Overtime Compensation Deduction: Maximizing Tax Benefits for Extra Hours Worked

The Overtime Compensation Deduction, effective from 2025 to 2028 under the IRS One Big Beautiful Bill Act, enables eligible taxpayers to deduct qualified overtime pay exceeding their regular rate. Individual filers can claim up to $12,500 annually, while joint filers are eligible for up to $25,000, subject to phase-out thresholds starting at $150,000 modified AGI for individuals and $300,000 for joint filers. This deduction targets wage earners seeking to reduce taxable income through documented overtime, offering substantial savings for those managing increased work hours. Consult a tax advisor to ensure compliance and optimal benefit utilization.

Overview

The Overtime Compensation Deduction, introduced by the IRS One Big Beautiful Bill Act and effective for tax years 2025 through 2028, provides a targeted tax benefit for employees earning overtime pay. This deduction allows individuals to reduce their taxable income by the amount of qualified overtime compensation that exceeds their standard hourly or salaried rate. Designed to alleviate tax burdens for those working additional hours, it supports financial planning by recognizing the extra effort involved. Eligible taxpayers must meet specific criteria, including income thresholds, to claim the maximum annual deduction of $12,500 for individuals or $25,000 for joint filers. The deduction phases out gradually for modified adjusted gross incomes exceeding $150,000 for single filers and $300,000 for those filing jointly, ensuring it benefits middle-income earners. Proper documentation, such as pay stubs and employer certifications, is essential to substantiate claims and avoid discrepancies during IRS audits. This provision reflects legislative efforts to incentivize workforce participation and provide equitable tax relief.

Specifications

Details

Calculation Method

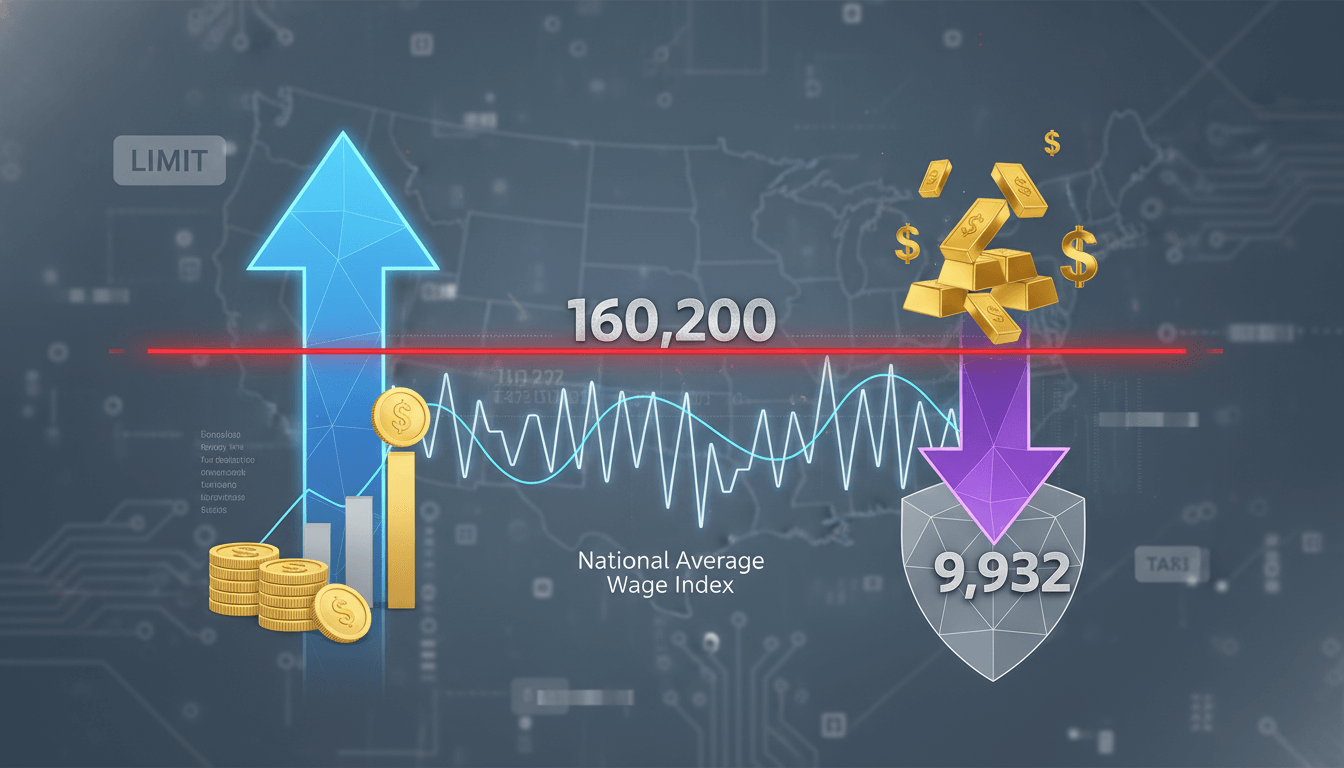

The deduction is calculated as the lesser of the actual qualified overtime compensation exceeding the regular rate or the maximum allowable amount based on filing status. For example, an individual with $15,000 in eligible overtime would deduct $12,500, while someone with $10,000 would deduct the full $10,000. The phase-out reduces the deduction by 1% for every $1,000 of modified AGI above the threshold, ceasing entirely at $162,500 for individuals and $325,000 for joint filers. Modified AGI includes all taxable income plus specific additions like student loan interest deductions and IRA contributions.

Qualifying Overtime Definition

Qualified overtime compensation refers to hours worked beyond the standard 40-hour workweek or as defined by employer agreements, paid at a premium rate (e.g., time-and-a-half). It excludes non-wage compensations like stock options, reimbursements, or non-cash benefits. Overtime must be documented through timesheets and verified by the employer to ensure compliance with Fair Labor Standards Act (FLSA) guidelines.

Claim Process

Taxpayers must complete IRS Form 8912, Overtime Compensation Deduction, attaching it to their annual return. Steps include: 1) Summarizing total overtime hours and pay from W-2 Box 1 and supplemental records; 2) Calculating the excess over regular pay using hourly rates or equivalent salaried computations; 3) Applying the phase-out based on modified AGI from Form 1040; 4) Retaining records for three years post-filing. Errors in calculation may lead to penalties, so using tax software or professional services is advisable.

Impact On Tax Liability

Assuming a 22% marginal tax rate, an individual claiming the full $12,500 deduction could save $2,750 in federal taxes annually. For joint filers at the same rate, the $25,000 maximum yields $5,500 in savings. This deduction interacts with other adjustments like student loan interest and IRA deductions, potentially lowering AGI further and qualifying taxpayers for additional credits like the Earned Income Tax Credit (EITC).

Common Scenarios

Scenario 1: A single filer with $160,000 modified AGI and $14,000 qualified overtime would see a phased deduction of $10,000 (reduced by $2,500 due to phase-out). Scenario 2: Joint filers with $290,000 modified AGI and $30,000 overtime could claim the full $25,000, as they are below the phase-out threshold. Scenario 3: An individual with $170,000 AGI receives no deduction, as phase-out completes at $162,500.

Comparison Points

Versus Standard Deduction: This is an above-the-line deduction, reducing AGI directly, whereas the standard deduction is a fixed amount based on filing status and does not require itemization.

Versus Other Employment Deductions: Unlike unreimbursed employee expenses (no longer deductible post-2017), this specifically targets overtime and has defined caps and phase-outs.

Versus Tax Credits: Deductions reduce taxable income, while credits like the Child Tax Credit directly reduce tax liability dollar-for-dollar; this deduction's value depends on the taxpayer's marginal rate.

Important Notes

Taxpayers should review employer payroll reports annually to ensure overtime is correctly categorized. The deduction sunsets after 2028 unless extended by Congress. Consult a certified tax professional for complex situations, such as self-employed individuals with overtime-equivalent pay or those with multiple jobs. Updates to IRS guidelines may occur; monitor Publication 17 for changes.