and adherence to IRS rules—you can minimize your tax burden and enhance your financial well-being. For personalized advice, consult a certified financial advisor or refer to IRS Publication 17, which provides detailed guidance on deductions and credits. Empower yourself with knowledge to make tax season an opportunity for savings rather than a source of stress.