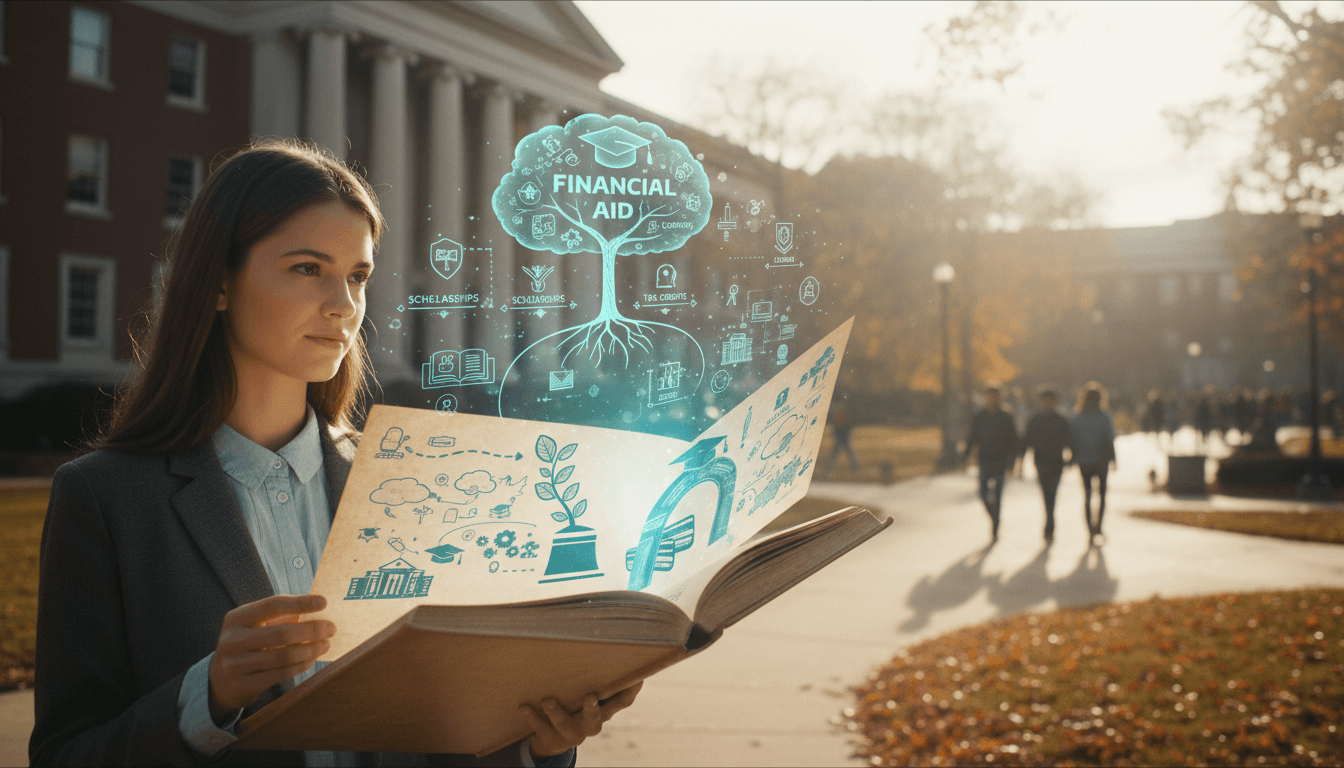

Understanding Tax Credits for Education: A Guide to the American Opportunity Tax Credit

This comprehensive guide explores the American Opportunity Tax Credit (AOC), a valuable tax incentive for students and parents covering up to $2,500 per student annually during the first four years of college. Learn about eligibility criteria, including income thresholds of $80,000 for single filers and $160,000 for married couples filing jointly, how to claim the credit, and strategies to maximize educational tax benefits. Essential for reducing tax burdens and funding higher education expenses effectively.

Article Information

Author | Financial Advisor Team |

Date | August 26, 2025 |

Rating | 4.8 / 5.0 |

Would Recommend | Yes |

Helpful Count | 2019 |

Helpful Votes | 2019 |

Not Helpful Votes | 258 |