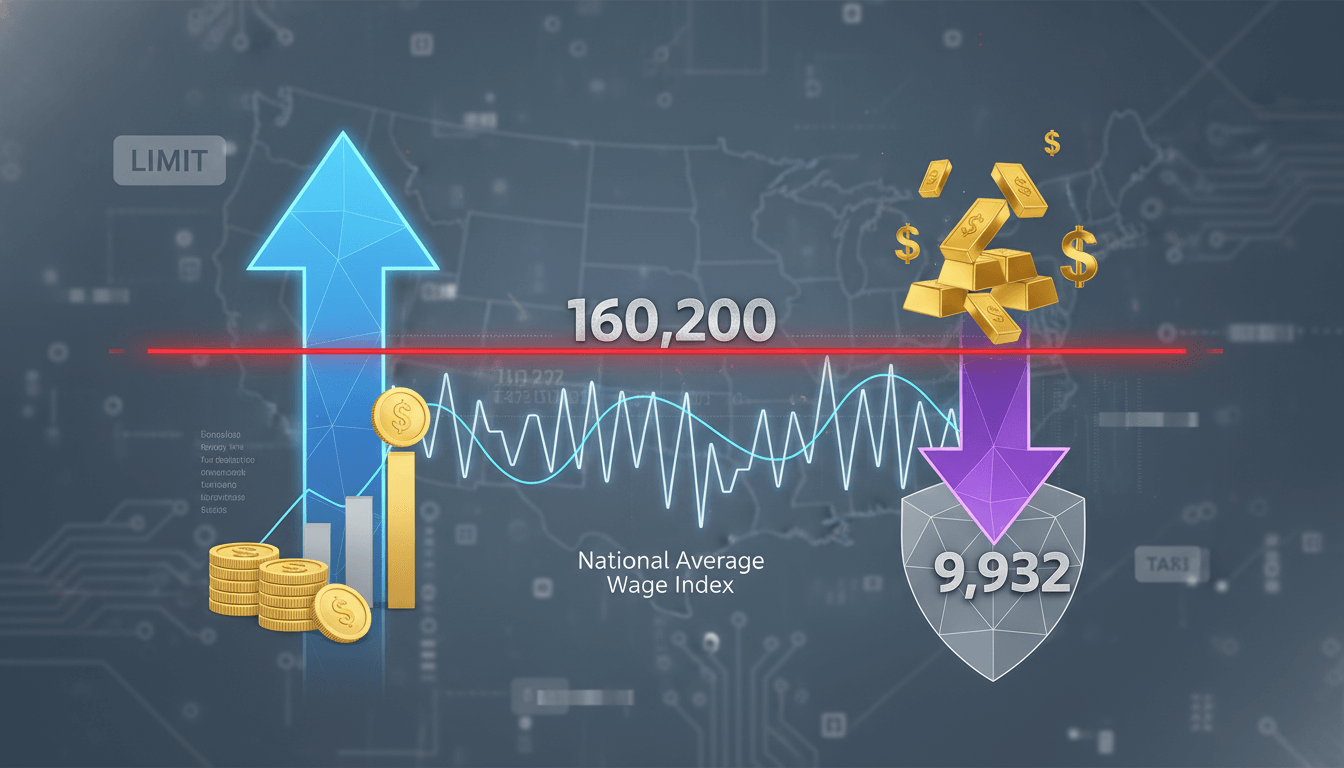

Retirement Account Contributions: Maximizing Tax Deductions and Credits

Learn how contributing to retirement accounts such as IRAs, 401(k)s, SEP IRAs, and SIMPLE IRAs can reduce your taxable income and qualify you for valuable tax credits. This guide covers contribution limits, eligibility requirements, and strategies for optimizing deductions, including the Saver's Credit for low-income taxpayers, to enhance your retirement savings and tax efficiency.

Overview

Retirement account contributions offer significant tax advantages by reducing your adjusted gross income (AGI) through deductions and potentially qualifying for the Saver's Credit. Taxpayers can deduct contributions to traditional IRAs, 401(k)s, and other qualified plans, while self-employed individuals benefit from SEP IRAs and SIMPLE IRAs. The Saver's Credit provides an additional incentive, offering up to $2,000 for joint filers or $1,000 for others, directly reducing tax liability. Understanding these mechanisms is crucial for effective tax planning and long-term financial security.

Specifications

Details

Deductible Contributions Explained

Contributions to traditional IRAs and employer-sponsored plans like 401(k)s are made with pre-tax dollars, directly lowering your taxable income. For example, if you contribute $7,000 to a traditional IRA and fall within the income limits, your AGI decreases by that amount, potentially placing you in a lower tax bracket. Self-employed individuals can deduct contributions to SEP IRAs, calculated as up to 25% of net earnings, or SIMPLE IRAs, with limits of $16,000 plus catch-up contributions. These deductions are claimed on Form 1040, specifically on Schedule 1 for IRA deductions and directly through W-2 adjustments for 401(k)s.

Saver'S Credit Eligibility And Claiming

The Saver's Credit, formally known as the Retirement Savings Contributions Credit, is available to taxpayers with AGI below specified thresholds. It is non-refundable but can reduce your tax bill to zero. To claim it, file Form 8880 with your tax return, calculating the credit based on your retirement plan contributions and AGI. For instance, a joint filer with AGI of $40,000 contributing $4,000 to a 401(k) could receive a 50% credit, equaling $2,000. Contributions must be made by the tax filing deadline, including extensions.

Strategic Planning Tips

Maximize deductions by contributing the full allowable amount to IRAs and 401(k)s, especially if you are 50 or older to utilize catch-up contributions. Coordinate with your spouse if filing jointly to optimize Saver's Credit benefits. Consider Roth IRAs for tax-free withdrawals in retirement, though contributions are not deductible. Regularly review IRS updates for inflation-adjusted limits and consult a financial advisor to align contributions with your overall tax strategy.

Comparison Points

Traditional IRA vs. Roth IRA: Deductions available for traditional IRAs subject to income limits; Roth IRAs offer tax-free growth but no upfront deduction.

Employer plans vs. IRAs: 401(k)s often have higher contribution limits and may include employer matching, while IRAs provide more investment flexibility.

Saver's Credit vs. deductions: Credits reduce tax liability dollar-for-dollar, while deductions lower taxable income, making the credit more valuable per dollar for eligible taxpayers.

Important Notes

Contributions to Roth IRAs are not deductible. Required minimum distributions (RMDs) apply to traditional IRAs and 401(k)s starting at age 73. Early withdrawals before age 59½ may incur a 10% penalty plus taxes, with exceptions for first-time home purchases or higher education expenses. Keep records of all contributions and consult IRS Publication 590-A for IRA rules and Publication 560 for retirement plans for self-employed individuals.