Foreign Earned Income Exclusion: Maximizing Tax Benefits for International Earners

The Foreign Earned Income Exclusion (FEIE) allows qualifying U.S. taxpayers to exclude up to $120,000 of foreign-earned income from their 2023 federal tax returns. This provision applies specifically to income earned outside the United States and requires meeting either the Bona Fide Residence Test or Physical Presence Test. Properly utilizing the FEIE can significantly reduce overall tax liability for expatriates and international workers while maintaining compliance with IRS regulations. Understanding eligibility requirements, calculation methods, and filing procedures is essential for maximizing this valuable tax benefit.

Overview

The Foreign Earned Income Exclusion represents one of the most significant tax benefits available to U.S. citizens and resident aliens living and working abroad. Established under Internal Revenue Code Section 911, this provision enables eligible taxpayers to exclude a substantial portion of their foreign-earned income from U.S. federal taxation. For the 2023 tax year, the exclusion amount stands at $120,000, adjusted annually for inflation. This exclusion applies specifically to earned income derived from services performed in foreign countries, including wages, salaries, professional fees, and other compensation for personal services. The FEIE operates independently of the Foreign Tax Credit, providing taxpayers with strategic options for minimizing their global tax burden. To qualify, individuals must meet specific residency requirements and properly document their foreign presence through either the Bona Fide Residence Test or Physical Presence Test. The exclusion requires filing Form 2555 with the annual tax return and cannot be claimed for income earned within the United States or its territories. Understanding the nuances of this exclusion is crucial for expatriates, international contractors, and global professionals seeking to optimize their tax position while maintaining full compliance with U.S. tax laws.

Specifications

- 2023

- Bona Fide Residence Test

- Physical Presence Test

Details

Eligibility Requirements

Taxpayers must meet either the Bona Fide Residence Test, requiring residence in a foreign country for an uninterrupted period that includes an entire tax year, or the Physical Presence Test, requiring physical presence in a foreign country for at least 330 full days during any period of 12 consecutive months. The taxpayer's tax home must be in a foreign country throughout the period of foreign residence or presence. Specific exceptions apply for countries with travel restrictions or those designated as combat zones.

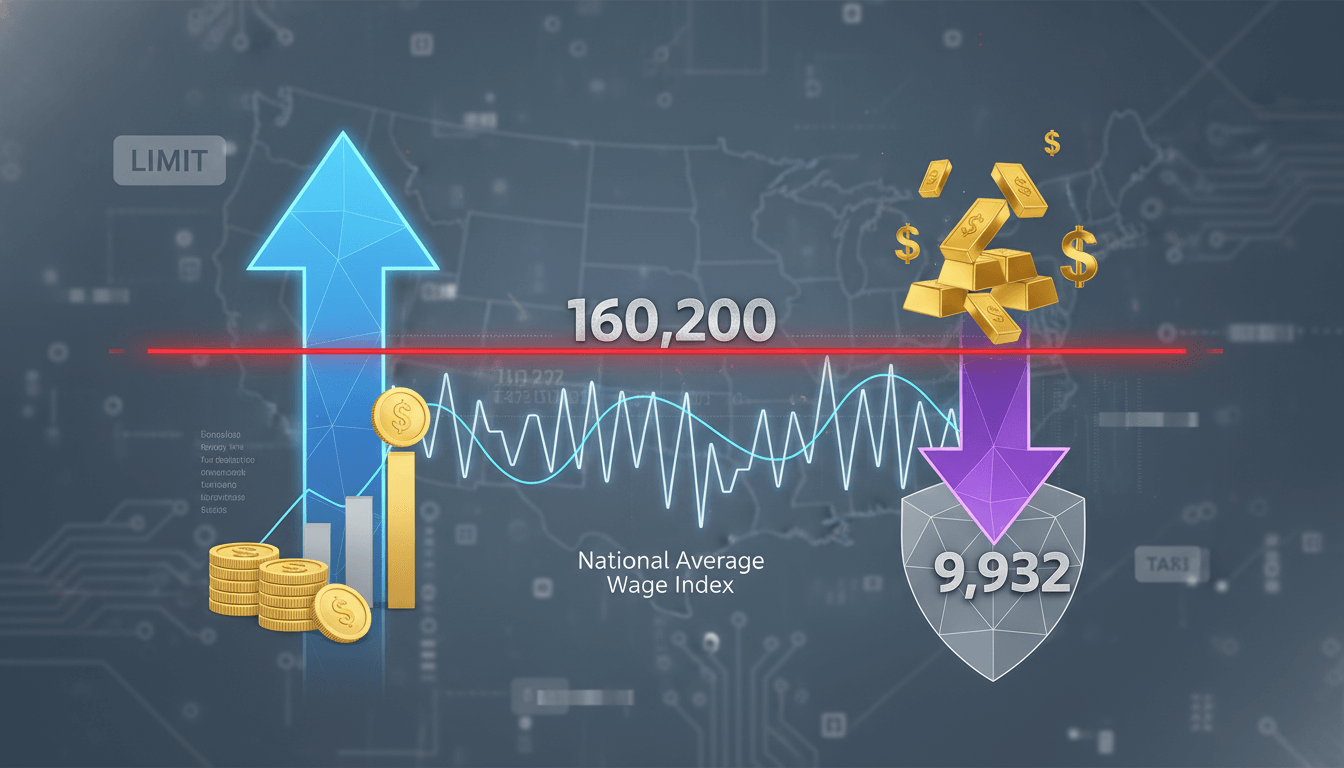

Calculation Methodology

The exclusion is calculated on a daily basis using the maximum exclusion amount divided by the number of days in the tax year. For 2023, the daily exclusion rate is $328.77 ($120,000 ÷ 365). Taxpayers multiply this daily rate by the number of qualifying days during the tax year to determine their allowable exclusion. Any foreign housing amounts must be calculated separately using Form 2555 and are subject to different limitations and calculations.

Documentation Requirements

Taxpayers must maintain detailed records including passport stamps, travel itineraries, residence permits, employment contracts, and bank statements documenting foreign-earned income. Form 2555 must be completed and attached to the annual tax return (Form 1040). Specific supporting documentation varies based on the qualification test chosen and may include utility bills, rental agreements, or employer certifications of foreign employment.

Limitations And Restrictions

The exclusion applies only to earned income and does not cover investment income, pension distributions, or U.S. government employee income. Self-employed individuals may claim the exclusion but must still pay self-employment tax on excluded income. The exclusion cannot exceed actual foreign-earned income, and any excess cannot be carried forward to future years. Taxpayers with income exceeding the exclusion amount remain subject to U.S. taxation on the excess at progressive rates.

Filing Procedures

Taxpayers must file Form 1040 with Form 2555 attached, even if no tax is due. The exclusion is claimed as an adjustment to gross income on Line 8 of Schedule 1 (Form 1040). Electronic filing is available for most taxpayers, though those claiming the exclusion for the first time may need to file paper returns. Extensions are available but do not extend the time for meeting physical presence requirements.

Comparison Points

FEIE vs. Foreign Tax Credit: FEIE excludes income from taxation while FTC provides dollar-for-dollar credit for foreign taxes paid

FEIE vs. Foreign Housing Exclusion: Housing exclusion provides additional benefits for qualified housing expenses above a base amount

FEIE annual adjustment vs. fixed deductions: Unlike many deductions, FEIE amounts adjust annually for inflation

FEIE for employees vs. self-employed: Both can claim FEIE, but self-employed individuals have additional reporting requirements

Important Notes

The $120,000 exclusion amount for 2023 represents a significant increase from previous years due to heightened inflation adjustments. Taxpayers should be aware that claiming the FEIE may affect eligibility for other tax benefits based on adjusted gross income. State tax treatment of the FEIE varies significantly, with some states not recognizing the federal exclusion. The exclusion does not apply to income earned in countries subject to U.S. embargoes or travel restrictions. Professional tax advice is recommended for taxpayers with complex international situations or those transitioning between foreign and domestic employment.