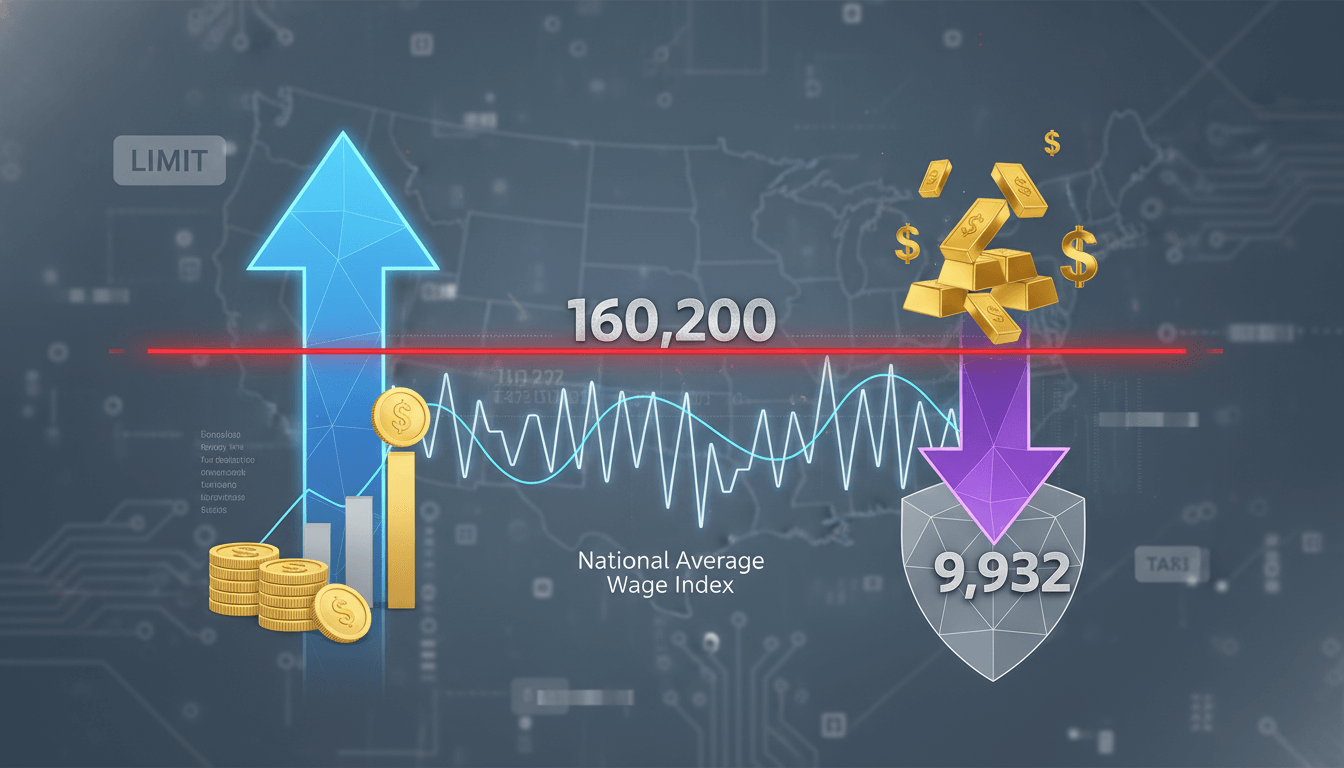

2023 Gift Tax Exclusion: A Comprehensive Guide to $17,000 Annual Gifting Limit

The annual gift tax exclusion for 2023 allows individuals to gift up to $17,000 per recipient without incurring federal gift tax or filing requirements. This inflation-adjusted amount provides significant opportunities for tax-efficient wealth transfer and financial planning. Understanding the per-recipient application, exclusion mechanics, and strategic implications helps taxpayers optimize gifting strategies while maintaining compliance with IRS regulations. This guide covers exclusion specifications, detailed reporting thresholds, and practical applications for personal financial management.

Overview

The annual gift tax exclusion represents a fundamental component of U.S. transfer tax system, allowing taxpayers to transfer wealth without incurring immediate tax consequences. For 2023, the exclusion amount increased to $17,000 per recipient, reflecting inflation adjustments monitored by the Tax Foundation. This exclusion enables individuals to make gifts up to this amount to any number of recipients without triggering gift tax liabilities or Form 709 filing requirements. The per-recipient application means taxpayers can strategically distribute assets to multiple family members, friends, or other beneficiaries while maximizing tax-free transfers. Understanding this exclusion is crucial for effective estate planning, intergenerational wealth transfer, and annual financial strategy development.

Specifications

Details

Exclusion Mechanics

The $17,000 annual exclusion applies per donor per recipient, meaning each individual can gift up to this amount to any number of people without tax consequences. Married couples can combine their exclusions through gift-splitting, allowing $34,000 per recipient without filing requirements. The exclusion refreshes annually on January 1st, creating ongoing planning opportunities. Gifts must be present interests, meaning recipients must have immediate rights to use and enjoy the gifted property. Future interests, such as trust arrangements with delayed benefits, do not qualify for the annual exclusion.

Reporting Requirements

No IRS reporting is required for gifts at or below the $17,000 threshold per recipient. When gifts exceed this amount, donors must file Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return. The excess amount applies toward the lifetime gift tax exemption, currently $12.92 million per individual. Importantly, exceeding the annual exclusion doesn't necessarily mean immediate tax payment—it simply reduces the available lifetime exemption. Proper documentation of all gifts is essential for accurate tax reporting and audit protection.

Strategic Applications

The annual exclusion enables systematic wealth transfer through regular gifting programs. Families can transfer up to $68,000 annually to a married couple with two children ($17,000 x 4 recipients). For grandparents, this can mean substantial intergenerational wealth transfer over time. The exclusion also works effectively with 529 college savings plans, where front-loading five years of exclusions ($85,000 per donor) accelerates education funding. Business owners can use gifting strategies to transition ownership to family members while minimizing transfer tax implications. All strategies must consider step-transaction doctrines and substance-over-form principles.

Compliance Considerations

Valuation of gifted assets must reflect fair market value at transfer date. For illiquid assets like real estate or business interests, qualified appraisals may be necessary. Gift documentation should include transfer instruments, valuation reports, and recipient acknowledgments. The three-year rule for gift tax inclusion applies to certain deathbed gifts, bringing them back into the estate if the donor dies within three years. State gift tax implications vary, with some states imposing their own gift tax regimes separate from federal rules.

Planning Opportunities

Consistent annual gifting can significantly reduce taxable estates over time. The exclusion works particularly well for appreciating assets, removing future growth from the donor's estate. Charitable gift strategies can combine annual exclusions with charitable deductions for optimized tax benefits. For non-citizen spouses, different rules apply, requiring specialized planning approaches. International gifting involves additional complexities including treaty considerations and foreign gift reporting requirements.

Comparison Points

2022 exclusion: $16,000 per recipient

2023 exclusion: $17,000 per recipient (6.25% increase)

Five-year average exclusion: $16,200

Projected 2024 exclusion: $17,500 (estimated)

Married couple combined exclusion: $34,000 per recipient

Lifetime exemption vs annual exclusion utilization rates

Important Notes

The annual exclusion amount is adjusted for inflation using the Chained Consumer Price Index (C-CPI-U). Gifts to political organizations and certain educational/medical payments made directly to institutions are excluded from gift tax entirely, regardless of amount. The annual exclusion cannot be carried forward to future years if unused. Valuation discounts for fractional interests in family entities may apply but are subject to increased IRS scrutiny. State-level gift tax considerations may apply in Connecticut and Minnesota, though most states have eliminated their gift tax regimes.