Electric Vehicle and Energy Efficiency Tax Credits: Your 2023 Guide

This comprehensive guide details how taxpayers can leverage federal tax credits for electric vehicles and home energy efficiency improvements in 2023. Learn about the $7,500 EV tax credit, 30% solar panel installation credit, and additional incentives for upgrades like windows, doors, and skylights. Understand eligibility criteria, income limits, and how to claim these credits to reduce your tax liability while contributing to environmental sustainability. Professional insights help you maximize benefits and avoid common filing errors.

Navigating federal tax incentives for electric vehicles (EVs) and energy-efficient home upgrades can significantly reduce your tax burden while promoting sustainable living. For the 2023 tax year, the Internal Revenue Service (IRS) offers substantial credits, including up to $7,500 for qualifying EV purchases and a 30% credit for solar panel installations. These incentives, governed by the Inflation Reduction Act, aim to accelerate the adoption of clean energy technologies. This guide provides a detailed breakdown of eligibility requirements, credit calculations, and step-by-step instructions for claiming these benefits, ensuring you optimize your tax strategy and comply with current regulations.

Electric Vehicle Tax Credit: Up to $7,500

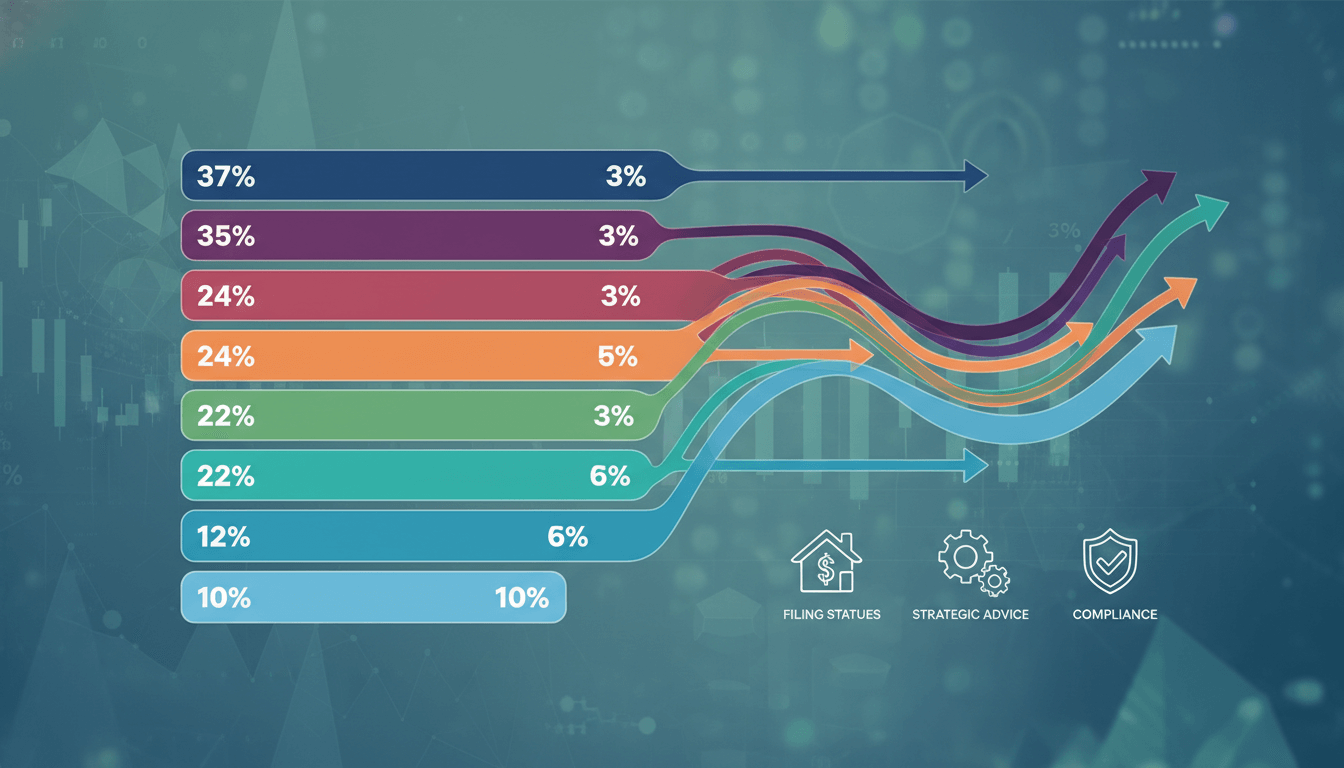

The federal EV tax credit provides a non-refundable credit of up to $7,500 for new, qualified plug-in electric vehicles (PEVs) and fuel cell electric vehicles (FCEVs). Eligibility depends on several factors, including the vehicle's manufacturer's suggested retail price (MSRP), final assembly location, and your modified adjusted gross income (MAGI). For 2023, the credit comprises two components: $3,750 for meeting critical mineral requirements and $3,750 for battery component requirements. Vehicles must undergo final assembly in North America, and MSRP limits are $80,000 for vans, SUVs, and pickup trucks, and $55,000 for other vehicles. Income caps are $300,000 for married couples filing jointly, $225,000 for heads of household, and $150,000 for all other filers. Additionally, the credit is subject to phase-out rules based on battery capacity and manufacturer sales. To claim the credit, file Form 8936 with your tax return and retain documentation such as the vehicle identification number (VIN) and proof of purchase.

Solar Panel Installation Credit: 30% of Total Cost

The Residential Clean Energy Credit allows homeowners to claim 30% of the total cost of solar panel installations, including labor, permitting, and inspection fees. This credit applies to systems placed in service between 2022 and 2032, with no upper limit on the credit amount. Eligible expenses encompass solar photovoltaic (PV) panels, inverters, mounting equipment, and energy storage devices with a capacity of 3 kilowatt-hours or more. The system must be installed in your primary or secondary residence within the United States, and you must own the system (leases or power purchase agreements do not qualify). The credit is calculated based on the gross installation cost before rebates or incentives. For example, a $20,000 solar installation yields a $6,000 credit. Claim this credit using Form 5695, and maintain receipts, contractor statements, and manufacturer certifications for audit purposes. This incentive also extends to other renewable energy systems, such as wind turbines and geothermal heat pumps.

Credits for Home Energy Upgrades

Beyond solar panels, the Energy Efficient Home Improvement Credit offers incentives for various upgrades that enhance your home's energy performance. For 2023, you can claim 30% of qualified expenses, up to a $1,200 annual limit, for items like exterior doors ($500 limit per door), windows and skylights ($600 total limit), and home energy audits ($150 limit). Additional credits include up to $2,000 for eligible heat pumps, biomass stoves, or biomass boilers. To qualify, products must meet specific energy efficiency standards set by the Consortium for Energy Efficiency (CEE) or ENERGY STAR. For instance, doors must have a U-factor equal to or less than 0.20, and windows must have a U-factor and Solar Heat Gain Coefficient (SHGC) of 0.30 or lower. These upgrades must be installed in your primary residence, and you must retain Manufacturer Certification Statements and receipts. File Form 5695 to claim these credits, and consult IRS guidelines for detailed eligibility criteria.

Eligibility and Income Considerations

To benefit from EV and energy efficiency credits, taxpayers must meet specific eligibility criteria. For EV credits, the vehicle must be new, purchased for personal use, and not for resale. Income limits, based on MAGI, are strictly enforced; exceeding these thresholds disqualifies you from the credit. Similarly, home energy credits require that the property is located in the U.S. and used as a residence. Income does not limit home energy credits, but the credits are non-refundable, meaning they can reduce your tax liability to zero but not generate a refund. Additionally, you cannot claim credits for expenses funded by subsidies or grants. Always verify product qualifications through the Department of Energy's and IRS's updated lists to ensure compliance. Planning purchases within tax years and coordinating with tax professionals can help maximize these incentives while avoiding disallowances.

How to Claim Your Credits

Claiming EV and energy efficiency credits involves precise documentation and form submission. For EVs, complete Form 8936, 'Qualified Plug-in Electric Drive Motor Vehicle Credit,' and attach it to your Form 1040. Provide the VIN, date of purchase, and vehicle make and model. For home energy credits, use Form 5695, 'Residential Energy Credits,' to report expenses for solar panels, windows, doors, and other upgrades. Retain all receipts, certification statements, and contractor details for at least three years post-filing. If you exceed credit limits in one year, some credits, like the solar panel credit, may carry forward to future tax years. E-filing through IRS-approved software simplifies the process, but consult a tax adviser if you have complex situations, such as multiple properties or business use. Timely filing and accurate reporting prevent delays and audits.

Key Takeaways

EV tax credits offer up to $7,500 but require meeting vehicle and income criteria.

Solar panel installations qualify for a 30% credit with no maximum limit through 2032.

Home energy upgrades like doors and windows provide credits up to $1,200 annually.

Income limits apply to EV credits but not to most home energy credits.

Proper documentation and Form 5695 or 8936 are essential for claiming credits.

Frequently Asked Questions

Can I claim the EV tax credit for a used electric vehicle?

Yes, for tax years after 2022, a credit of up to $4,000 or 30% of the sale price (whichever is lower) is available for used EVs, provided the vehicle is at least two years old, purchased from a dealer, and meets price and income requirements.

Do energy efficiency credits apply to rental properties?

No, these credits are generally for primary and secondary residences only. Rental properties may qualify under different rules, such as the Business Energy Investment Tax Credit (ITC).

What happens if my tax liability is less than the credit amount?

EV and home energy credits are non-refundable, so they can reduce your tax liability to zero but not result in a refund. However, unused portions of the solar panel credit may carry forward to future tax years.

Are there state-level incentives for EVs and energy efficiency?

Yes, many states offer additional rebates, tax credits, or exemptions. Check your state's energy department or tax agency for specifics, as these can complement federal incentives.

Conclusion

Leveraging electric vehicle and energy efficiency tax credits in 2023 can lead to substantial savings, with up to $7,500 for EVs and 30% for solar panels. By understanding eligibility, maintaining thorough records, and filing the correct forms, you can reduce your tax liability while investing in sustainable technologies. Always consult the latest IRS guidelines or a financial adviser to navigate evolving regulations and maximize your benefits. Start planning your purchases and upgrades today to capitalize on these valuable incentives.