Social Security Tax Limit 2023: Maximum Earnings and Tax Withholding

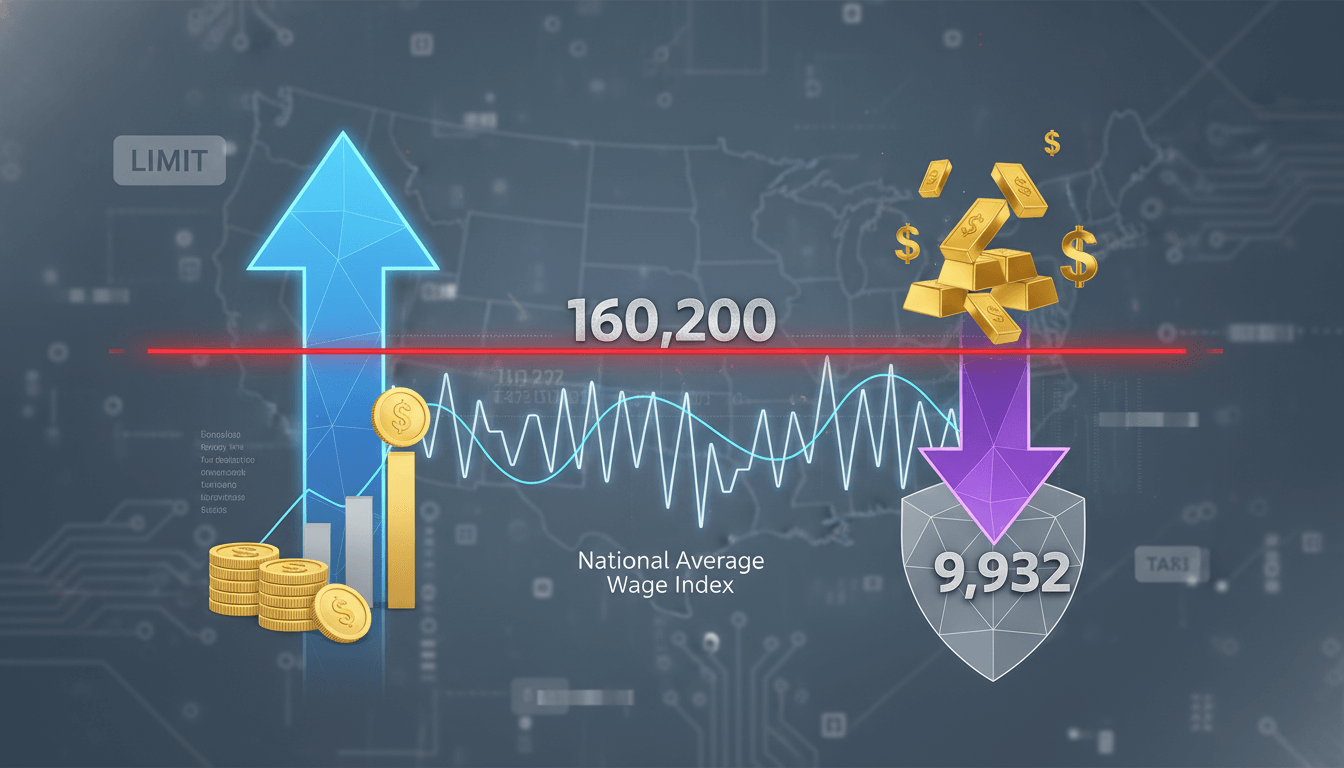

The Social Security tax limit for 2023 sets the maximum earnings subject to payroll tax at $160,200, with a corresponding maximum annual tax withholding of $9,932. This annual adjustment, tied to the National Average Wage Index, ensures the system's sustainability. High-income earners benefit from this cap, as earnings above this threshold are not subject to Social Security tax. Understanding this limit is essential for accurate tax planning, payroll compliance, and optimizing personal financial strategies, especially for those with multiple income sources or self-employment income.

Overview

The Social Security tax limit, officially known as the contribution and benefit base, represents the maximum amount of earnings subject to the Social Security payroll tax each year. For 2023, this limit increased to $160,200, up from $147,000 in 2022, reflecting a 9% adjustment for wage inflation. This means employees and employers each pay 6.2% on earnings up to this threshold, resulting in a maximum annual tax contribution of $9,932 per party. Self-employed individuals pay the combined 12.4% rate, making their maximum potential Social Security tax $19,864. The limit applies only to the Old-Age, Survivors, and Disability Insurance (OASDI) portion of FICA taxes; the 1.45% Medicare tax applies to all earnings without limit, with an additional 0.9% Medicare surtax on high-income earners. This cap structure creates a regressive tax system where lower-income workers pay a higher percentage of their total income toward Social Security than high-income earners. The annual adjustment mechanism, based on the National Average Wage Index, ensures the system maintains its purchasing power while adapting to economic changes. Understanding this limit is crucial for accurate tax withholding, financial planning, and retirement strategy development, particularly for those approaching or exceeding the threshold.

Specifications

Details

The Social Security tax limit mechanism serves multiple purposes within the U.S. social insurance system. First, it protects higher-income earners from unlimited tax liability while ensuring adequate funding for the program. The $160,200 threshold means that individuals earning exactly this amount pay the maximum $9,932, representing 6.2% of their income. Those earning more than $160,200 pay the same maximum amount, making their effective Social Security tax rate lower than 6.2% when calculated as a percentage of total income. For example, someone earning $300,000 pays $9,932 in Social Security tax, representing just 3.31% of their income. The limit adjustment process occurs automatically each year based on increases in the National Average Wage Index, calculated by the Social Security Administration. This index measures wage growth across the economy, ensuring the limit keeps pace with general wage inflation rather than consumer price inflation. When workers have multiple employers, each employer must withhold Social Security tax until the employee reaches the $160,200 limit across all employment. Employees who overpay due to multiple employers can claim a refund when filing their annual tax return. For self-employed individuals, the calculation occurs on Schedule SE of Form 1040, with the 12.4% Social Security tax applying to net earnings up to the limit. The Medicare portion remains uncapped, applying to all net self-employment income. The limit also affects benefit calculations, as only earnings up to the taxable maximum count toward determining Social Security retirement benefits. This creates a progressive benefit formula that replaces a higher percentage of pre-retirement earnings for lower-income workers while providing absolute higher benefits for those who consistently earn at or above the limit.

Comparison Points

2023 limit of $160,200 represents a $13,200 increase from 2022's $147,000 limit

The 9% year-over-year increase exceeds the 20-year average annual increase of approximately 3.5%

Maximum tax liability increased by $818 from 2022's $9,114 to 2023's $9,932

The 2023 limit maintains the historical pattern where approximately 82-86% of covered earnings fall below the taxable maximum

Compared to the 2000 limit of $76,200, the 2023 limit represents a 110% increase over 23 years, averaging 3.3% annual growth

The 2023 adjustment of 9% significantly exceeds the 5.9% COLA applied to Social Security benefits for the same year

Important Notes

The Social Security tax limit applies separately to each type of employment income. Wages, salaries, bonuses, commissions, and taxable fringe benefits all count toward the limit. Non-cash compensation and certain deferred compensation may also be subject. The limit does not apply to investment income, rental income, or retirement distributions. Employers must track earnings carefully and cease Social Security withholding once an employee reaches $160,200 in cumulative earnings for the year. The limit resets each calendar year, so high earners will see Social Security withholding resume in January of each new year. For tax planning purposes, individuals approaching the limit may want to adjust their withholding allowances to avoid over-withholding. Those with irregular income patterns should monitor their earnings closely to anticipate when they will reach the limit. The annual limit announcement typically occurs in October for the following year, allowing employers and payroll providers time to implement changes. While the limit provides tax relief for high earners, it also caps their potential Social Security benefits, creating important retirement planning considerations. Future limit increases are projected to continue, with estimates suggesting the limit could reach $180,000-$190,000 by 2030 based on current wage growth projections.