2024 Tax Brackets and Income Tax Rates: A Comprehensive Guide

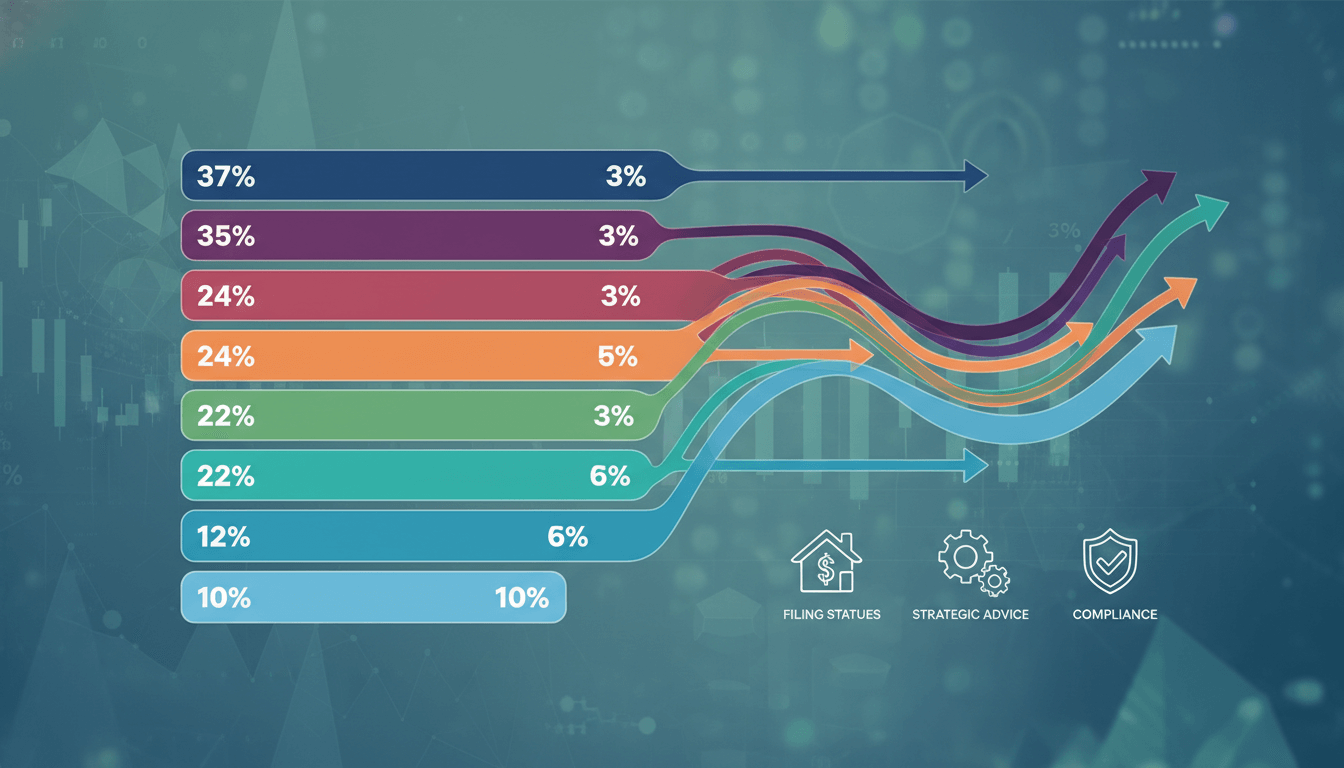

The IRS has maintained the existing seven federal income tax brackets for 2024—10%, 12%, 22%, 24%, 32%, 35%, and 37%—while adjusting income thresholds for inflation. These adjustments may lower your overall tax burden by allowing more income to be taxed at lower rates. This guide provides detailed breakdowns, filing status considerations, and strategic advice to optimize your tax planning and compliance under the current tax code.

Understanding the federal income tax brackets is essential for effective financial planning and compliance. For the 2024 tax year, the Internal Revenue Service (IRS) has retained the seven marginal tax brackets established under the Tax Cuts and Jobs Act: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. While these percentages remain unchanged from previous years, the income ranges for each bracket have been adjusted upward to account for inflation. These adjustments can significantly impact your taxable income, potentially shifting portions into lower brackets and reducing your overall tax liability. This article provides a comprehensive analysis of the 2024 tax brackets, detailed breakdowns by filing status, strategic tax planning tips, and answers to frequently asked questions to help you navigate your tax obligations confidently.

Overview of 2024 Federal Income Tax Brackets

The U.S. employs a progressive tax system where income is taxed at increasing rates as it exceeds specific thresholds. For 2024, the seven marginal tax rates are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. These brackets apply to taxable income after accounting for adjustments, deductions, and exemptions. The income thresholds for each bracket have been adjusted for inflation based on the Chained Consumer Price Index (C-CPI-U), which measures changes in the cost of living. This indexing helps prevent 'bracket creep,' where inflation pushes taxpayers into higher tax brackets without an actual increase in real income. For example, a single filer with $50,000 in taxable income falls into the 22% bracket for 2024, but only the portion above $47,150 is taxed at that rate, with lower portions taxed at 10% and 12%. Understanding these brackets is crucial for estimating tax liability and planning withholdings or estimated tax payments.

Detailed 2024 Tax Bracket Breakdown by Filing Status

Tax brackets vary significantly based on filing status, which includes Single, Married Filing Jointly, Married Filing Separately, and Head of Household. For Single filers in 2024, the 10% bracket applies to income up to $11,600, the 12% bracket covers $11,601 to $47,150, the 22% bracket spans $47,151 to $100,525, the 24% bracket includes $100,526 to $191,950, the 32% bracket ranges from $191,951 to $243,725, the 35% bracket applies to $243,726 to $609,350, and the 37% bracket covers income above $609,350. Married couples filing jointly see doubled thresholds for most brackets, with the 10% rate up to $23,200, 12% up to $94,300, 22% up to $201,050, 24% up to $383,900, 32% up to $487,450, 35% up to $731,200, and 37% above that. Head of Household filers have thresholds between Single and Joint, such as the 22% bracket ending at $100,500. These adjustments ensure equitable taxation across different household structures and prevent marriage penalties in many cases.

Impact of Inflation Adjustments on Tax Liability

The inflation adjustments for 2024 tax brackets are based on a 5.4% increase in the C-CPI-U from the previous year. This results in higher income thresholds across all brackets, which can lower effective tax rates for many taxpayers. For instance, a Single filer with $50,000 of taxable income in 2023 would have $4,850 taxed at 22%, but in 2024, only $2,850 falls into the 22% bracket due to the increased threshold—saving approximately $440 in taxes. Similarly, standard deductions have risen: $14,600 for Single filers (up $750), $29,200 for Married Joint filers (up $1,500), and $21,900 for Head of Household (up $1,100). These changes reduce adjusted gross income (AGI), potentially qualifying taxpayers for additional credits and deductions phase-outs. It's important to note that while tax rates are fixed, effective tax rates—the average rate paid on total income—vary based on these thresholds and deductions, emphasizing the need for accurate income projections and withholding adjustments.

Strategic Tax Planning with 2024 Brackets

Leveraging the 2024 tax brackets can optimize your financial outcomes through careful planning. Consider income shifting strategies, such as deferring bonuses or accelerating deductions like charitable contributions or mortgage interest, to keep income within lower brackets. Retirement contributions to 401(k)s or IRAs reduce taxable income directly; for 2024, limits are $23,000 for 401(k)s ($30,500 for those 50+) and $7,000 for IRAs ($8,000 for 50+). Tax-loss harvesting in investment portfolios can offset capital gains, while utilizing Health Savings Accounts (HSAs) provides triple tax benefits. For high-income earners near the 32% or 35% brackets, evaluating Roth conversions or municipal bond investments may yield long-term savings. Additionally, understanding the kiddie tax and education credits like the American Opportunity Tax Credit (AOTC) can further reduce liabilities. Always consult a tax professional to align strategies with your specific financial situation and avoid underpayment penalties.

Key Takeaways

2024 retains seven tax brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37% with inflation-adjusted thresholds.

Income threshold increases may lower tax liability by taxing more income at lower rates.

Filing status significantly affects bracket ranges; Married Joint filers benefit from doubled thresholds.

Standard deduction increases reduce AGI, potentially enhancing eligibility for tax credits.

Strategic planning, including retirement contributions and income shifting, can optimize tax outcomes.

Frequently Asked Questions

How do inflation adjustments affect my 2024 tax bill?

Inflation adjustments raise the income thresholds for each tax bracket, meaning more of your income may be taxed at lower rates. For example, if your income remains constant from 2023 to 2024, you could pay less in taxes due to these higher thresholds, reducing your effective tax rate.

What is the difference between marginal and effective tax rates?

Your marginal tax rate is the highest rate applied to your last dollar of income (e.g., 22% for a portion of income), while your effective tax rate is the average rate paid on your total taxable income (total tax divided by total income). Effective rates are typically lower due to the progressive bracket system.

Can I change my tax bracket by contributing to retirement accounts?

Yes, contributions to traditional retirement accounts like 401(k)s or IRAs reduce your taxable income, potentially moving you into a lower tax bracket. For instance, contributing $5,000 could shift income from the 22% to the 12% bracket, saving you money on taxes.

Are tax brackets the same for all states?

No, federal tax brackets apply nationwide, but states have their own income tax systems with varying brackets, rates, and thresholds. Some states, like Texas and Florida, have no state income tax, while others, like California and New York, have progressive brackets similar to federal ones.

Conclusion

The 2024 tax brackets, with their unchanged rates but inflation-adjusted thresholds, offer opportunities for taxpayers to minimize liabilities through informed planning. By understanding how brackets interact with filing status, deductions, and credits, you can make strategic decisions to optimize your financial health. Regularly review your income projections, leverage tax-advantaged accounts, and consult professionals to ensure compliance and maximize savings. Stay updated with IRS announcements, as future legislative changes could impact these brackets, and always file accurately to avoid penalties.