Alternative Minimum Tax (AMT): Comprehensive Guide to Calculation, Impact, and Strategic Planning

The Alternative Minimum Tax (AMT) represents a parallel federal income tax system designed to ensure high-income taxpayers pay a minimum amount of tax regardless of deductions, credits, or exemptions. Created through the Tax Reform Act of 1969, AMT requires taxpayers to calculate their liability twice—once under regular income tax rules and again under AMT provisions—then pay the higher amount. This comprehensive guide explores AMT mechanics, exemption amounts, applicable tax rates, common triggers, calculation methodologies, and strategic approaches to minimize AMT exposure while maintaining compliance with IRS regulations.

Overview

The Alternative Minimum Tax (AMT) operates as a secondary federal income tax system established to prevent high-income individuals and corporations from using preferential tax treatments to eliminate their tax liability. Under this dual-calculation framework, taxpayers must compute their tax obligation using both standard income tax rules and AMT provisions, ultimately paying whichever amount is higher. The AMT system disallows or reduces many common tax preferences, including state and local tax deductions, miscellaneous itemized deductions, and certain business expense deductions. Originally targeting 155 high-income households in 1969, AMT now affects millions of taxpayers annually, though recent legislative changes have reduced its scope through increased exemption amounts and phase-out thresholds.

Specifications

Details

Historical Context

The AMT originated from congressional concern that 155 high-income households legally avoided federal income tax entirely in 1966 through extensive use of deductions, preferences, and shelters. The system has undergone multiple revisions, most significantly through the Tax Reform Act of 1986, which established the current AMT structure, and the Tax Cuts and Jobs Act of 2017, which substantially increased exemption amounts and phase-out thresholds through 2025.

Calculation Mechanics

AMT calculation begins with regular taxable income, then adds back AMT preference items and adjusts for AMT adjustments. Key steps include: starting with regular taxable income, adding tax preference items (such as certain tax-exempt interest), applying AMT adjustments (including standard deduction add-back and limitation of certain itemized deductions), subtracting AMT exemption amount (phased out at higher income levels), applying AMT tax rates (26% or 28%), and comparing AMT liability to regular tax liability to determine ultimate tax payment.

Common Amt Triggers

High state and local taxes (SALT), large miscellaneous itemized deductions, exercise of incentive stock options (ISOs), significant long-term capital gains, high numbers of personal exemptions (pre-2018), tax-exempt interest from private activity bonds, accelerated depreciation differences, passive activity losses, and certain net operating loss deductions.

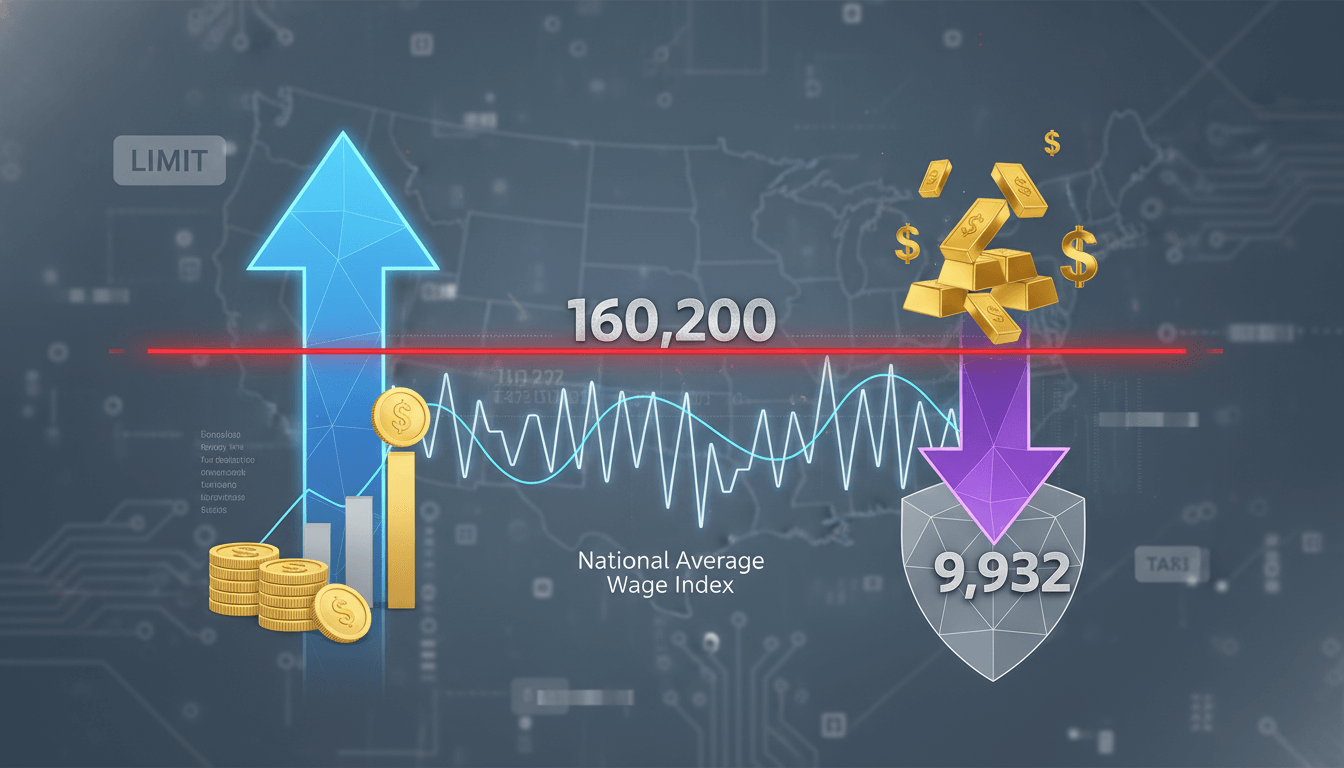

Exemption Phaseout Calculation

The AMT exemption amount reduces by 25 cents for each dollar of alternative minimum taxable income (AMTI) above the threshold. For 2025, the phase-out begins at $609,350 for single filers and $1,218,700 for married couples filing jointly, completely eliminating the exemption at $1,020,600 and $1,707,700 respectively.

Strategic Planning Approaches

Timing of income recognition and deduction payments, careful management of incentive stock option exercises, consideration of AMT credits in future years, evaluation of itemized deduction timing, analysis of state and local tax payment strategies, and coordination with other tax planning initiatives to minimize multi-year AMT exposure.

Comparison Points

AMT uses a broader definition of taxable income than regular tax system

AMT disallows standard deduction and personal exemptions

AMT limits state and local tax deductions to $10,000

AMT treats certain tax-exempt interest as taxable

AMT uses only two tax rates (26% and 28%) versus seven regular tax brackets

AMT provides different depreciation schedules for certain assets

AMT credit allows recovery of some AMT payments in future years

Important Notes

The AMT system creates significant complexity for affected taxpayers, requiring careful tax planning and potential estimated tax payments. Recent legislation has reduced AMT impact for middle-income taxpayers but maintained its function for high-income individuals. Taxpayers subject to AMT should maintain detailed records and consider working with qualified tax professionals to navigate compliance requirements and planning opportunities. Future legislative changes may further modify AMT parameters, particularly as provisions from the Tax Cuts and Jobs Act expire after 2025.