Retirement Account Contribution Limits for 2024: Maximizing Tax-Advantaged Savings

The IRS has announced updated contribution limits for 2024, enabling individuals to enhance their retirement savings through tax-advantaged accounts. Traditional IRA contributions are capped at $7,000, with an additional $1,000 catch-up provision for those aged 50 and above. 401(k) plans see an increase to $23,000. This guide provides a detailed breakdown of these limits, strategies to optimize contributions, and how to leverage these changes for tax efficiency and long-term financial security, based on authoritative data from Charles Schwab Financial Insights.

Staying informed about annual adjustments to retirement account contribution limits is essential for effective financial planning. The Internal Revenue Service (IRS) periodically revises these limits to account for inflation, providing opportunities to bolster retirement savings while optimizing tax benefits. For 2024, key updates include a $7,000 limit for Traditional IRA contributions, a $1,000 catch-up for individuals aged 50 and older, and a $23,000 cap for 401(k) plans. Understanding these figures allows you to align your savings strategy with current regulations, potentially reducing your taxable income and securing a more comfortable retirement. This article delves into the specifics of these limits, offering actionable advice to maximize your contributions.

Understanding 2024 IRA Contribution Limits

Individual Retirement Arrangements (IRAs) remain a cornerstone of retirement planning due to their tax advantages. For 2024, the base contribution limit for Traditional and Roth IRAs is set at $7,000, unchanged from 2023 when adjusted for inflation. This applies to individuals under age 50. Those aged 50 and older can contribute an additional $1,000 as a catch-up provision, bringing their total allowable contribution to $8,000. It is crucial to note that these limits are aggregate across all IRAs you own; you cannot contribute $7,000 to a Traditional IRA and another $7,000 to a Roth IRA in the same tax year. Eligibility to deduct Traditional IRA contributions may phase out based on your modified adjusted gross income (MAGI) and participation in an employer-sponsored retirement plan. For example, if you are covered by a workplace plan and your MAGI exceeds $83,000 (single filers) or $136,000 (married filing jointly), your deduction limit begins to decrease. Roth IRA contributions also phase out at higher income levels—starting at MAGI of $146,000 for single filers and $230,000 for married couples filing jointly. Contributing the maximum amount early in the year can enhance compounding growth, but spreading contributions throughout the year may better suit cash flow management.

401(k) Plan Updates and Strategic Contributions

Employer-sponsored 401(k) plans offer one of the most powerful vehicles for retirement savings, with higher contribution limits than IRAs. In 2024, the elective deferral limit for employees is $23,000, a $500 increase from 2023. Participants aged 50 and older can make an additional catch-up contribution of $7,500, allowing them to save up to $30,500 annually. These contributions are typically made on a pre-tax basis, reducing your current taxable income. Some plans also offer Roth 401(k) options, where contributions are made with after-tax dollars but qualified withdrawals are tax-free. It is important to distinguish between employee contributions and the overall plan limit, which includes employer matches and after-tax contributions, capped at $69,000 for 2024 (or $76,500 including catch-up contributions). To maximize benefits, aim to contribute at least enough to receive your employer's full matching contribution, as this is essentially free money. Automating contributions through payroll deductions ensures consistency and leverages dollar-cost averaging. If your budget allows, front-loading contributions early in the year can maximize time in the market, though this should be balanced against other financial obligations and potential liquidity needs.

Leveraging Catch-Up Contributions for Accelerated Savings

Catch-up contributions are designed to help individuals aged 50 and older accelerate their retirement savings as they approach retirement age. For IRAs, the catch-up is fixed at $1,000, allowing a total contribution of $8,000. For 401(k), 403(b), and most 457 plans, the catch-up is $7,500, enabling a total of $30,500 in employee deferrals. These provisions recognize that older savers may have higher disposable income and a shorter time horizon to grow their nest egg. To qualify, you must turn 50 by the end of the calendar year. There are no income limits or special eligibility requirements beyond age for making catch-up contributions, making them accessible to all eligible participants. Strategically, if you have neglected retirement savings earlier in life or experienced financial setbacks, maximizing catch-up contributions can significantly bolster your retirement funds. Combined with potential employer matches, these contributions can substantially increase your account balance over a relatively short period. It is advisable to review your budget and cash flow to ensure you can afford these higher contributions without compromising essential expenses or emergency savings.

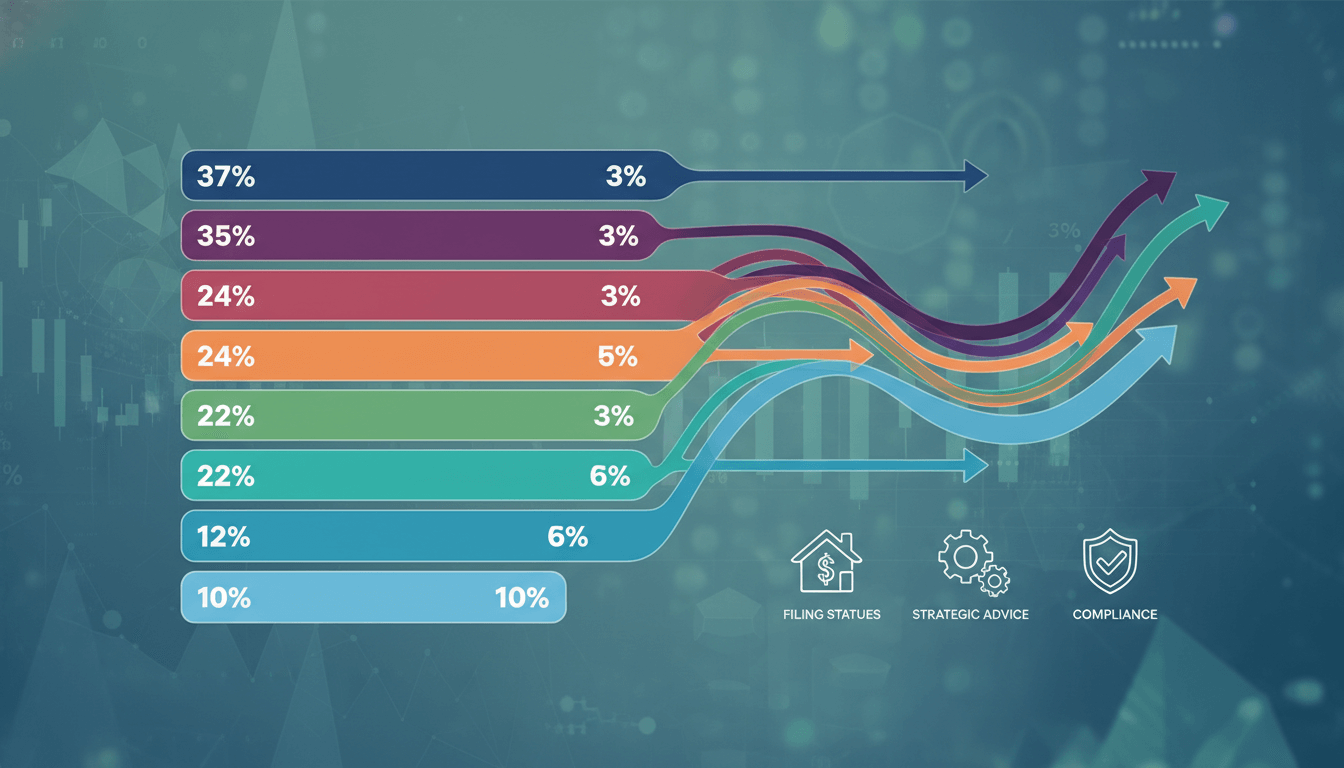

Tax Implications and Optimization Strategies

Contributing to tax-advantaged retirement accounts directly impacts your tax liability. Traditional IRA and 401(k) contributions reduce your adjusted gross income (AGI) for the year in which they are made, potentially lowering your tax bracket and increasing eligibility for other tax credits and deductions. For instance, a $7,000 IRA contribution could reduce your federal tax bill by $1,540 if you are in the 22% marginal tax bracket. Roth accounts, while not providing an immediate tax deduction, offer tax-free growth and withdrawals in retirement, which can be beneficial if you expect to be in a higher tax bracket later. To optimize your strategy, consider your current and projected future tax rates. Diversifying between Traditional and Roth accounts can provide tax flexibility in retirement. Additionally, if you have multiple income streams or are self-employed, explore options like SEP IRAs or Solo 401(k)s, which may allow even higher contributions. Always ensure contributions are made by the tax filing deadline (typically April 15 of the following year for IRAs) and keep accurate records for tax preparation. Consulting a tax advisor can help tailor these strategies to your specific financial situation, ensuring compliance and maximization of benefits.

Common Pitfalls and Compliance Considerations

While maximizing contributions is advantageous, it is essential to avoid common pitfalls that could lead to penalties or reduced benefits. Exceeding contribution limits can result in a 6% excise tax on the excess amount each year until it is corrected. For IRAs, the limit applies across all accounts, so contributing $7,000 to a Traditional IRA and $1,000 to a Roth IRA in the same year would result in a $1,000 excess if you are under 50. Required Minimum Distributions (RMDs) must also be considered; for 2024, the age for starting RMDs is 73 for those who turned 72 after December 31, 2022. Failure to take RMDs incurs a 25% penalty on the amount not withdrawn. Additionally, early withdrawals before age 59½ generally face a 10% penalty plus income taxes, though exceptions exist for certain circumstances like first-time home purchases or higher education expenses. To stay compliant, monitor your contributions throughout the year, especially if you have multiple accounts or change employers. Use IRS Form 5498 to track IRA contributions and review your 401(k) statements regularly. If you discover an excess contribution, withdraw it promptly along with any associated earnings to minimize penalties.

Key Takeaways

IRA contribution limit is $7,000 for 2024, with a $1,000 catch-up for those 50+.

401(k) employee deferral limit rises to $23,000, plus a $7,500 catch-up for eligible participants.

Maximize tax savings by contributing to Traditional accounts to reduce current taxable income.

Leverage catch-up contributions if aged 50+ to accelerate retirement savings.

Avoid excess contributions to prevent IRS penalties and ensure compliance.

Frequently Asked Questions

What is the IRA contribution limit for 2024?

The IRA contribution limit for 2024 is $7,000 for individuals under age 50. Those aged 50 and older can contribute an additional $1,000 as a catch-up, totaling $8,000.

How much can I contribute to my 401(k) in 2024?

For 2024, you can contribute up to $23,000 to your 401(k) as an employee elective deferral. If you are 50 or older, you can contribute an additional $7,500, bringing the total to $30,500.

Are there income limits for contributing to a Roth IRA in 2024?

Yes, Roth IRA contributions phase out at higher income levels. For single filers, the phase-out range is $146,000 to $161,000 MAGI. For married couples filing jointly, it is $230,000 to $240,000 MAGI.

What happens if I exceed the contribution limits?

Exceeding contribution limits may result in a 6% excise tax on the excess amount each year until it is corrected. You should withdraw the excess and any associated earnings to avoid penalties.

Can I make catch-up contributions to both an IRA and a 401(k)?

Yes, if you are eligible (aged 50 or older), you can make catch-up contributions to both an IRA ($1,000) and a 401(k) ($7,500) simultaneously, provided you meet the respective account requirements.

Conclusion

The 2024 retirement account contribution limits present valuable opportunities to enhance your financial future through tax-advantaged savings. By understanding the specifics—$7,000 for IRAs with a $1,000 catch-up, and $23,000 for 401(k)s with a $7,500 catch-up—you can strategically allocate resources to minimize taxes and build a robust retirement portfolio. Regularly reviewing your contribution strategy, considering both Traditional and Roth options, and avoiding common compliance issues will help you make the most of these limits. As always, consult with a financial advisor to tailor these guidelines to your personal circumstances, ensuring you stay on track toward a secure and prosperous retirement.