Maximizing Medical Expense Deductions: A Strategic Tax Guide

Medical and dental expense deductions can significantly reduce your tax liability if you qualify. To claim these deductions, your eligible expenses must exceed 7.5% of your adjusted gross income (AGI), and you must itemize deductions on your tax return. For instance, with an AGI of $100,000, only expenses above $7,500 are deductible—meaning a $10,000 expense yields a $2,500 deduction. This guide covers eligibility, calculation methods, record-keeping essentials, and strategies to maximize your savings while complying with IRS regulations.

Navigating medical expense deductions is a critical component of tax planning for individuals facing significant healthcare costs. According to the Nolo Tax Guide, these deductions allow taxpayers to reduce their taxable income by claiming qualified medical and dental expenses that exceed 7.5% of their adjusted gross income (AGI). For example, if your AGI is $100,000, only expenses above $7,500 are deductible—so a $10,000 expense results in a $2,500 deduction. This article provides an in-depth exploration of eligibility requirements, calculation methodologies, and strategic approaches to optimize your tax benefits while adhering to IRS guidelines. Understanding these rules can lead to substantial savings, especially for those with chronic conditions or unexpected medical bills.

Understanding the 7.5% AGI Threshold and Eligibility

The cornerstone of medical expense deductions is the 7.5% AGI threshold, which mandates that only expenses exceeding this percentage of your adjusted gross income are deductible. Adjusted gross income (AGI) includes wages, dividends, capital gains, business income, and other sources minus specific adjustments like student loan interest or traditional IRA contributions. For a taxpayer with an AGI of $100,000, the deductible floor is $7,500; thus, $10,000 in medical expenses yields a $2,500 deduction. It's essential to itemize deductions using Schedule A (Form 1040) rather than taking the standard deduction. Eligible expenses encompass a wide range, including payments to doctors, dentists, surgeons, hospitals, prescription medications, and medically necessary equipment like wheelchairs or hearing aids. Transportation costs for medical care, such as mileage at the IRS-approved rate (e.g., 22 cents per mile in 2023), and insurance premiums for medical care are also included, though expenses reimbursed by insurance or paid from flexible spending accounts (FSAs) are not deductible.

Qualified Medical Expenses and Documentation Requirements

The IRS defines qualified medical expenses as those primarily to alleviate or prevent a physical or mental illness, not for general health improvements. Common examples include payments for diagnosis, cure, mitigation, treatment, or prevention of disease; prescription drugs and insulin; long-term care services; and acupuncture or chiropractic services if medically necessary. Cosmetic procedures, like teeth whitening or elective surgery, are generally ineligible unless required for medical reasons (e.g., reconstructive surgery after an accident). To substantiate your deduction, maintain detailed records such as receipts, invoices, and explanation of benefits (EOB) statements from insurers. For mileage, log dates, distances, and purposes of trips. The IRS may request this documentation during an audit, so organize records by date and provider. Additionally, if you pay expenses for a dependent, such as a child or elderly parent who meets specific criteria, those costs can be included in your deduction calculation, further maximizing potential savings.

Calculating Your Deduction and Tax Impact

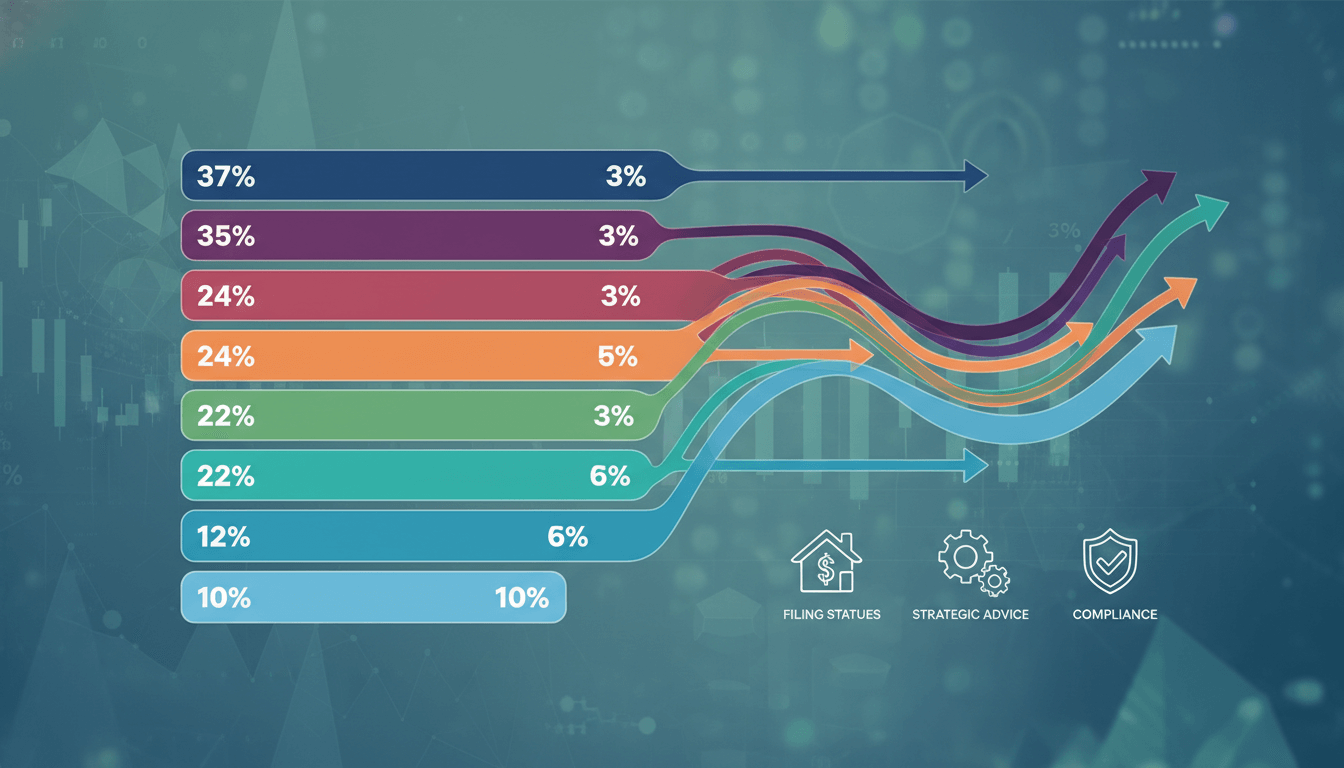

To calculate your medical expense deduction, start by summing all qualified expenses for the tax year, then subtract 7.5% of your AGI. For instance, with an AGI of $80,000 and $12,000 in medical expenses, the threshold is $6,000 (7.5% of $80,000), leaving a deductible amount of $6,000. This deduction reduces your taxable income, which can lower your tax bracket and overall liability. Suppose you're in the 22% federal tax bracket; a $6,000 deduction saves approximately $1,320 in taxes. However, if your total itemized deductions (including medical, state taxes, mortgage interest, etc.) are less than the standard deduction—e.g., $13,850 for single filers in 2023—itemizing may not be beneficial. Use tax software or consult a professional to compare scenarios. Note that partial deductions are allowed, as in the Nolo example, where only the amount above the threshold is deductible. Planning ahead, such as bundling medical procedures into one tax year, can help surpass the 7.5% floor and increase deductions.

Common Pitfalls and IRS Compliance Guidelines

Many taxpayers overlook key rules, leading to denied deductions or audits. A frequent error is claiming ineligible expenses, like over-the-counter medications (unless prescribed), vitamins, or non-medical insurance premiums. Another mistake is failing to itemize; if you take the standard deduction, you cannot claim medical expenses. The IRS also scrutinizes deductions for capital improvements, such as installing a ramp for disability, which may be partially deductible if they do not increase home value. To avoid issues, refer to IRS Publication 502 for a comprehensive list of qualified expenses and keep records for at least three years from your filing date. If you're self-employed, you may deduct health insurance premiums separately from the 7.5% threshold calculation, but coordination is crucial to prevent double-dipping. Always report expenses accurately on Schedule A, and consider using tax preparation services to ensure compliance with evolving regulations, such as changes to the AGI threshold (which has fluctuated between 7.5% and 10% in recent years).

Strategies to Maximize Deductions and Long-Term Planning

Proactive tax planning can enhance your medical expense deductions. If possible, time non-urgent procedures to concentrate expenses in a single tax year when your AGI is lower, making it easier to exceed the 7.5% threshold. For example, scheduling elective surgery in a year with reduced income due to job loss or retirement. Additionally, use health savings accounts (HSAs) or flexible spending accounts (FSAs) for eligible expenses, as contributions are tax-deductible or pre-tax, though note that FSA reimbursements cannot be double-counted as deductions. For retirees, medical costs including Medicare premiums (Parts B and D) and long-term care insurance may qualify, potentially yielding significant deductions. If you support dependents with high medical needs, ensure they meet IRS dependency tests to include their expenses. Lastly, review state tax laws, as some states offer medical deductions with lower thresholds or different rules. Consulting a financial advisor can help integrate these strategies into a broader plan for retirement, insurance, and estate planning, ensuring ongoing tax efficiency.

Key Takeaways

Medical expenses are deductible only if they exceed 7.5% of your AGI and you itemize deductions.

Eligible costs include payments to healthcare providers, prescriptions, and necessary equipment, but not reimbursed expenses.

Keep detailed records, such as receipts and mileage logs, to support your deduction in case of an IRS audit.

Partial deductions are allowed; for example, with a $100,000 AGI, $10,000 in expenses yields a $2,500 deduction.

Strategically time medical spending and use HSAs/FSAs to optimize tax savings and compliance.

Frequently Asked Questions

Can I deduct medical expenses if I take the standard deduction?

No, medical expense deductions require itemizing on Schedule A. If your total itemized deductions are less than the standard deduction, you cannot claim medical expenses.

What types of medical expenses are eligible for the deduction?

Eligible expenses include payments for doctors, dentists, hospitals, prescription drugs, medically necessary equipment, and transportation for care. Refer to IRS Publication 502 for a full list.

How do I calculate the deduction if my AGI changes during the year?

Use your total AGI from your tax return for the year. The 7.5% threshold is based on this figure, regardless of income fluctuations.

Are health insurance premiums deductible as medical expenses?

Yes, premiums for medical care insurance, including Medicare, generally qualify, but not premiums for life or disability insurance.

Can I deduct expenses for a family member?

Yes, if the person is your dependent under IRS rules, their medical expenses can be included in your deduction calculation.

Conclusion

Medical expense deductions offer a valuable opportunity to reduce your tax burden, particularly for those with high healthcare costs. By understanding the 7.5% AGI threshold, maintaining meticulous records, and employing strategic timing, you can maximize savings while staying compliant with IRS regulations. Always consult a tax professional or refer to authoritative sources like the Nolo Tax Guide to adapt to changing tax laws and ensure accurate filings. With careful planning, these deductions can provide significant financial relief, supporting both your health and fiscal well-being.