Tax Refund Direct Deposit Strategy: Maximizing Efficiency and Security

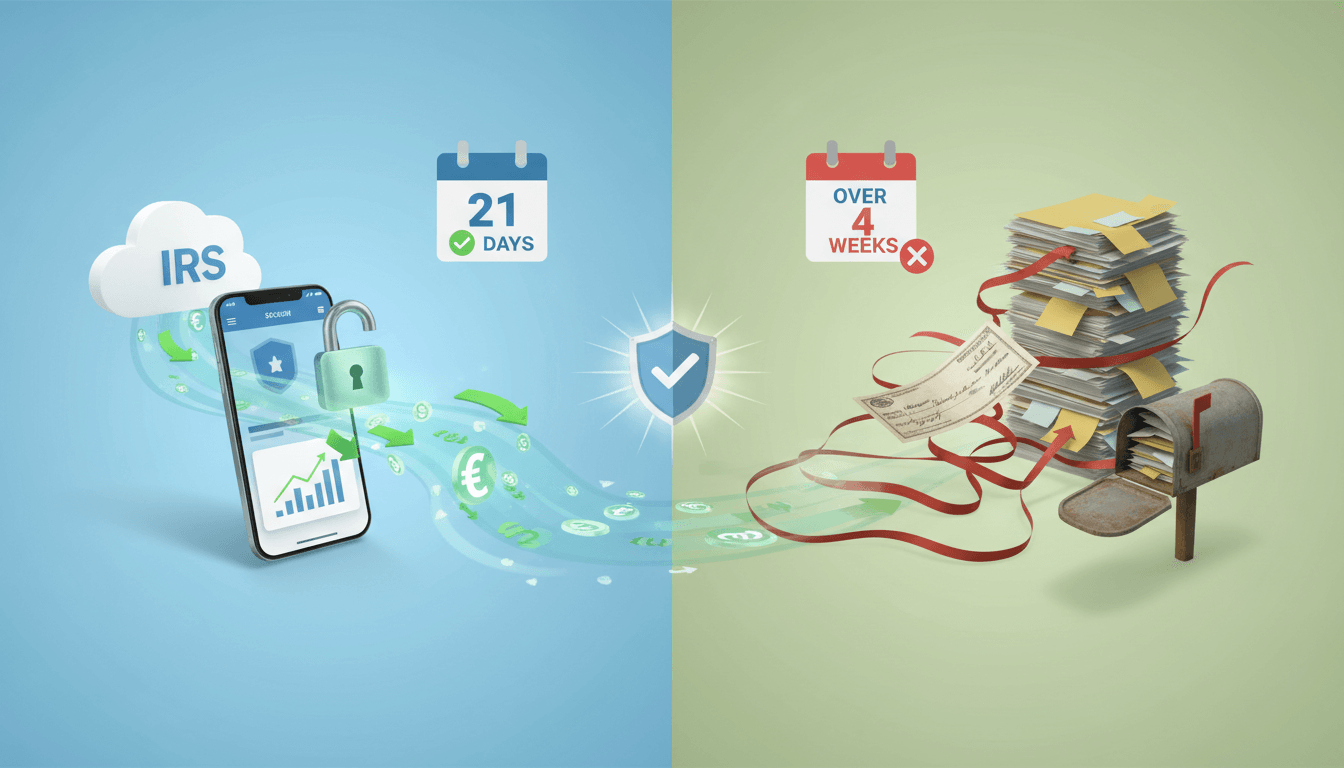

This guide explores the IRS's shift from paper checks to direct deposit for tax refunds, emphasizing the faster processing time of 21 days for electronic filings compared to over four weeks for paper returns. Learn essential steps to prepare accurate bank account information, avoid common errors, and implement strategies for secure, timely refunds. With expert insights from the IRS Refund Processing Guide, taxpayers can optimize their refund experience while minimizing delays and risks associated with traditional methods.

Article Information

Author | Financial Advisor Team |

Date | August 30, 2025 |

Rating | 5 / 5.0 |

Would Recommend | Yes |

Helpful Count | 3741 |

Helpful Votes | 3741 |

Not Helpful Votes | 420 |