Charitable Contribution Deductions: Maximizing Tax Benefits in 2024 and Beyond

This comprehensive guide explores charitable contribution deductions for 2024, detailing how cash donations are deductible up to 60% of Adjusted Gross Income (AGI) and non-cash assets held over one year are limited to 30% of AGI. Beginning in 2026, taxpayers can claim up to $1,000 in cash contributions without itemizing. Learn strategies to optimize deductions, ensure compliance with IRS rules, and leverage these tax benefits to reduce your overall tax burden while supporting charitable causes.

Charitable contribution deductions provide significant tax advantages for individuals who support qualified organizations. For the 2024 tax year, the Internal Revenue Service (IRS) permits deductions up to 60% of Adjusted Gross Income (AGI) for cash donations and 30% of AGI for non-cash assets held longer than one year. These limits are critical for taxpayers aiming to reduce taxable income while contributing to philanthropic causes. Additionally, starting in 2026, a new above-the-line deduction will allow up to $1,000 in cash charitable contributions without the need to itemize, expanding accessibility for more taxpayers. Understanding these rules, including documentation requirements and strategic planning, is essential to maximize benefits and avoid common pitfalls.

Understanding Charitable Contribution Deduction Limits for 2024

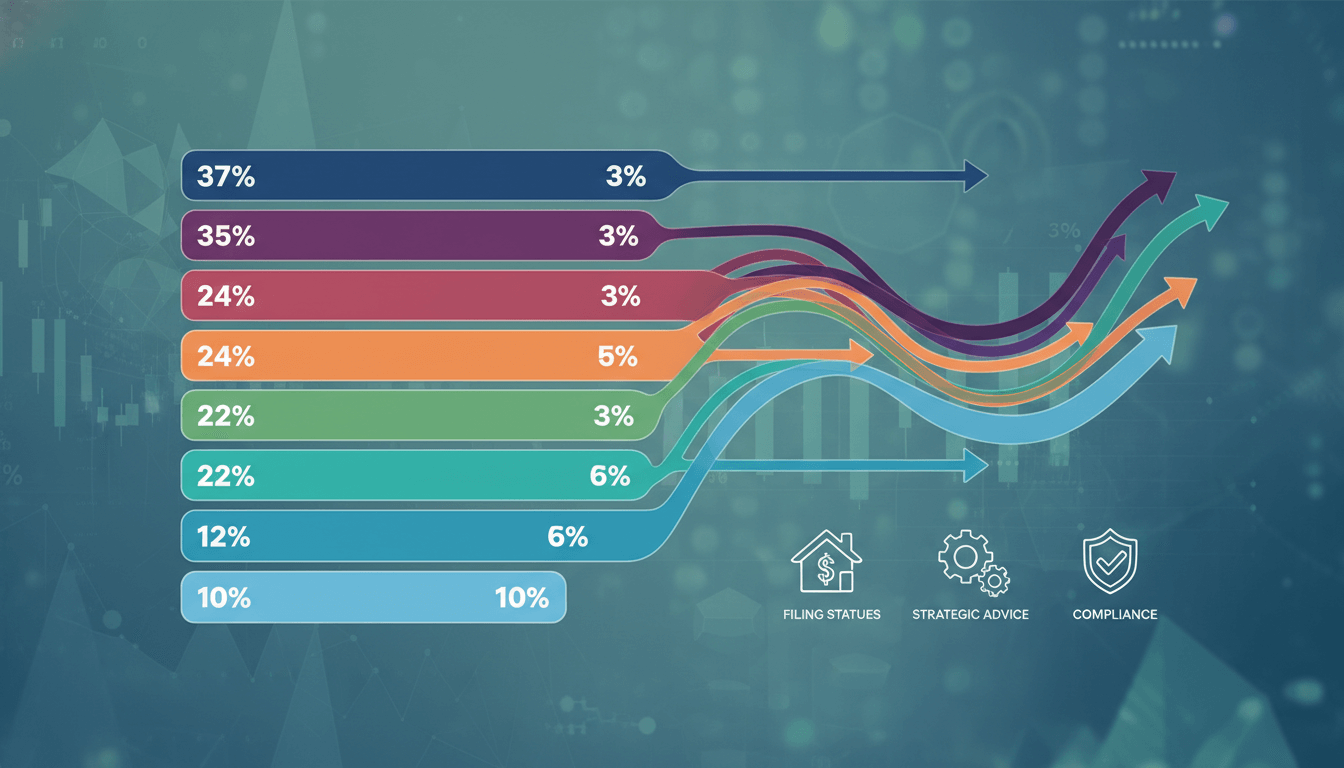

The IRS sets specific percentage-based limits on charitable deductions to prevent abuse and ensure equitable tax treatment. For 2024, cash contributions to public charities are deductible up to 60% of your AGI. This means if your AGI is $100,000, you can deduct up to $60,000 in cash donations. Contributions exceeding this limit can be carried forward for up to five years. Non-cash assets, such as stocks, real estate, or vehicles held for more than one year, are deductible up to 30% of AGI. For example, with a $100,000 AGI, the maximum deduction for appreciated assets is $30,000. It's crucial to obtain written acknowledgments for donations over $250 and to use Form 8283 for non-cash contributions exceeding $500. Proper valuation is required, especially for assets like securities, where fair market value on the donation date determines the deduction amount.

Cash vs. Non-Cash Donations: Key Differences and Strategies

Cash donations include money, checks, or electronic transfers and are straightforward to document with bank records or receipts. The 60% AGI limit encourages substantial giving but requires meticulous record-keeping. In contrast, non-cash donations involve assets like stocks, bonds, or property. Donating appreciated assets held over one year offers dual benefits: a deduction at fair market value and avoidance of capital gains tax. For instance, donating stock worth $10,000 that was purchased for $2,000 eliminates capital gains tax on the $8,000 appreciation. However, deductions for non-cash items are capped at 30% of AGI, and higher-value items may require a qualified appraisal. Strategic donors often bundle contributions in high-income years or use donor-advised funds to optimize timing and deductions.

Future Changes: Above-the-Line Deductions Starting in 2026

Beginning in the 2026 tax year, taxpayers will be eligible for an above-the-line deduction of up to $1,000 ($2,000 for joint filers) for cash charitable contributions, regardless of whether they itemize deductions. This change simplifies tax filing for millions who currently take the standard deduction, making charitable giving more accessible. For example, a taxpayer with $50,000 AGI could deduct $1,000 directly from gross income, reducing AGI to $49,000. This deduction applies only to cash donations and does not affect existing itemized deduction limits. Taxpayers should plan ahead by adjusting their giving strategies to leverage both above-the-line and itemized deductions, ensuring maximum tax efficiency under the new rules.

Compliance and Documentation Requirements

To claim charitable deductions, taxpayers must comply with IRS documentation rules. For cash donations under $250, a bank record or receipt from the charity suffices. Contributions of $250 or more require a contemporaneous written acknowledgment detailing the amount, date, and whether any goods or services were received in exchange. Non-cash donations between $500 and $5,000 require a description and how the property was acquired. For donations over $5,000, a qualified appraisal is mandatory, and Form 8283 must be filed. Failure to adhere can result in disallowed deductions and penalties. Additionally, donations to qualified organizations must be verified using the IRS Tax Exempt Organization Search tool to ensure eligibility.

Advanced Strategies for Maximizing Deductions

Sophisticated strategies can enhance charitable tax benefits. Bunching donations involves consolidating multiple years' contributions into one tax year to exceed the standard deduction threshold, enabling itemization. For example, donating $15,000 in a single year instead of $5,000 annually may yield higher deductions. Donor-advised funds allow donors to contribute assets, receive an immediate deduction, and recommend grants to charities over time. Qualified Charitable Distributions (QCDs) from IRAs for those aged 70½ or older exclude up to $105,000 (2024 limit) from taxable income, satisfying Required Minimum Distributions without increasing AGI. Consulting a tax advisor is recommended to align these strategies with overall financial goals and changing tax laws.

Key Takeaways

Cash charitable contributions are deductible up to 60% of AGI in 2024, while non-cash assets held over one year are limited to 30% of AGI.

Starting in 2026, taxpayers can deduct up to $1,000 in cash donations without itemizing, via an above-the-line deduction.

Proper documentation, including receipts and appraisals for high-value non-cash donations, is essential for IRS compliance.

Strategies like bunching donations, using donor-advised funds, and making Qualified Charitable Distributions can optimize tax benefits.

Excess contributions can be carried forward for up to five years, allowing flexibility in tax planning.

Frequently Asked Questions

What is the difference between cash and non-cash charitable deduction limits?

Cash donations are deductible up to 60% of AGI, whereas non-cash assets held over one year are limited to 30% of AGI. Cash includes money or equivalents, while non-cash covers property like stocks or real estate.

How does the above-the-line deduction work starting in 2026?

Taxpayers can deduct up to $1,000 ($2,000 joint) for cash charitable contributions directly from gross income without itemizing. This reduces AGI and is available regardless of whether you take the standard deduction.

What records are needed for charitable deductions?

For cash under $250, bank records or receipts suffice; over $250, a written acknowledgment from the charity is required. Non-cash donations over $500 need detailed descriptions, and over $5,000 require a qualified appraisal and Form 8283.

Can I carry forward unused charitable deductions?

Yes, contributions exceeding AGI limits can be carried forward for up to five tax years, subject to the same percentage limits each year.

Are all charitable organizations eligible for tax deductions?

No, only donations to qualified 501(c)(3) organizations are deductible. Verify eligibility using the IRS Tax Exempt Organization Search tool to ensure compliance.

Conclusion

Charitable contribution deductions offer valuable opportunities to reduce tax liability while supporting meaningful causes. By understanding the 2024 limits of 60% AGI for cash and 30% AGI for non-cash assets, taxpayers can plan donations effectively. The upcoming above-the-line deduction in 2026 will further broaden access, benefiting those who do not itemize. Adhering to documentation requirements and employing advanced strategies, such as bunching or using donor-advised funds, can maximize benefits. Always consult a tax professional to tailor approaches to your financial situation, ensuring compliance and optimal tax savings. For more guidance, explore related articles on Personal-Financial-Advisers.com.