Free Tax Filing Options: A Comprehensive Guide to Eligibility and Software Comparisons

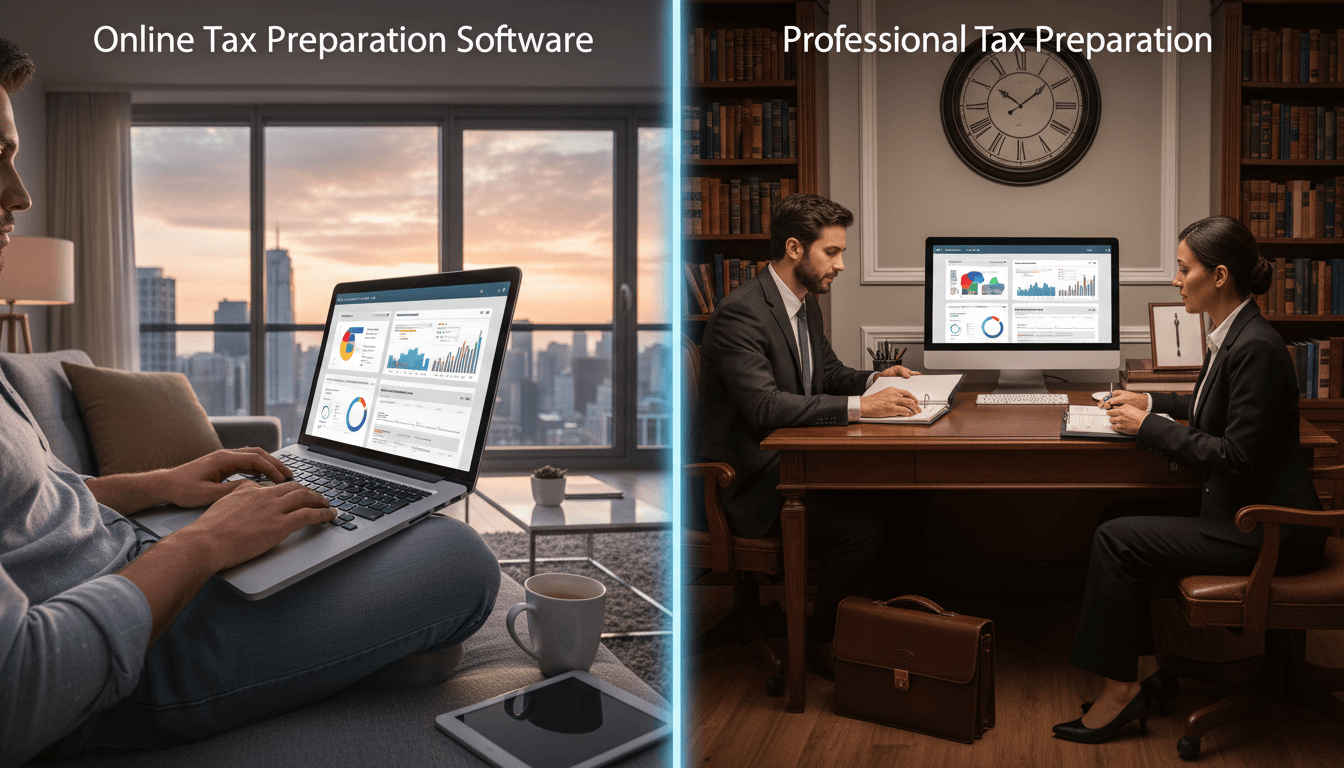

Explore free tax filing services ideal for taxpayers with straightforward financial situations, including W-2 income, standard deductions, and common credits like Earned Income Tax Credit and child tax credits. This guide details eligibility criteria, provider variations, and coverage limitations, helping approximately 37% of taxpayers identify suitable options. Learn how to navigate free tiers effectively while ensuring accuracy and maximizing refunds without incurring preparation fees.

Free tax filing options provide a cost-effective solution for individuals with uncomplicated tax situations, typically encompassing W-2 earnings, standard deductions, and select credits. According to industry analyses, around 37% of taxpayers qualify for these services, which streamline Form 1040 submissions without complex schedules. This guide examines key providers, eligibility requirements, and coverage specifics to help you make informed decisions, reduce preparation expenses, and ensure compliance with IRS regulations.

IRS Free File Program

Pros

- No cost for eligible taxpayers

- Direct partnership with IRS for accuracy

- Covers W-2 income, EITC, and child tax credits

- User-friendly interface for simple returns

Cons

- Income limitations apply (e.g., under $73,000 AGI)

- Excludes complex investments or self-employment

- Varies by provider software capabilities

Specifications

Commercial Tax Software Free Editions

Pros

- Accessible for basic returns with W-2s and student loan interest

- Mobile app availability for convenience

- Includes common credits like Earned Income and child tax

- Real-time refund calculations

Cons

- Upsells for state returns or additional forms

- Limited to specific tax situations without complex schedules

- May not cover rental income or itemized deductions

Specifications

Comparison Table

| Provider | Eligibility Criteria | Covered Items | Limitations |

|---|---|---|---|

| IRS Free File | AGI under $73,000, simple return | W-2, EITC, child credits, student loan interest | No self-employment or investments |

| TurboTax Free Edition | Form 1040 with basic income | W-2, standard deduction, child tax credit | Excludes itemized deductions and state filing |

| H&R Block Free Online | Simple federal return | W-2, EITC, student loan interest | No support for rental income or complex credits |

Verdict

Free tax filing options are ideal for taxpayers with straightforward situations, such as W-2 income and standard credits, benefiting approximately 37% of filers. While providers like IRS Free File and commercial software offer robust coverage for basic Form 1040 submissions, limitations exist for complex scenarios. Evaluate eligibility carefully, prioritize providers matching your needs, and consult professional advice if your return includes investments, self-employment, or itemized deductions to ensure accuracy and maximize savings.